If we examine the volatility of the NAV, we get a very different conclusion.

Traditional reporting by the PE funds has their NAV average at 14% volatility, or about 0.9 times the market average of 16%.

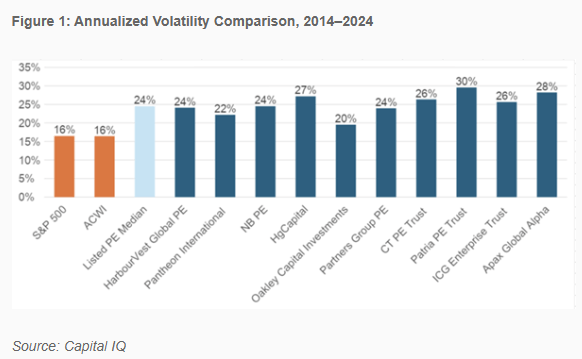

The annualized volatility of the PE funds’ stock price is closer to 24% or 1.5 times of the market.

The chart below shows the annualized volatility of the funds:

The annualized standard deviation for the US small cap value is closer to 28% for the past 98 years.

The name for these companies might be low-margin, leveraged micro-caps.

Post Comment