The Shocking Truth Behind Private Equity: Why Most Investors Are Blind to Its Wild Risks and Massive Potential

Is private equity really the low-volatility, steady-eddy investment everyone claims it to be—or is that just smoke and mirrors? Dan Rasmussen from Verdad Capital throws a wrench into the usual narrative, challenging the cozy idea that private equity swoons at a mere 10% annual volatility—about the same as your typical balanced portfolio. But here’s the kicker: if these private investments are truly that stable, then why do publicly listed private equity funds on the London Stock Exchange show such wild swings in their Net Asset Values? It’s almost like discovering your “sedate” neighbor moonlights as a stunt driver! Through Dan’s sharp lens, we dig deep into how infrequent valuations, survivorship bias, and the shadowy art of pricing private investments paint a different story—one where real, tangible volatility is lurking beneath the surface. And if you’ve ever wondered why some investors deride micro-caps yet flock to these funds loaded with tiny, leveraged companies… maybe it’s time to question your own playbook. Buckle up, this isn’t your average private equity pitch. LEARN MORE

Dan Rasmussen over at Verdad Capital has a pretty good article providing a different view on the “no/low volatility” of private equity.

When Private Funds Are Publicly Traded

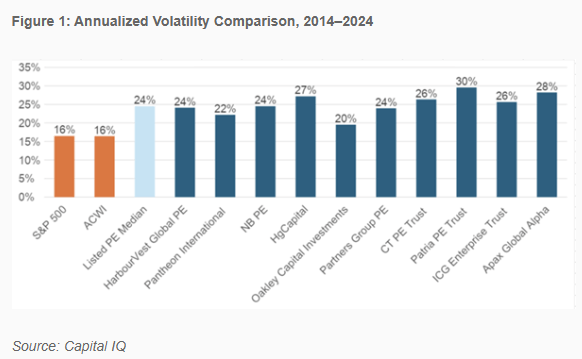

When you have private equity biased firms saying that the annualized volatility (standard deviation) is closer to 10%, then you start ruffling feathers of people in the public equity space.

10% annualized standard deviation is equivalent to that of a 60% equity and 40% fixed income, or what we call a Balanced portfolio.

The main problem is that

- The private investments are valued more infrequently.

- There is survivorship bias.

- You also don’t know how coherent is the way they are valued.

But Dan thought that we can use a proxy… to kind of see things from another perspective.

Now suppose there are funds that owns these private investments. If the volatility of the private investments are really that low, then the NAV of these funds over time should be pretty low right?

So there are these private equity funds that are listed publicly on the London Stock Exchange (LSE).

Dan listed the 10 of the largest and most liquid:

- HarbourVest Global Private Equity (ticker: HVPE) | 2025 Annual Report

- Pantheon International (PIN) | Website

- NB Private Equity Partners (NBPE) | 2024 Report

- HgCapital Trust (HGT) | Q1 Report

- Oakley Capital Investments (OCI) | 2024 Annual Report

- Partners Group Private Equity (PEY) | 2024 Annual Report

- CT Private Equity Trust (CTPE) | Website

- Patria Private Equity Trust (PPET) | 2024 Annual Report

- Apax Global Alpha (APAX) | 2024 Annual Report

- ICG Enterprise Trust (ICGT) | 2025 Annual Report

I have link you to some of the main documents so that you can preview them. (Maybe some of you would thank me for sharing this with you haha.)

If we examine the volatility of the NAV, we get a very different conclusion.

Traditional reporting by the PE funds has their NAV average at 14% volatility, or about 0.9 times the market average of 16%.

The annualized volatility of the PE funds’ stock price is closer to 24% or 1.5 times of the market.

The chart below shows the annualized volatility of the funds:

The annualized standard deviation for the US small cap value is closer to 28% for the past 98 years.

The name for these companies might be low-margin, leveraged micro-caps.

Some people detest investing in small caps. They believe that small caps won’t do well compare to large cap. But how come they might be interested in investing in a basket of micro-caps.

The Discount to NAV Makes People Question the Valuation

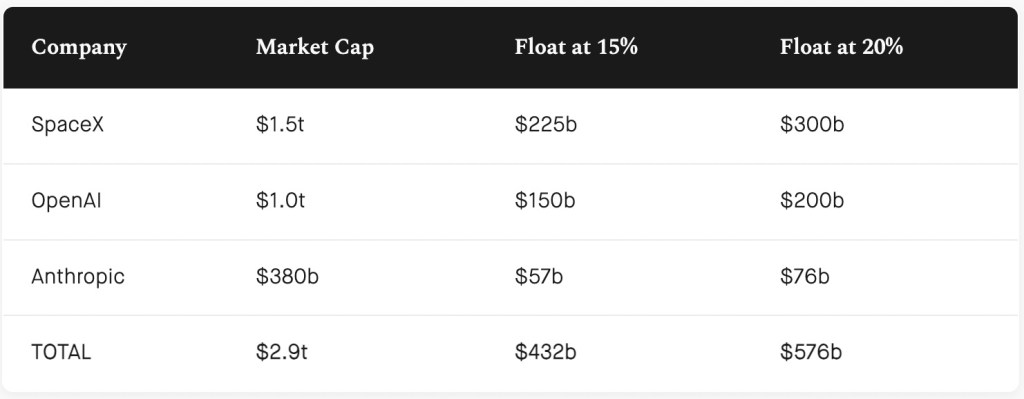

Dan also tabulated the market cap-weighted discount to NAV for the listed PE Funds:

The funds, as a market-cap weighted aggregate, currently trades at 70 cents to a dollar.

Normally, you would look at that and be very interested to invest because if you buy the fund at 70 cents and they liquidate the fund today, assuming they can sell all the underlying, you get back 1 dollar.

But… what if the stuff cannot sell at 1 dollar?

What does that tell us about the valuation about the funds?

This is also an increasingly relevant question as U.S. congresswoman Elise Stefanik is now probing whether college endowments should be allowed to use NAVs rather than, say, recent secondary market transactions as the sole source of valuation for private assets.

Market observers attribute this change to rising interest rates shifting investor preferences toward more liquid assets, coupled with growing concerns over the perceived opacity in the underlying assets of portfolios. This shift in investor sentiment has led to greater scrutiny and caution around illiquid and opaque assets like PE funds. As a result, investors demand a higher liquidity premium, meaning a higher discount to NAV, to compensate for the elevated risk and reduced liquidity. This increased required return enhances the widening discount, pushing down the market prices of PE fund shares relative to their reported NAVs.

I think the main thing they are trying to highlight is not that you should not invest in these funds. For all we know, many of them are public portfolio managers that have small cap companies on their portfolio.

What they would like to bring to your attention is that infrequent and suspect valuation does not mean that there aren’t real volatility.

It is what it is.

If you don’t like to invest in small nascent companies, but like to invest in large Mag 7, you really got to ask yourself why is there such a disconnect in your investment philosophy.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment