The 4,364 ETH Move That’s Sending Shockwaves Through Ethereum — What Every Investor Must Know Now

Ever wonder what happens when the engine that fuels an Ethereum DAT starts sputtering just as the market’s already heating up? Sharplink Gaming’s recent stumble offers a front-row seat to that exact drama. After a dazzling Q3 rally that had investors riding high, SBET’s sharp slide has investors squirming—and rightly so. The media buzz around a supposed wallet move only lit a fuse on an already tense scene where unrealized losses aren’t just numbers but looming signals of eroding confidence. When your capital-raising wheels grind to a halt because your stock’s losing its shine, selling off ETH might not just be an option—it could be a necessity. And if that door swings wide, it won’t just rattle Sharplink but could send waves through the whole Ethereum DAT ecosystem. It’s a hard pill to swallow, but as Q4 unfolds, the real question is: how much longer can this delicate balance hold before reality demands a reckoning?

Key Takeaways

Why is a Sharplink-driven ETH sell-off plausible?

The recent media frenzy exposed market sensitivity. As SBET’s stock drop tightens its capital-raising channel, the company may need to sell ETH.

How are investors feeling about Ethereum DATs?

SBET’s unrealized losses, BitMine’s $2.1 billion paper losses, highlight growing pressure and softening confidence in Ethereum DATs.

Q4 is shaping up to be a hard reality check for Ethereum [ETH] DATs.

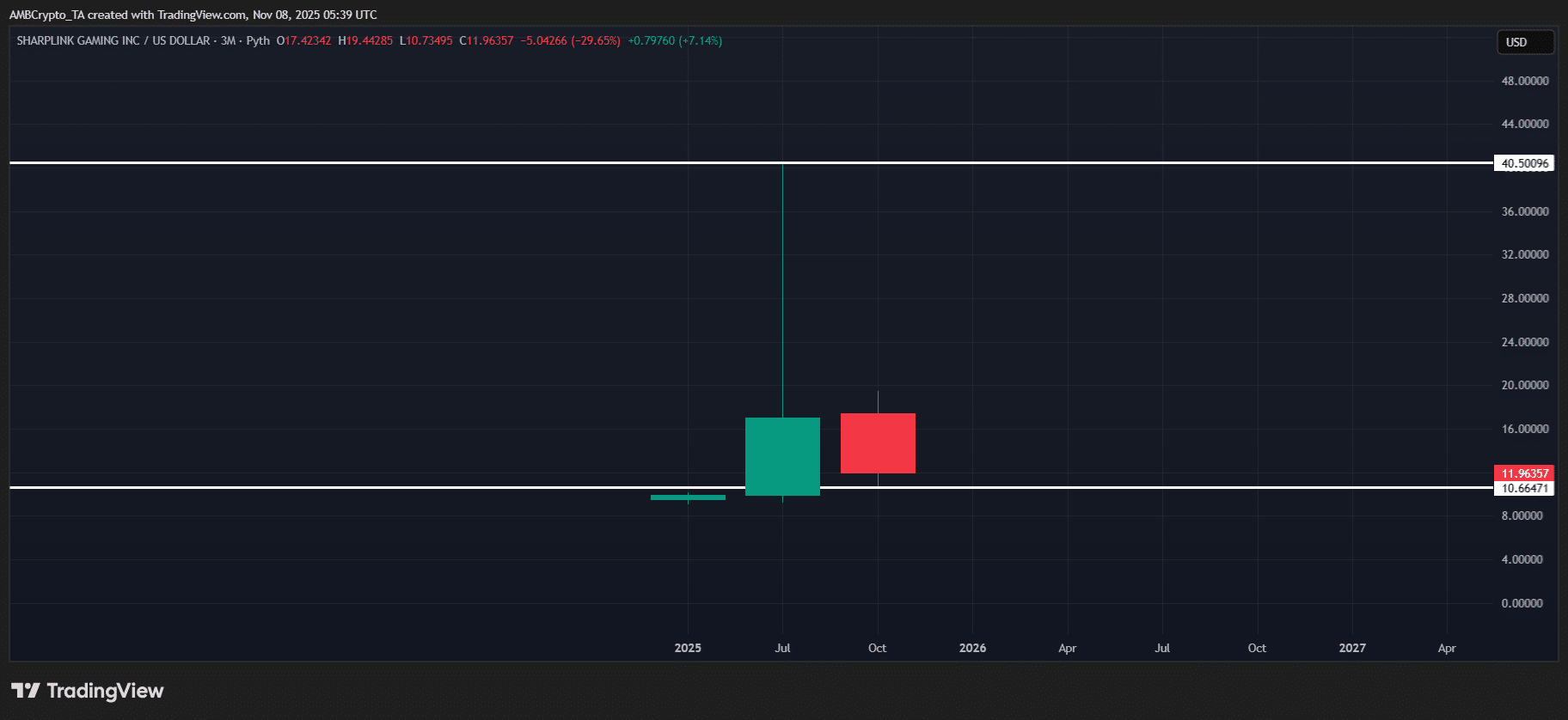

After a 71.26% Q3 rally, Sharplink Gaming [SBET] has already unwound about 40% of those gains, and we’re not even halfway through the quarter. So anyone who chased the late-Q3 breakout is now deep underwater.

Notably, SBET isn’t the only one feeling the squeeze.

The largest ETH DAT, BitMine [BMNR], has accumulated roughly 442,000 ETH since the mid-October drawdown. But now, according to CryptoQuant data, that position is sitting on $2.1 billion dollars in unrealized losses.

In this context, the media flare-up around SBET wasn’t exactly unexpected.

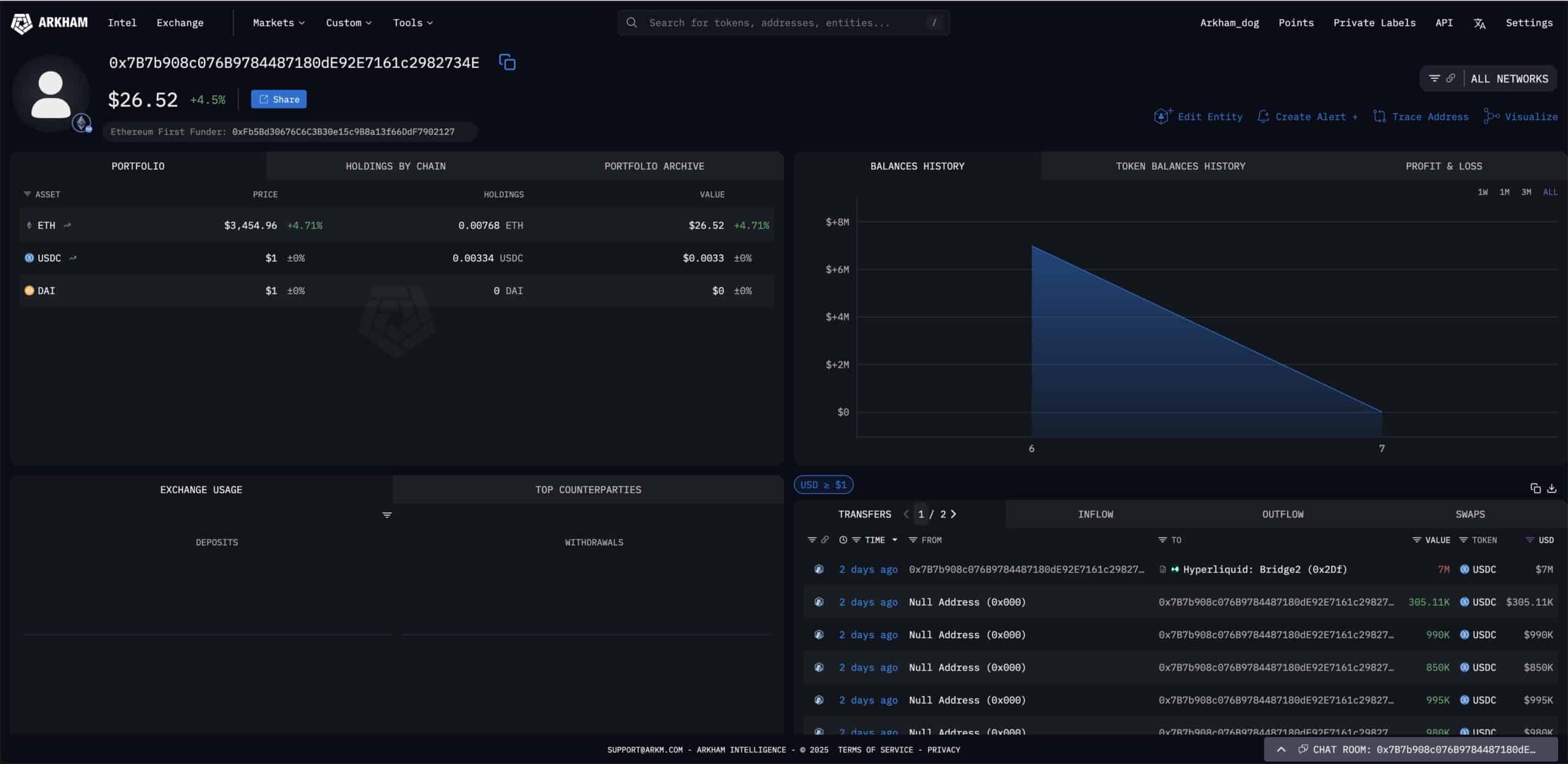

To recap, Arkham Intelligence flagged a wallet tied to Sharplink that moved 4,364 ETH into OKX, triggering a headline cycle. But a few hours later, SBET’s CIO clarified that the address wasn’t affiliated with the company.

Still, the market’s outsized reaction stood out.

Essentially, Sharplink’s model runs on an equity-fueled ETH accumulation loop. However, with SBET’s Q4 turning bearish, did this flare-up “expose” a real soft patch in investor confidence, backing up CryptoQuant’s thesis?

Sharplink ETH stack faces a reality check amid rising losses

On paper, conviction in SBET is hanging by a thread.

At its Q3 peak, unrealized gains ballooned to roughly 920 million dollars as Sharplink’s stock pushed toward 40 and its market cap hit about 4 billion. Now, though, that valuation has slid to around 2.3 billion.

CryptoQuant backs this up. SBET’s unrealized losses spiked to 320 million on the 4th of November, right as the stock fell to 11. And with SBET trading around 11.90 at press time, shareholders remain well out of the money.

Against this setup, a Sharplink-driven ETH sell-off wouldn’t be surprising.

After all, SBET normally raises capital by issuing new shares to build its ETH stack. But when the stock trades lower, that channel tightens, so the company may need to unlock liquidity by selling ETH instead.

Hence, the recent market frenzy was a reality check. It showed that the risk-reward on these ETH DATs is leaning against investors. If this trend holds, an ETH sell-off by Sharplink would not be too far-fetched.

Post Comment