Solana’s $5.84B Surge Masks a Silent Warning: Why That 6% Drop Could Be Your Ultimate Opportunity or Disaster

Ever wondered what happens when Solana suddenly becomes the favorite playground for ETFs, ETPs, and a tidal wave of capital streaming in from other blockchains? Last week, over $400 million flowed into Solana — a mix of direct investments and bridged assets that sparked a notable uptick in network revenue. Despite a recent 6% dip in a 24-hour window, Solana’s weekly performance painted a different, much brighter picture, with daily trading volumes shooting up nearly 60%. So while the wider crypto market was catching its breath, Solana seemingly sprinted ahead, defying the downtrend — but what’s really fueling this surge? It turns out, institutions and smart money are converging on Solana’s promise, riding the wave of real-world utility and speculative moves alike, all while the network quietly overtakes competitors in revenue generation for almost half a year straight. Is this the calm before another Solana price explosion, or just a cleverly disguised trap for the unwary? Let’s unpack the details. LEARN MORE

Key Takeaways

Solana inflows surged in the previous week, with ETFs and ETPs leading. Still, there was a lot more bridging from other chains into Solana. This raised the amount of revenue generated.

Solana [SOL] has maintained a strong trend in price action and real world use cases. The inflows in the past one week surpassed $400 million that included Solana-based products and bridged assets.

In the past 24 hours, Solana has declined by 6%, but was up when viewed from a weekly timeframe scale. Interestingly, the daily volume was at $5.84 billion, up by 58% at the time of writing.

The altcoins maintained serious capital pull at a time the market is correcting. The total crypto market cap was down about 3.56%. That said, why was Solana different in terms of money flow?

What’s driving inflows?

Institutions and Solana products like ETFs and ETPs were responsible for driving this charge. As per Farside Investors data, the total inflow of REX-Osprey (SSK) was $166.7 million.

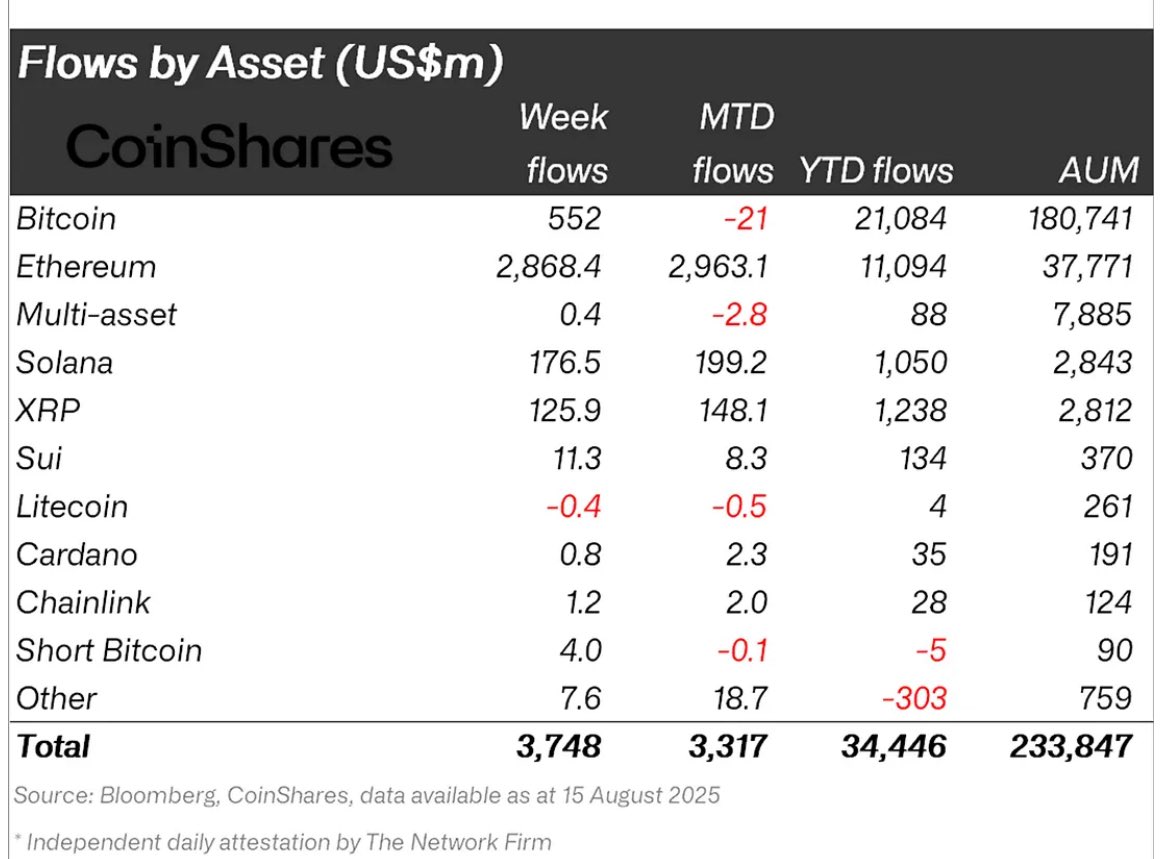

Last week alone, more than $176 million was injected. This took the month-to-date total to $199 million, and year-to-date slightly surpassed $1 billion.

Only Ethereum [ETH] and Bitcoin [BTC] had higher weekly inflows, of $2.87 billion and $552 million, respectively.

The total assets under management on Solana blockchain reached at $2.84 billion.

More capital entered SOL through bridging. Most of the money (roughly 62%) came from Ethereum network. That was about $126 million from a total of $230 million over a similar period.

About $56 million was bridged from Arbitrum One [ARB] while $20 million left Base chain. Other chains like Polygon [POL], Avalanche [AVAX] and Sui Network [SUI] contributed amounts less than $10 million.

Also, capital from whales from trading of memecoins.

Smart Money flows were dominating in terms of ROI over the past seven. Memecoins built on Solana were in a pullback face. Whales were rotating their capital into the speculative assets.

Still, minting drew more money. Circle minted more than $1.25 billion USDC. The total on the network now stood at $24 billion.

Stablecoins were generally rising in supply across multiple blockchains, as noted earlier in AMBCrypto’s analysis.

This surge in inflows and activity has resulted in higher revenue.

Solana network revenue soaring

Particularly, activities on Solana-based platforms like Jupiter [JUP], Raydium [RAY], LetsBONKfun, Pump.fun are the main revenue drivers.

Pump.fun reclaimed its lead for the second week with $10 million generated. The total for all dApps was $35 million.

Solana led other chains by revenue generation for 22 consecutive weeks, per Solana Floor. Tron [TRX], Ethereum and Bitcoin followed.

However, Solana continues to face backlash due to its wide acquisition by venture capital firms. The current inflow should therefore be viewed on all fronts.

At times, transactions like these are to lure gullible traders and trap them. Still, the outlook of Solana stayed bullish, and the inflows could be a signal that another price surge was building up.

Post Comment