- The private investments are valued more infrequently.

- There is survivorship bias.

- You also don’t know how coherent is the way they are valued.

But Dan thought that we can use a proxy… to kind of see things from another perspective.

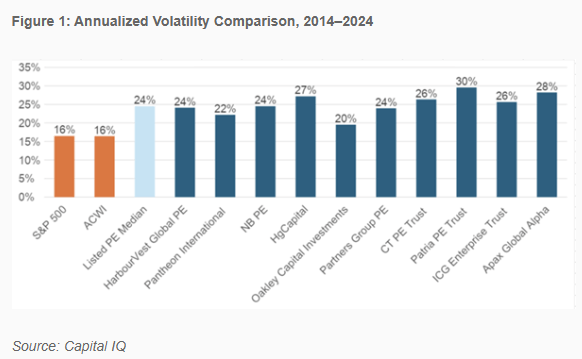

Now suppose there are funds that owns these private investments. If the volatility of the private investments are really that low, then the NAV of these funds over time should be pretty low right?

So there are these private equity funds that are listed publicly on the London Stock Exchange (LSE).

Post Comment