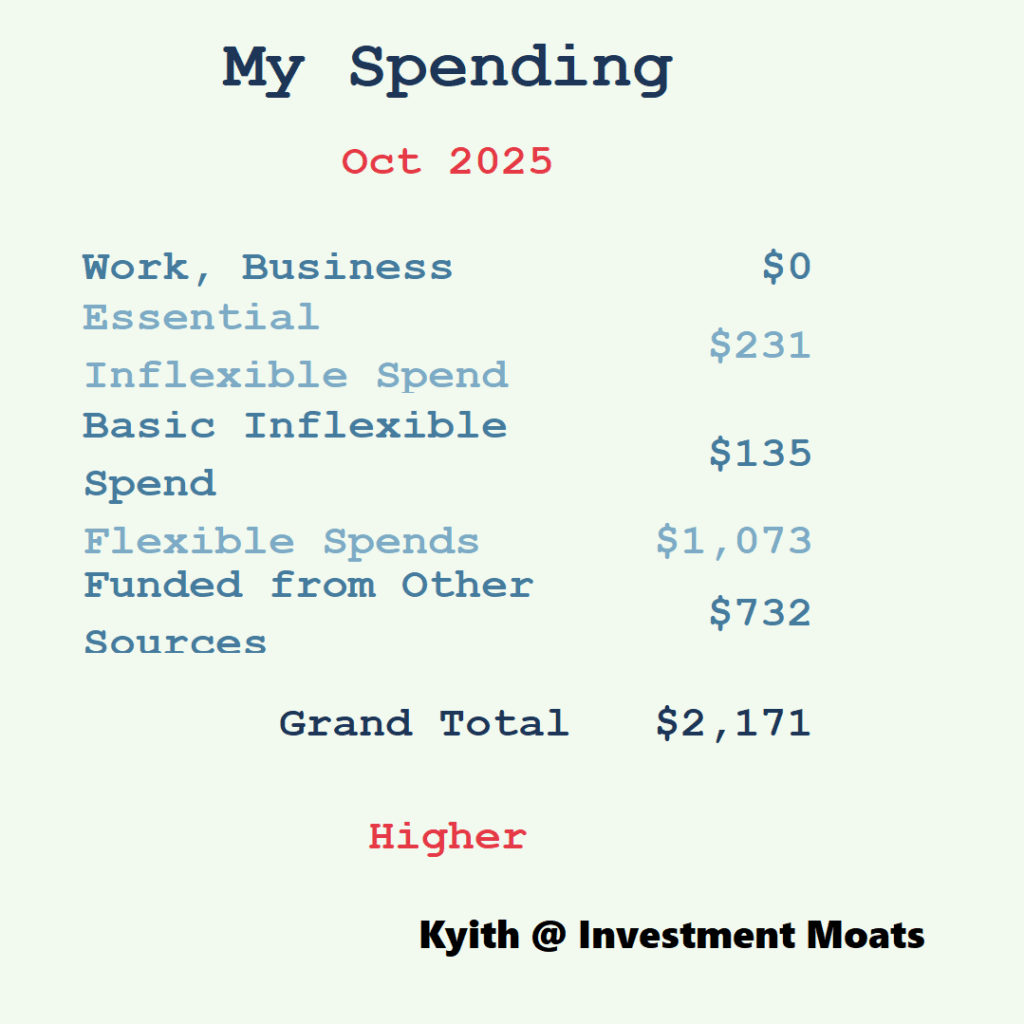

This October’s $2,171 Spending Breakdown Reveals Shocking Secrets Every Entrepreneur Must Know to Dominate Finances!

Ever wonder how a single guy with a fully paid-up home actually spends his money month to month? Spoiler alert: it’s not all avocado toast and endless lattes. Tracking spending can easily feel like peering into someone’s diary—except way less juicy and way more revealing about priorities, habits, and that unexpected $7 mop stick that suddenly makes your life way better. But here’s the twist: I don’t just dump numbers. I break down my expenses through a framework you might find surprisingly useful—flexible vs. inflexible, finite vs. ongoing, and role-based spending that peels back what really sticks around or fades away when you change life phases. This isn’t just bookkeeping; it’s a glimpse into the architecture of financial independence — how your dollars can either box you in or set you free. This October’s numbers have a few quirks, including an overlooked trip tally that’s waiting to jump into next month’s count. Curious how all this fits into the bigger picture of planning, prepping, and playing the long game? Let’s dig in and see exactly where those dollars went — eye-opening insights and maybe a few laughs included. LEARN MORE

img#mv-trellis-img-1::before{padding-top:100%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:100%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:100%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:100%; }img#mv-trellis-img-4{display:block;}img#mv-trellis-img-5::before{padding-top:77.624309392265%; }img#mv-trellis-img-5{display:block;}img#mv-trellis-img-6::before{padding-top:72.867298578199%; }img#mv-trellis-img-6{display:block;}img#mv-trellis-img-7::before{padding-top:125.18337408313%; }img#mv-trellis-img-7{display:block;}img#mv-trellis-img-8::before{padding-top:75%; }img#mv-trellis-img-8{display:block;}img#mv-trellis-img-9::before{padding-top:99.609375%; }img#mv-trellis-img-9{display:block;}img#mv-trellis-img-10::before{padding-top:99.70703125%; }img#mv-trellis-img-10{display:block;}

I would periodically update everyone my personal spending. This is the update for this month.

You can review my past spending logs by going to the personal notes section of investment moats here in the future.

How I Group My Spending.

One of the reasons for publishing the spending is to show people just how spending should be. Some would wonder if it is consistent or erratic, high or low. If you are interested, you see it, and you form your own tale about it.

You will be able to tune in to a spending profile of someone who is single, older, a fully paid up home. If you spend more than this, then you can ponder why is that and what you think about it. If you spend less than this, then you can ponder why and what do you think about it.

I group my spending based around a few technical grouping:

- Flexible or Inflexible: There are some spending that we can be more flexible with. The spending tends to fluctuate over time. There are some spending that is more inflexible. The impact of this is felt more if you are retrench from work, wish to take a hard pivot in your life or career, planning for financial security or future retirement. A more inflexible spending would require your planned income stream to be more conservative while you can take some more risk if you have flexibility in your spending.

- Finite or Ongoing: There are some spending that will stop at some point but there are some spending that we don’t see it stopping objectively. Finite spending are insurance premiums, mortgage, allowance for kids, allowance for parents etc. Ongoing spending is a certain kind of transport spending.

- Role or Responsibility: What am I currently? Am I a worker? A husband? Or a Son? Some of the spending are group this way so that we are able to see just how much we are spending on something. Some of these responsibility will go away. For example, you spend on some travels, clothes, pay income tax because you are a worker. But if you are planning for a non-working phase of life, would you wish to know how much that you spend today can be peeled away.

In a way, this works for me because I always have an eye from the Financial Independence planning perspective. You might not, and you have your own reasons.

I hope that your way of grouping have some sensibility to it and helps you in your own way.

This is the spending for the month of October. Illustrations can be found on my Instagram here.

My October spending is about $300 higher. Actually it should be $500 higher because I went on a trip but I realize by the time I wrote this post, I haven’t exactly tally with the numbers so I will likely do it as part of next month’s spending.

I will break how I spend in the subsequent sections.

The Essential Inflexible Spend

I wrote about my essential inflexible spend here in this note: What kind of lifestyle would I need to buy for myself?

I group and track this set of rather inflexible spending to be reflective about how realistic is the numbers as part of the notes written above. The income stream from my Daedalus Income Portfolio is meant to pay for this spending as well.

The food spending is mainly the groceries that I use in my meal prep. I would eat 1 meal mainly a day, but think 15 days in a month, I would usually eat 2 meals. So what you see is just that.

The conservancy fee is 50% this month. This month I am also paying $0 for my utilities.

Overall, the essential inflexible spend is lower than the $850 monthly plan for Daedalus Income portfolio.

The Basic Inflexible Spending

The difference between the basic and the essential is that.. its less essential. You can probably think of something that you can at least be slightly more flexible… but actually not too flexible about that would make life more sane.

You want to renovate your place every 10 years or replace something right? You want to try and make life easier on an ongoing basis right? You want to take better care of your health right? Some of you will have strong opinions about some areas, more than others. To you the spending can be rather inflexible, but if you touch your heart, you know you can cut if the conditions are really bad.

If it fits those it ends up here.

This is also eventually what Daedalus Income Portfolio also need to provide.

I describe this spending in this note: Aside from my most essential spending needs, I need $5,160 yearly for my basic needs. I would set aside $174,000 to provide income for it.

I was walking on the pavement in Bangkok and my spectacles fell off. Spectacles are suppose to be more resistant to wear and tear like this but I guess after 3 years of use, the specs broke off.

I went to OwnDays in Thailand to buy an OwnDays Air for about $128, after claiming some VAT back. It could have been $5 cheaper if I follow them or do whatever shxt on Line but then I don’t have Line.

It could even be cheaper had I bought a damn travel insurance (which I thought I did but never).

I also bought a mop stick for $7. The current one is something that can extend and shorten but that flexibility is also what makes it so frustrating to use. I decided to cut my main by just paying for a mop stick. Now I enjoy my mopping process sooooooooooo much more.

I wish it is just 2 inches longer.

The Flexible Spends

I would group most of my spending that are flexible into one big pot. Realistically, this is the spending that make life interesting.

Realistically, we can be more flexible with these spends as well.

I find this spending to be less important for long term retirement planning but you might hold a different opinion. I do think that if you wish to enjoy something, maybe you would also want to work for it. But there are some sub-accounts that allow me to tune in to them.

There are going to be a few items that I decide to get so that I don’t have to think about it so much for travel.

The first one is a travel organizer for all the cables and dongles so that I can have them all in one place $6.

The second is a Tessan 140W Gan charger so that I can multiple charge. $63.

Also bought a Thailand Sim Card for $7.60.

I gifted my brother a Logitech MX 3S. This one comes up to be $102 during a flash sale. Probably a very competent mouse and Logitech battery is really long lasting.

I paid $180 for my DBS YUU credit card fee that I cannot waive off KNN.

I bought this Supcase Magnetic Triphone stand for $59. Damn bulky. Might not be for you. But the magnet is damn strong.

Also bought 2 USB C cables that come up to $8.

In October, I have the privilege to have meals with the following people:

- Matthias

- Ray

- Thomas

- Royston

- Huey Meng

The meals with them came up to a total of $170

This month’s treat for colleagues at Providend:

- Munchi pancakes: $3

- Peanut and red bean Shiopans from Gokoku: $94

- Baker’s Bench Bakery @ Bukit Pasoh: $286

Spending Funded from Other Sources

These are spending that comes from sinking fund/saving groups that we capitalized.

This would be mainly for my real insurance protection needs. You can read more about them here: Cutting My F.I. Capital Needs for Insurance Premiums from $131,366 to $58,132 by Prepaying for It.

If I capitalized this spending, I take it out from my recurring spend. A few line items of my insurance are really finite. Term insurance is. My $50,000 Limited Whole Life is. My health insurance is in my inflexible essential spend above, which I have plan as part of my expenses even if I am not spending it today (so as to shore it up for the later years).

The insurance is higher because I paid $585 for an annual term life insurance with advanced critical cover.

Spending on Work

I don’t have a lot of responsibilities like a lot of other people. Spending on work is a way to track those spending that is directly attributed to work. If I stop working this goes away.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment