Dan Rasmussen over at Verdad Capital has a pretty good article providing a different view on the “no/low volatility” of private equity.

When Private Funds Are Publicly Traded

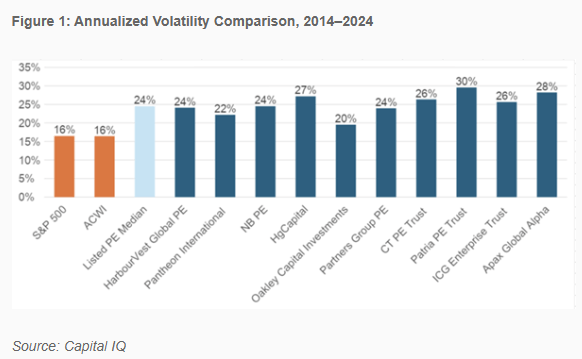

When you have private equity biased firms saying that the annualized volatility (standard deviation) is closer to 10%, then you start ruffling feathers of people in the public equity space.

10% annualized standard deviation is equivalent to that of a 60% equity and 40% fixed income, or what we call a Balanced portfolio.

The main problem is that

Post Comment