Threadneedle Street’s Dark Secret: What the Banking Nightmare Means for Your Portfolio Right Now

What caught my eye this week feels like one of those classic “Wait, what just happened?” moments in finance — you know, the kind where you think you understand the game, then suddenly the rules flip on you. I dove into this week’s episode of *A Long Time In Finance*, titled *The Great QE Rip-Off*, and wow, the Bank of England’s moves look more like a high-stakes gamble than a masterclass in economic strategy. Imagine paying £101 for government bonds during Quantitative Easing, only to sell them back for a mere £28 later on. Sounds like a rough deal, right? But here’s the kicker — it’s taxpayers footing a possible £115 billion bill. Now, I’m no central bank wizard — in fact, grading the Bank of England’s work might just be above my pay grade — but it’s baffling how this saga unfolds, especially when the full cost impact only sneaks in at the end of the discussion. Are we really paying the price for a strategy meant to stave off economic disaster, or is this the financial equivalent of burning money to keep warm? Let’s unpack why QE, QT, and all that bond market chaos might be more complicated than anyone’s spreadsheet can capture, and why sometimes even the “experts” seem as lost as the rest of us. LEARN MORE

What caught my eye this week.

I admit that marking the work of the Bank of England is probably above my pay grade.

However listening to this week’s episode of A Long Time In Finance didn’t exactly have me reaching for gold stars for the Old Lady.

The title – The Great QE Rip-Off – sets the tone for where the podcast is coming from, as does the show’s blurb:

Christopher Mahon of Columbia Threadneedle talks to Jonathan and Neil about how the Bank of England bought government stocks and sold them back at a loss.

One example: paying £101 (QE) and later selling it for £28 (QT).

The cost of this insane behaviour to the taxpayer? Probably over £115 billion.

It’s an interesting listen for sure. However I’d suggest the podcast makes things harder to follow than they need be.

That’s because it’s only at the end of the episode that Mr. Mahon explains how the Bank’s chosen course of action is directly costing the taxpayer.

Mahon’s contention is that by dumping long duration gilts into a pretty illiquid market that doesn’t hugely want them, the Bank is putting upwards pressure on yields.

This is increasing government (/taxpayer) borrowing costs – and at a time when we can ill-afford the extra burden.

Cue poor returns

Such market timing and yield curve distortion issues aside, it seems to me the BoE bought its expected returns when it made its gilt purchases, just like any of us do when we buy a portfolio of bonds.

And those returns were never going to be pretty, given it was buying near-zero yield bonds in 2020, for instance.

However QE was done for a reason.

You remember? It was to ward off a depression during the financial crisis years, and to support an economy that was all but switched off at times with Covid.

Hence any proper accounting of ‘the cost to the taxpayer’ from the BoE’s profit and loss agnostic bond trading strategy should take into account what would have happened if the Bank had bought different bonds or assets. Or even if it had done nothing at all.

Who knows? £115bn might be a snip compared to the cost of going into a depression.

Perhaps with all the unknowns, working out the true cost and benefit of QE and QT is beyond everyone’s pay grade.

At least if the bond rout of 2022 left you feeling bruised and befuddled then you might be comforted to hear the Bank of England doesn’t seem to have gotten through the regime change any better!

Related reading:

- Is the long gilt sell-off an opportunity? – Interactive Investor [Affiliate link]

- Europe can escape a bond doom loop. The US, not so much – Reuters

Have a great weekend!

From Monevator

Decumulation: year two for the No Cat Food portfolio – Monevator [Members]

FIRE-side chat: Accelerating to escape velocity – Monevator

From the archive-ator: You need a plan, not predictions or platitudes – Monevator

News

Contactless payments could become unlimited under new plans – BBC

Shopper confidence falls as Brits expect food inflation to climb – City AM

Car finance compensation should be paid next year, says FCA – BBC

House prices could fall as Budget fears spook buyers – This Is Money

Ministers must do more on Lifetime ISA reform, say MPs – BBC

It’s a tough time to be job hunting in America… – Washington Post via MSN

…while in the UK, ‘job hugging’ is a thing – Yahoo Finance

Farmers feel abandoned as thousands of contracts cut – BBC

Is Britain a good place to retire? – This Is Money

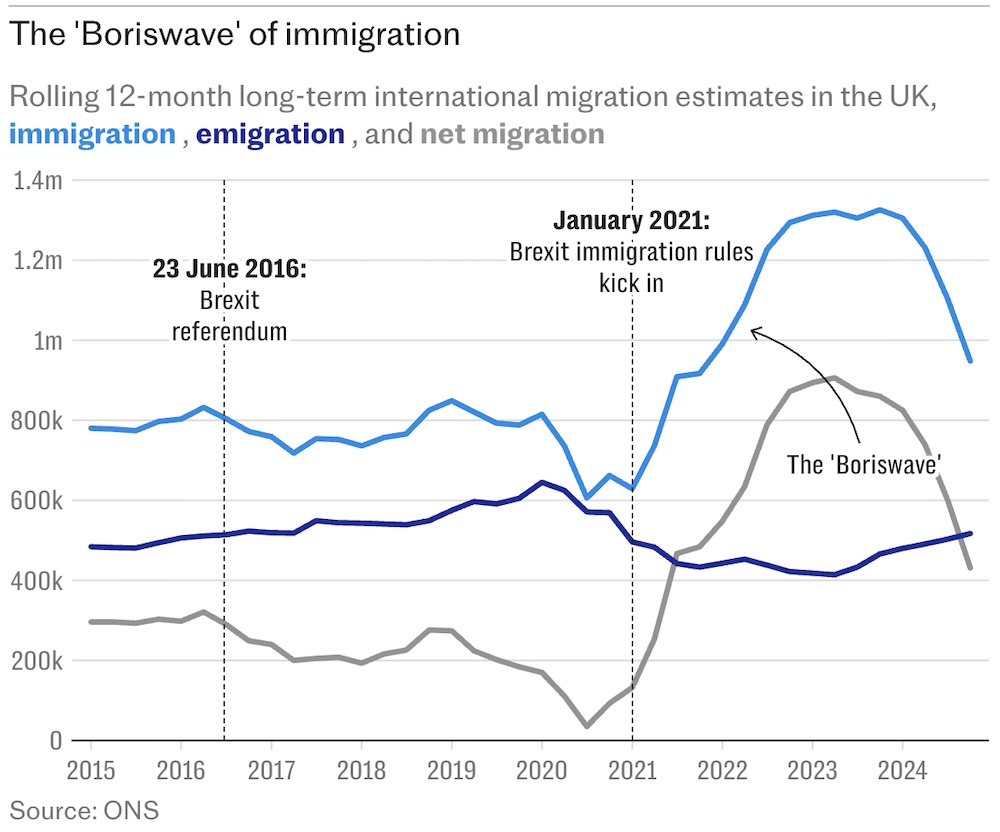

How Boris Johnson’s Brexit opened the door to the biggest wave of migrants in history – Telegraph [Or Sky with no paywall]

Products and services

Three in four savings accounts pay less than the base rate of 4%… – This Is Money

…though Nationwide’s regular savings account pays an attractive 6.5%… – via Yahoo Finance

…so should you fix your savings for five more years? – Which

Get up to £200 cashback when you open or switch to an Interactive Investor SIPP. Terms and fees apply, affiliate link. – Interactive Investor

Co-operative Bank switch offer: £100 + £75 – Be Clever With Your Cash

Vanguard 2.0 – Morningstar

How to avoid overpaying on your car insurance – Which

Supermarket Christmas savings scheme hack – Be Clever With Your Cash

Get up to £100 as a welcome bonus when you open a new account with InvestEngine via our link. (Minimum deposit of £100, T&Cs apply, affiliate link. Capital at risk) – InvestEngine

Why trading apps are going social – Blockworks

Tudor homes for sale in villages, in pictures – Guardian

Comment and opinion

Charles Ellis’ very short guide to very long-term investing – CFA Institute

Inventing problems – Humble Dollar

Just how bad would an ‘AI bubble’ be? – The Atlantic

Yes, a stock market crash is coming – Our Tour

Should you make tax-free pension withdrawals before the Budget? – Which

The ‘vinyl rule’ of retirement: plan for two sides in your next act – Kiplinger

Why don’t even the well-off feel rich? – This Is Money

Active versus passive is a false dichotomy – Alpha Architect

The goldilocks financial plan – The Purpose Code

Capital gains tax Hokey Cokey – Simple Living in Somerset

FIRE may make multi-generational wealth impossible – Financial Samurai

Keeping up with the Joneses mini-special

The bar only gets higher – Of Dollars and Data

All the things you need a billion dollars to buy are bad – How Things Work

How to avoid First World problems – A Teachable Moment

Naughty corner: Active antics

The hypocrisy of avoiding defence investments – Institutional Investor

Extreme concentration in the S&P 500 [Charts, PDF] – Axios

Bloomberg deep dive on crazy high-yielders – Random Roger

Where to? The story of Uber – Quartr

Equity duration and predictability [Research] – Alpha Architect

Kindle book bargains

Flash Boys by Michael Lewis – £0.99 on Kindle

Alchemy by Rory Sutherland – £0.99 on Kindle

The Green Budget Guide by Nancy Birtwhistle – £0.99 on Kindle

Techno Feudalism by Yanis Varoufakis – £0.99 on Kindle

Or grab one of our all-time favourites – Monevator shop

Environmental factors

Back to petroleum: BP’s backpedaling – The Observer

How France built 40 nuclear reactors in a decade – Works in Progress

The plastic recycling changes coming to England in 2027 – Yahoo News

New Zealand looks to kill to conserve – NPR

UK battery firms aim to unlock the path to net zero – Guardian

Corals growing on North Sea oil rig re-homed to artificial reef – BBC

Oysters on a mission to save the North Sea – Fakenham & Wells Times

Protect Arctic from ‘dangerous’ climate engineering, warn scientists – BBC

Robot overlord roundup

Techno-pipe dreams – Aeon

Geoffrey Hinton: AI will make a few rich but most poorer… [Paywall] – FT

…but anyway, AI won’t make you rich – Colossus

Your brain on ChatGPT – Klement on Investing

Evidence from Brazil on the impact of AI in the workplace – CEPR

AI and the breaking of Silicon Valley’s social contract [Podcast] – Odd Lots via Apple

Not at the dinner table

Killing of Trump ally lays bare America’s bloody and broken politics – BBC

The era of a step-on-a-rake capitalism – The Atlantic [h/t Abnormal Returns]

Wealth taxes are making Norway poorer – Unherd

America is getting the economy it voted for – Noahpinion

Ken Griffin: Trump’s risky game with the Fed – Wall Street Journal

New UK Green leader talks to Nigel Farage’s constituents – Guardian

America’s Perón – The Atlantic [h/t Abnormal Returns]

Israel’s war in Gaza and proportionality – BBC

Historical perspectives mini-special

The lost art of thinking historically… – Noema

…or maybe it’s all quite simple (and dark) – Ryan Holiday

Off our beat

Never bet against America – Unchartered Territories

Mike Lynch’s last night: a wildly improbable storm of coincidences – Wired

The school shooting industry in the US is worth billions – NPR

Sicker and stupider – Klement on Investing

On commitment – Adam Singer

Wild running: freedom, but also looking over your shoulder – Independent

Thank you, Melvyn Bragg – Defector

And finally…

“Our earth is degenerate in these latter days: bribery and corruption are common; children no longer obey their parents; every man wants to write a book, and the end of the world is evidently approaching.”

– Assyrian tablet, c. 2,800 BC., Devil Take The Hindmost

Like these links? Subscribe to get them every Saturday. Note this article includes affiliate links, such as from Amazon and Interactive Investor.

Post Comment