TRON’s Liquidity Overhaul: What Billions in Stablecoins on the Move Means for Your Crypto Portfolio

Ever get the feeling that in the ever-evolving crypto world, the tides of power can flip overnight? Well, something seismic just happened in TRON’s stablecoin arena, and it’s shaking up the game in ways that demand our attention. While everyday users keep plugging along with their usual USDT dealings, a stealthy but significant migration is underway — big wallets are swelling, Binance is dialing back, and the Tether Treasury is boldly stepping into the spotlight. What does this mean for the broader market? Circle’s USDC inflows have soared to a level unseen in four years, hinting at a brewing storm of activity behind the scenes. If you thought the stablecoin landscape was just background noise, think again — this liquidity reshuffle on TRON could be the catalyst that sets the next big market moves into motion. So, where exactly is the real influence moving, and how can savvy investors position themselves before the next wave hits? Dive in, because the answers might surprise you. LEARN MORE

Key takeaways

What’s happening with USDT on TRON?

Big wallets are growing fast while Binance steps back, giving Tether Treasury the top spot.

Why does it matter for the broader market?

USDC inflows just hit a four-year-high.

Something big just shifted in TRON’s [TRX] corner of the stablecoin world.

The balance of power in crypto is shifting. With billions on the move, it’s about WHERE the real influence is going.

Liquidity reshaped on TRON

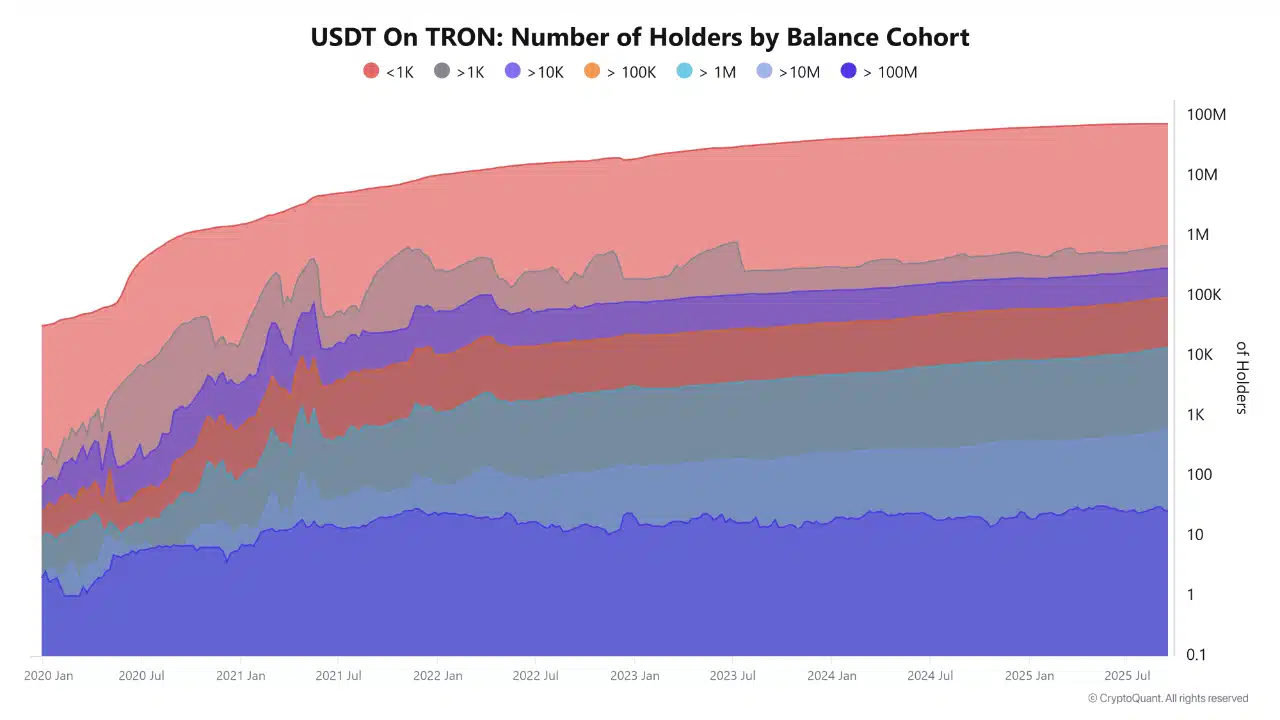

While small users stuck to their usual patterns – using USDT for everyday transactions – the bigger story was in the mid-to-large cohorts.

Wallets holding between 1K and 100K USDT grew by 3.51%, so there’s more institutional and active trader participation.

At the higher end, wallets holding over 1 million increased by 3.68%, while those with 10 million or more surged by 9.34%.

The largest whales, holding over 100 million, remained steady. Overall, the data suggests that liquidity is gradually shifting toward larger holders.

But that’s not all.

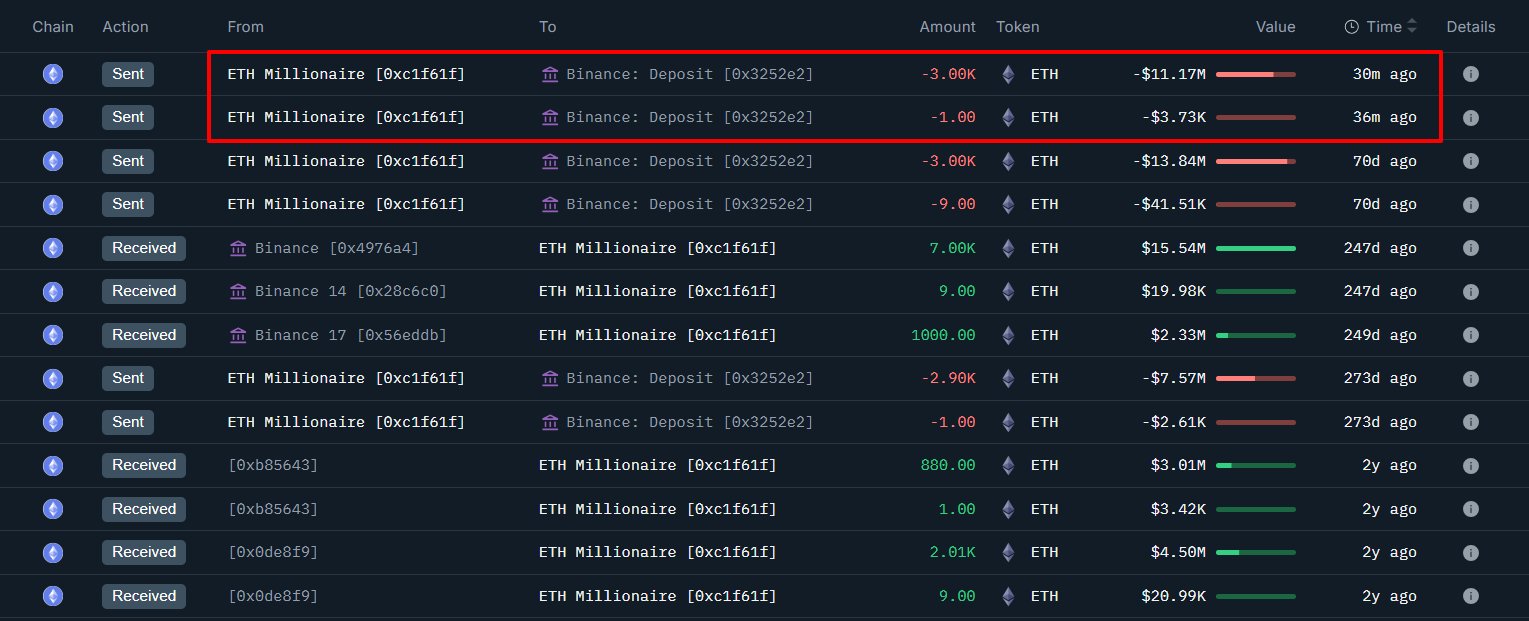

Binance steps back, Tether steps up

Binance, once the undisputed leader with nearly $9 billion in holdings, has seen its stash tumble to just $2 billion.

That slide not only closed the gap with other players but also cleared the way for Tether Treasury to take the crown.

Tether’s wallets have steadily climbed to about $4 billion since early September.

Bybit, on the other hand, held its ground around $1.3 billion. Strategies are evolving in liquidity management, changing how institutional players use TRON for USDT flows.

USDC inflows hit a 4-year high

If TRON’s reshuffle wasn’t enough, the stablecoin market is flashing its own lights.

Circle’s (USDC) exchange inflows just surged to $1.33 billion, at press time, the highest level seen in more than four years. Big deposits like this are often the calm before the storm.

Whether it’s fresh buying power entering the market or hedging ahead of volatility, such spikes usually precede strong moves.

Combined with shifting whale dynamics on TRON’s USDT, it is clear that stablecoins are a big part of what’s driving the market’s next push.

Post Comment