Trump-Backed WLFI Token Skyrockets to $30B Valuation—Is This the Next Big Crypto Power Move or a Bubble Ready to Burst?

Ever wonder what happens when big ambition meets big names and even bigger numbers in the crypto world? World Liberty Financial just crashed the party with their brand-new WLFI token launching at a jaw-dropping $30 billion valuation. Backed by none other than Donald Trump himself, this Ethereum-based DeFi project didn’t just tiptoe onto the scene—it strutted in, shaking up the rankings and outshining heavy hitters like Litecoin and Polkadot on its first day. But here’s the kicker: more tokens hit circulation than anyone anticipated, fueling its meteoric rise right out of the gate. Curious how this blend of politics, massive tokenomics, and multi-chain stablecoin expansion is rewriting the playbook? Let’s dive into the details that are causing waves across major exchanges and beyond. LEARN MORE

WLFI debuts with more tokens in circulation than forecast, propelling it into top-tier crypto valuations at launch.

Key Takeaways

- World Liberty Financial launched its WLFI token with an initial valuation exceeding $30 billion.

- The project operates on Ethereum, has backing from Donald Trump, and its USD1 stablecoin is expanding across multiple chains.

Share this article

WLFI, issued by Trump-backed DeFi firm World Liberty Financial, went live on leading exchanges today at $0.3, giving the token a $30 billion fully diluted valuation.

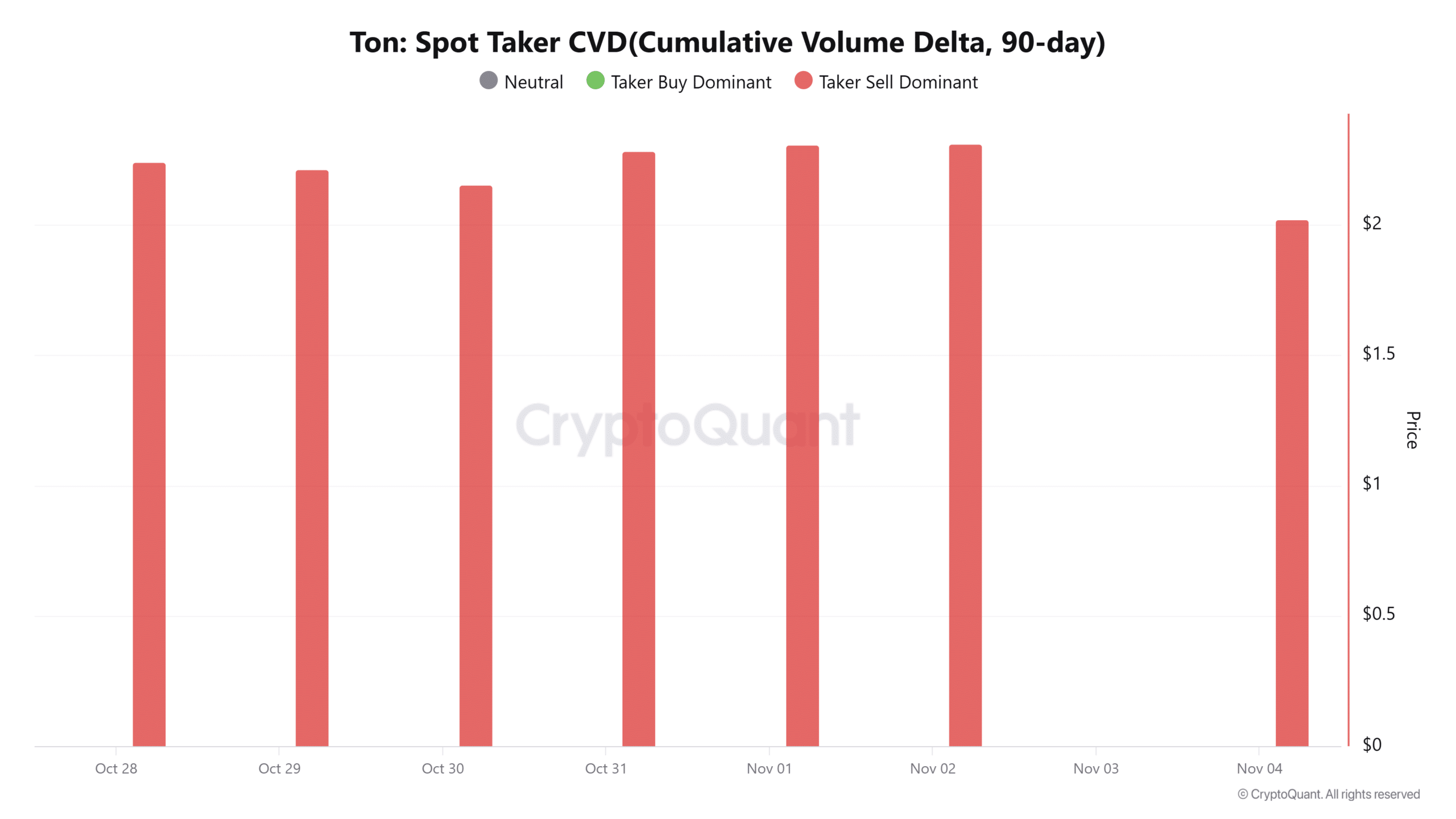

WLFI briefly surpassed $0.33 before retracing. At the time of writing, the token was trading at $0.29, with a market capitalization of $8.7 billion. It is now the 27th-largest crypto asset by market cap, ahead of prominent names such as Litecoin, Toncoin, and Polkadot.

World Liberty Financial has set the total supply of its governance token at 100 billion WLFI. At launch, approximately 25 billion tokens, equivalent to about a quarter of the supply, will be in circulation.

That includes 10 billion tokens allocated to World Liberty Financial, 7 billion for partner Alt5 Sigma Corporation, and 2.8 billion earmarked for liquidity and marketing. Early investors in the project’s funding rounds will also be able to unlock around 4 billion tokens, equal to 20% of their original purchases, through the Lockbox process.

The remaining non-circulating supply consists of nearly 20 billion WLFI for the Treasury, 33.5 billion for the team, 16 billion as the locked portion of the public sale, and 5.8 billion for strategic partners, all subject to vesting or lock-up conditions.

WLFI is now available for spot trading and deposits across Binance, Bybit, MEXC, Bitget, Gate, KuCoin, and Hyperliquid.

Share this article

Post Comment