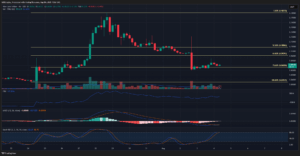

Solana’s $160 Crash: Is This the Ultimate Buy Opportunity or the Beginning of the End?

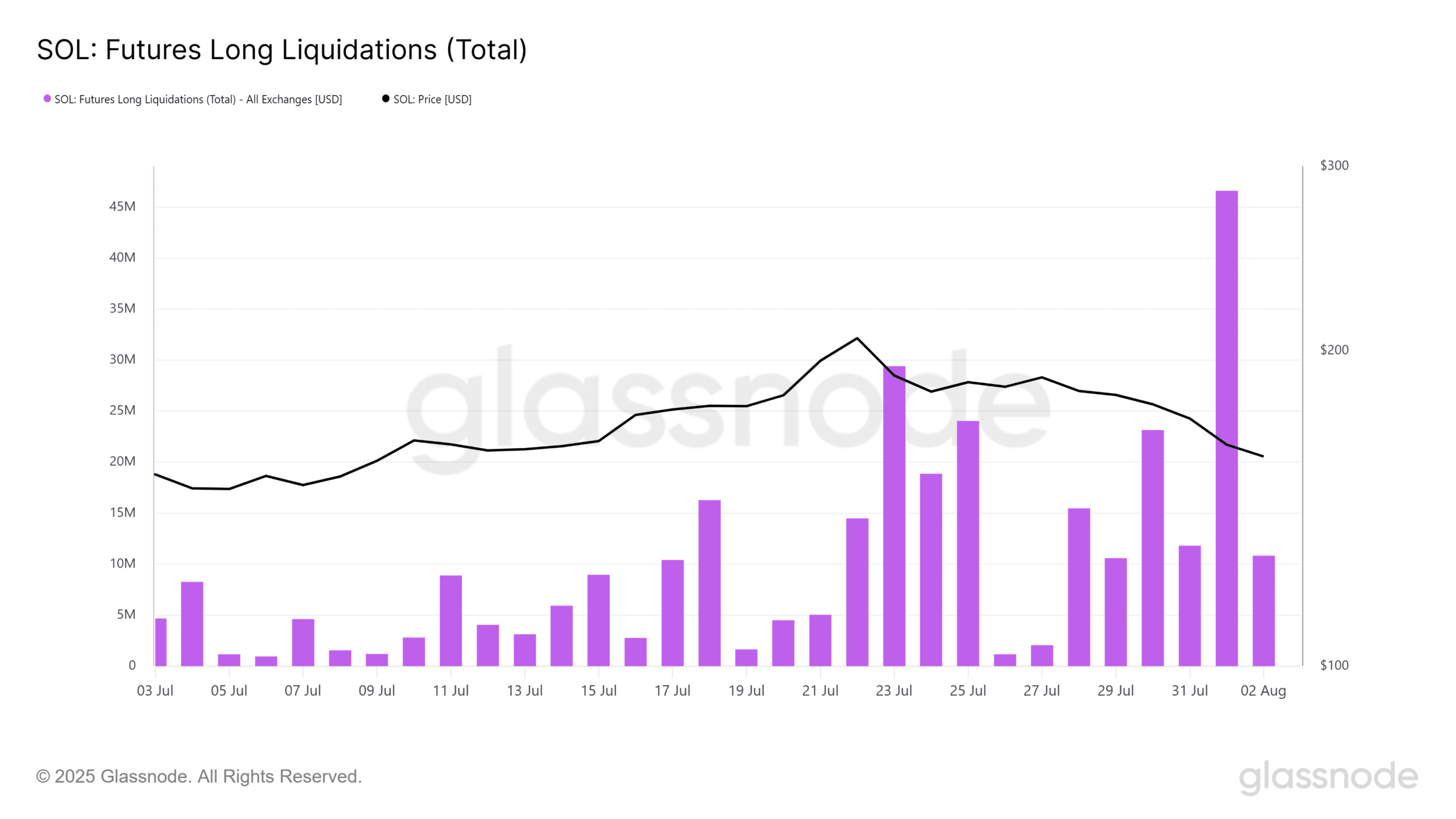

But the market flipped risk-off, triggering a cascade of long liquidations. In fact, on the 1st of August, Solana registered $46 million in long liquidations, marking its largest single-day wipeout since Q1.

Despite this, perp funding remains skewed. Binance’s 5-minute SOL perpetual data still shows 78% long dominance, pointing to continued directional crowding.

In this context, Binance’s 110k SOL offload appears highly tactical.

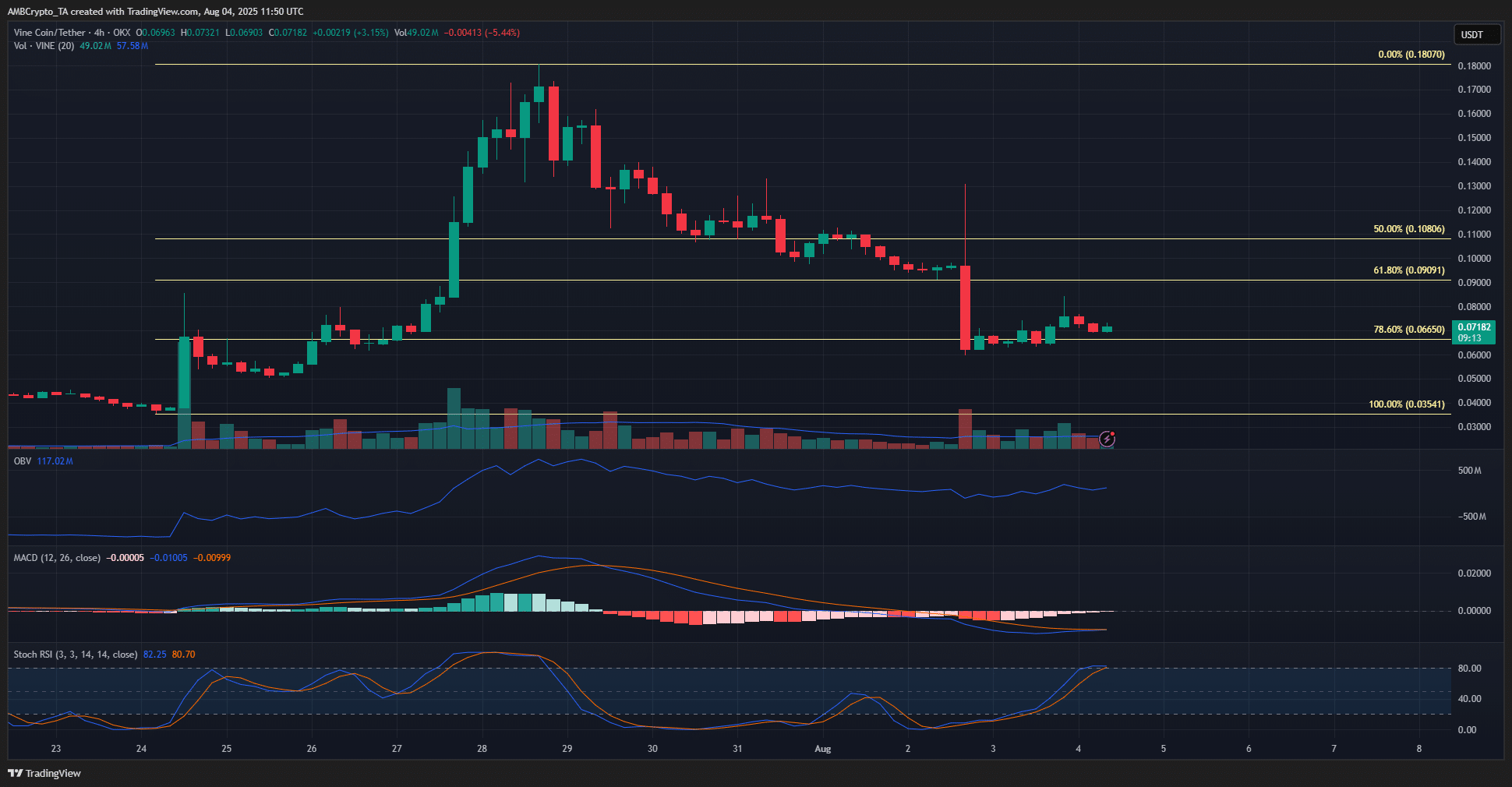

With Solana already down 15% on the week, the sell pressure likely drove price into thin liquidity, flushed out excess leverage, and primed the market for a cleaner reset ahead of potential reaccumulation.

Post Comment