Tether’s $5.7B Profit Is Just the Beginning—Get Ready for a U.S. Stablecoin Shakeup That Could Rewrite the Rules This Q4!

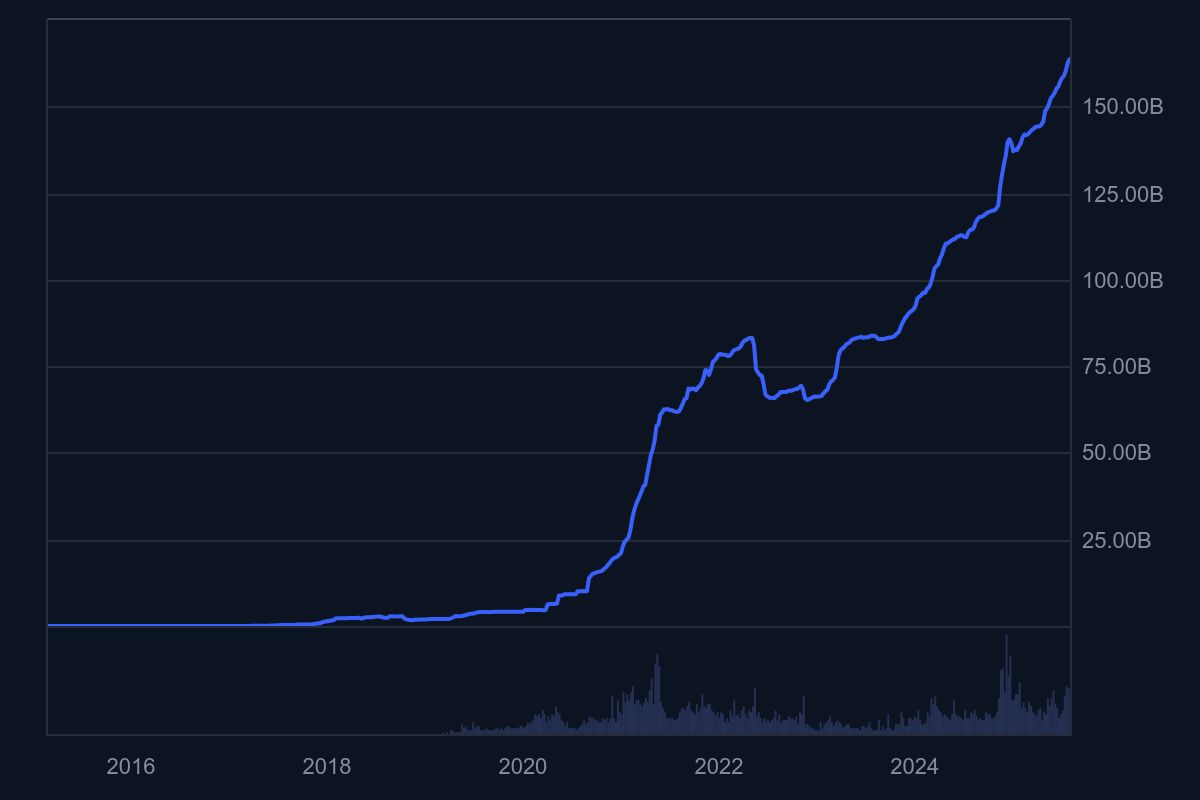

When a giant like Tether makes moves, you better sit up and take notice. How often do you see a company clocking an eye-watering $5.7 billion in year-to-date profit while gearing up to re-enter the notoriously tough U.S. market in Q4? And not just with the same old stablecoin, but with brand-new offerings tailor-made for the “highly efficient” American financial scene. Now, here’s the kicker — Tether isn’t just sitting on a pile of cash; they’re practically swimming in $127 billion worth of U.S. Treasury bills as reserve backing. What does this tell us? That Tether’s business model is bulletproof, even as regulations tighten and markets shift beneath our feet. But will their fresh venture live up to the legacy of USDT, or is this the start of something totally new—and possibly game-changing? Buckle up; this is where the stablecoin saga gets downright intriguing. LEARN MORE

Key Takeaways

Tether eyes Q4 for U.S. market re-entry with new stablecoin offerings separate from USDT. The firm’s YTD profit surged to $5.7B with a reported $127B in Treasury bills exposure.

World’s largest stablecoin issuer, Tether, announced that its year-to-date (YTD) profit jumped to $5.7 billion ahead of planned re-entry into the U.S. market.

In the latest USDT Q2 reserve report, the issuer attributed the remarkable profitability to ‘the strength of its business model.’

“Tether’s profitability also underscores the strength of its business model. Net profit for Q2 2025 totaled approximately $4.9 billion, bringing the total for the first six months of the year to $5.7 billion.”

Tether eyes U.S re-entry in Q4

The firm had over $127 billion in U.S. Treasury bills exposure as part of reserve backing for its global stablecoin USDT and eyed U.S. market re-entry in Q4, according to the CEO, Paolo Ardoino.

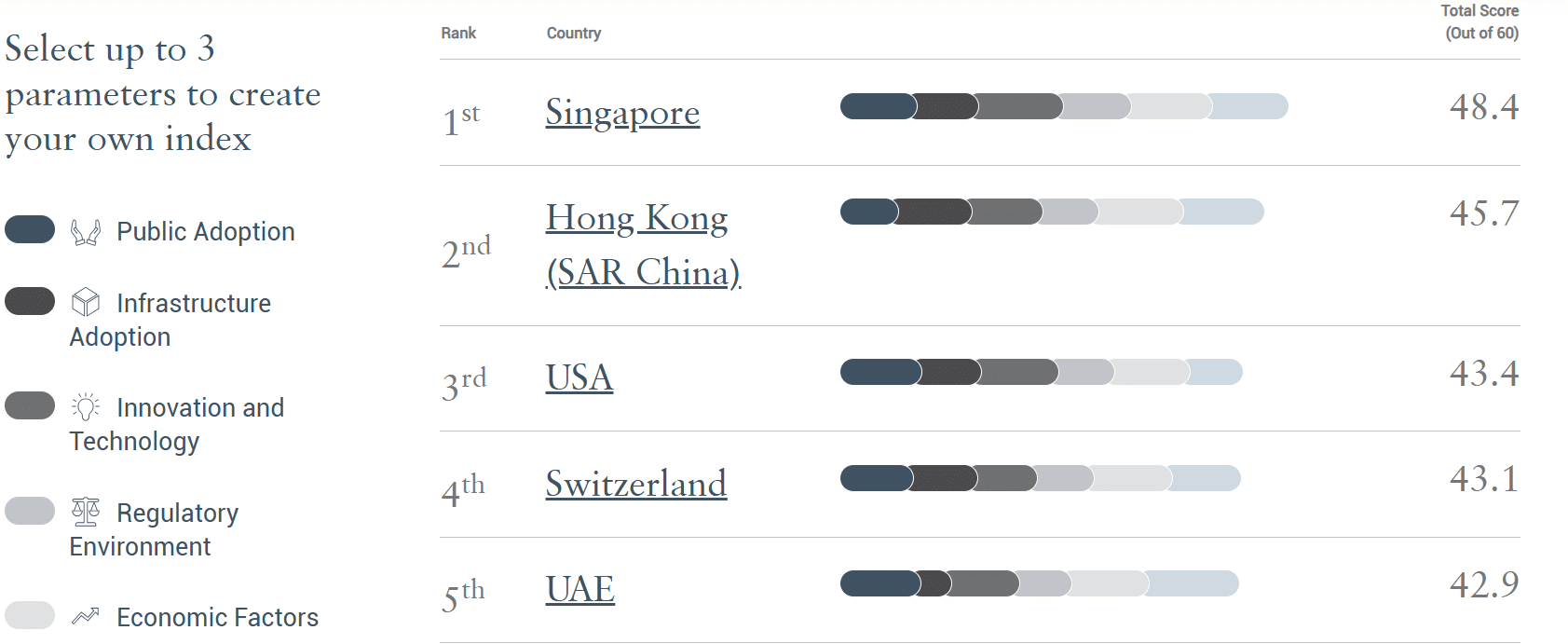

The new stablecoin venture will be designed for the mature and ‘highly efficient’ U.S. market, added Ardoino.

“In the upcoming quarter, Tether will focus on a new venture in the U.S, to build a best-in-class product suite (stablecoins plus more), designed for the specific, already highly efficient, market.”

Its plan for a separate U.S.-focused stablecoin offering from the USDT is part of the compliance push under the new stablecoin law, the GENIUS Act.

The Act demands 100% backing of reserve assets by Treasury bills or cash equivalents, besides the issuer being domiciled in the U.S.

That said, the planned offering could have a yield feature and target mostly institutional investors and players. In a recent Bloomberg interview, Ardoino clarified that,

“It’s (U.S. stablecoin offering) going to be focused on the US institutional markets, providing an efficient stablecoin for payments but also for interbank settlements and trading.”

Tether’s popular USDT offering has a completely different model from the new venture. It’s focused on the ‘inefficient’ emerging markets for users seeking faster USD rails and hedging against local currency devaluations and inflation.

As a result, Tether pockets all the interest earned from the treasury reserves backing USDT. That may not be the case for the upcoming venture.

Meanwhile, the USDT market cap has hit a record high of $163.6 billion. This helped it to keep a $100B lead over the second-largest stablecoin, USDC, which had a $64 billion market size.

Post Comment