Tron’s $0.40 Breakout Looms — But One Crucial Challenge Could Make or Break TRX’s Surge!

Ever wonder what happens when almost 90% of a cryptocurrency disappears from the trading floor, locked away in staking vaults? That’s exactly the toy Tron’s playing with right now—a real supply crunch that’s squeezing liquidity tighter than your grandma’s hug. This scarcity is like rocket fuel for bullish momentum, hinting at a possible sprint toward the $1.1 mark. But—and here’s the kicker—the very same tight supply that spices things up also turns volatility into a wild card, ready to flip the script at any sudden unstaking move or market tremor. Now, we’re at a crossroads: will Tron’s price dance keep up above its ascending trendline and resistance thresholds, or will a dip under $0.331 roll out the red carpet for a setback? With futures traders piling in and funding rates glowing faintly green, the energy is palpable, but the stakes have never been higher. Can Tron juggle this delicate balance and keep the bulls cheered? Let’s dive deep into the forces shaping TRX’s next big move and what it means for savvy investors like us.

Key Takeaways

How does Tron’s supply crunch shape its upside potential?

Tron’s shrinking supply and high staking ratio limit liquidity, boosting bullish momentum but also heightening volatility risks.

What market signals confirm Tron’s next major move?

Holding the ascending trendline and $0.355 resistance with strong taker buys, and positive funding could fuel continuation, while a breakdown under $0.331 weakens momentum.

Tron’s [TRX] supply has been shrinking steadily, with nearly 89% of circulating tokens locked in staking, creating a highly illiquid environment that amplifies volatility.

This scarcity strengthens bullish momentum and sets the stage for potential upside toward the $1.1 mark.

However, such limited liquidity also magnifies the impact of sudden unstaking events or exchange inflows. While the long-term structure remains supportive, short-term market conditions are fragile.

The market now faces a decisive moment where supply scarcity could trigger an aggressive rally or lead to sharp corrections.

Can TRX price sustain momentum above its ascending trendline?

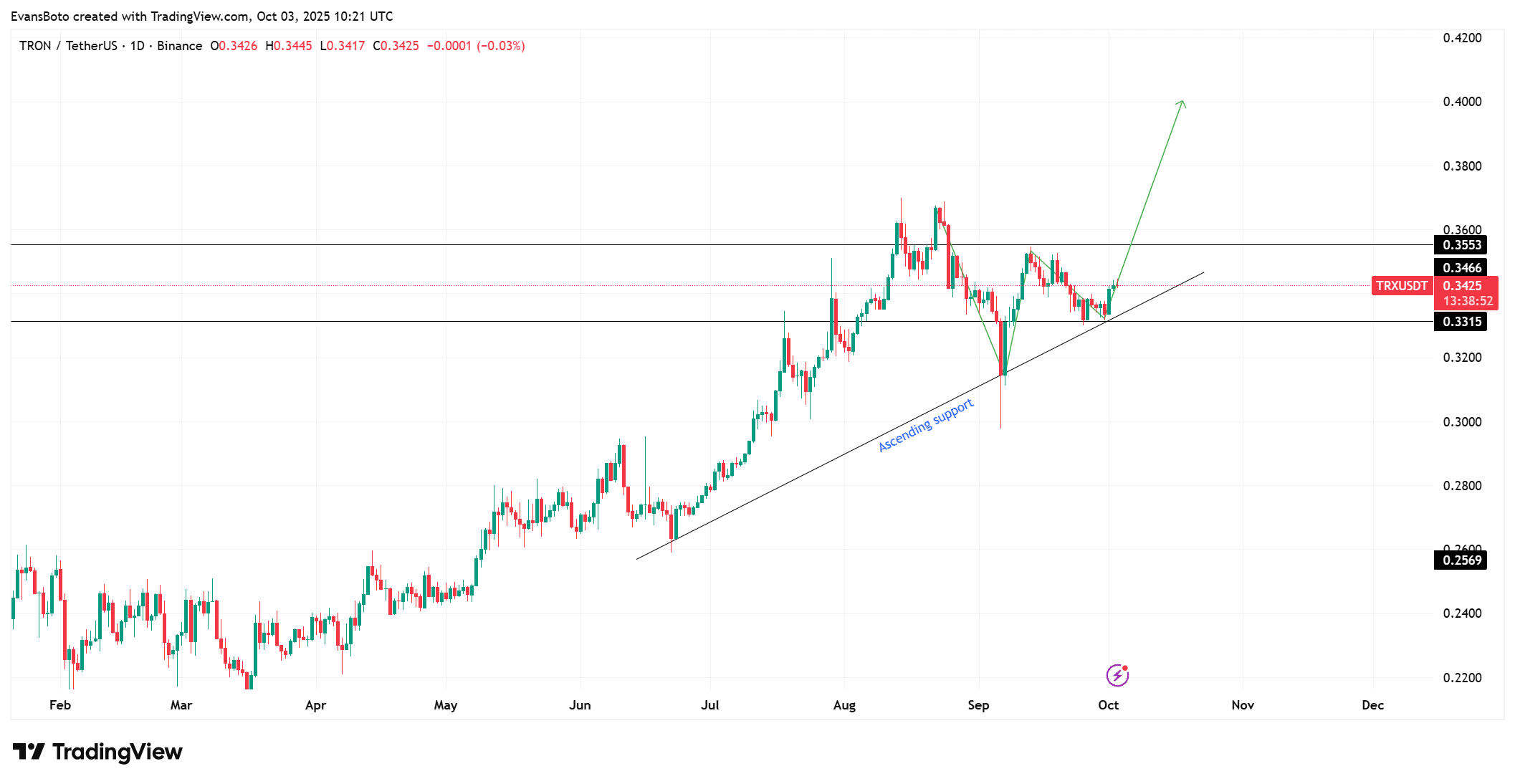

The daily TRX chart shows the asset holding firmly above an ascending support trendline, reinforcing a bullish structure that has been intact since July.

Key resistance sits around $0.355, while support has consolidated near $0.331, giving traders a clear range to monitor.

A breakout above resistance could spark an extended push toward $0.40, supported by strengthening momentum.

However, failure to hold the rising support trendline could expose TRX to downside risks. The ability to maintain higher lows is now a critical driver of sentiment across the market.

Futures taker buy volume signals traders are driving the upside

The Cumulative Volume Delta (CVD) reflects a surge in taker buy activity, confirming that futures traders are aggressively leaning long on TRX.

This dominance of buy-side flows underlines the conviction behind recent price resilience and suggests that derivative traders expect continuation.

While such positioning can accelerate rallies, it also increases the risk of volatility if momentum stalls.

A sudden shift toward profit-taking or liquidation could quickly reverse gains. However, as long as buying pressure remains dominant, the Futures market continues to reinforce bullish momentum for Tron.

Source: CryptoQuant

TRX positive Funding Rates keep supporting bullish appetite

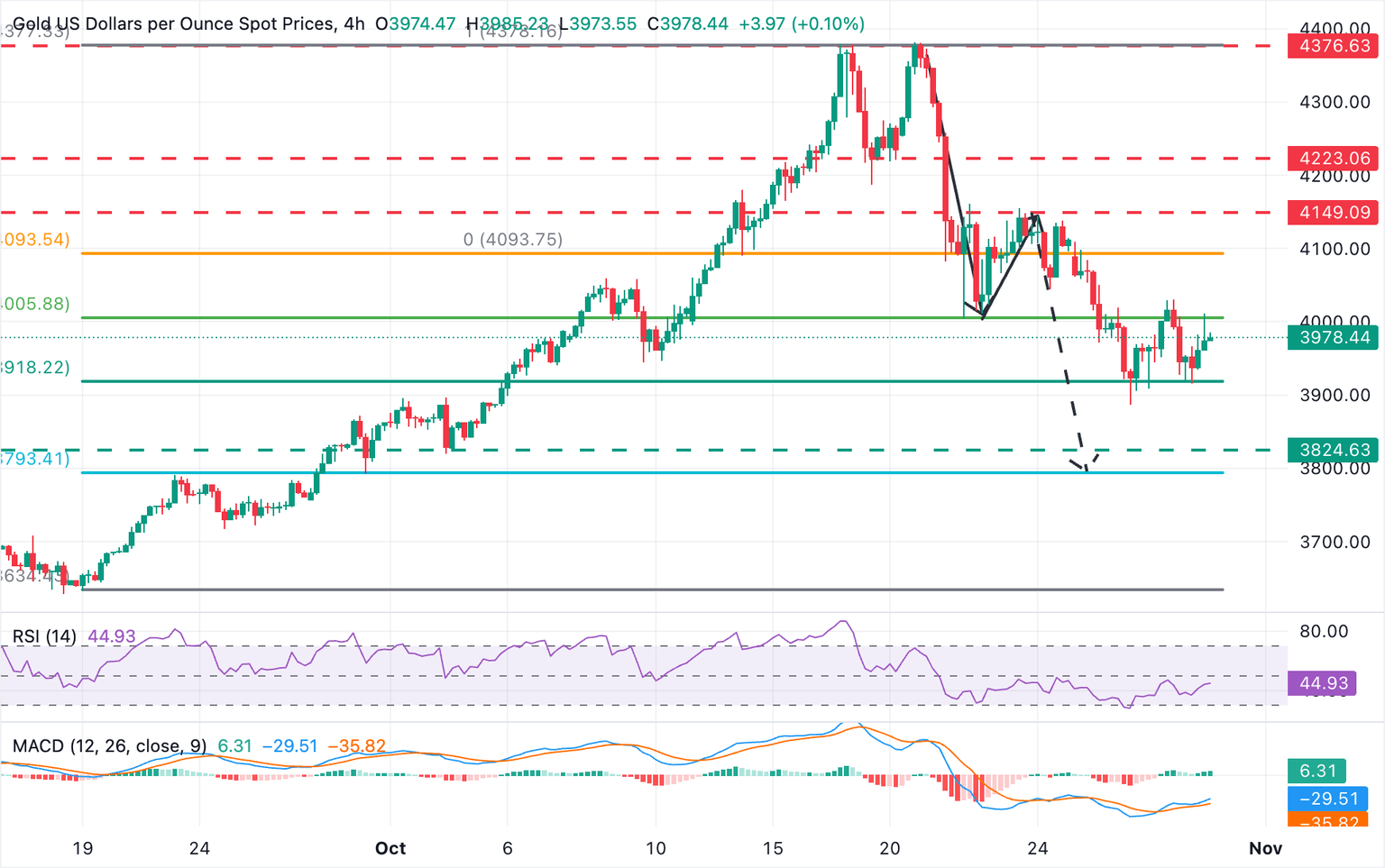

Funding Rates across TRX Perpetual Futures have remained slightly positive at 0.009%, as of writing, signaling that the majority of traders are paying to maintain long exposure.

This persistent green bias highlights strong conviction among leveraged participants and supports higher spot prices when combined with technical and on-chain signals.

However, elevated long positioning often introduces the risk of sharp pullbacks if funding becomes overheated.

Still, the current modest levels of positivity provide room for upside without immediate liquidation risks. This balance keeps the broader market tone cautiously optimistic for further gains.

Source: Santiment

Can TRX maintain its bullish foundation?

Tron’s tightening supply, strong staking ratio, ascending support, dominant taker activity, and positive funding all point toward a sustained bullish setup.

Yet, the same factors that amplify upside potential also heighten volatility risks, especially if unstaking or profit-taking accelerates.

In the near term, maintaining momentum above $0.355 could unlock further rallies, while a breakdown under $0.331 would weaken the bullish case.

For now, the structure favors continuation, suggesting Tron has the foundation to maintain its bullish footing if demand remains steady.

Post Comment