Trump-Backed WLFI’s Nasdaq Move: Is This $1.5 Billion Token Treasury the Next Billion-Dollar Game Changer?

Ever wonder what happens when old-school finance rubs shoulders—and wallets—with the whirlwind world of crypto? Well, World Liberty Financial (WLFI), a Trump-linked player, might just be writing the next chapter in this saga by eyeing a $1.5 billion Nasdaq-listed company to hold its WLFI tokens. It’s like watching a crypto startup take a page out of the Strategy playbook but with a Trumpish twist. And just when you think the game can’t get more interesting, WLFI drops a USD1 loyalty program aimed squarely at the heavy hitters of trading and DeFi — because who doesn’t love a little extra incentive to play bigger? This move is not just about money; it’s a savvy bid to bridge traditional markets with the tokenized future, sparking questions on whether we’re witnessing the dawn of a new crypto-stock hybrid era. Curious to know how it all unfolds? LEARN MORE

Key takeaways

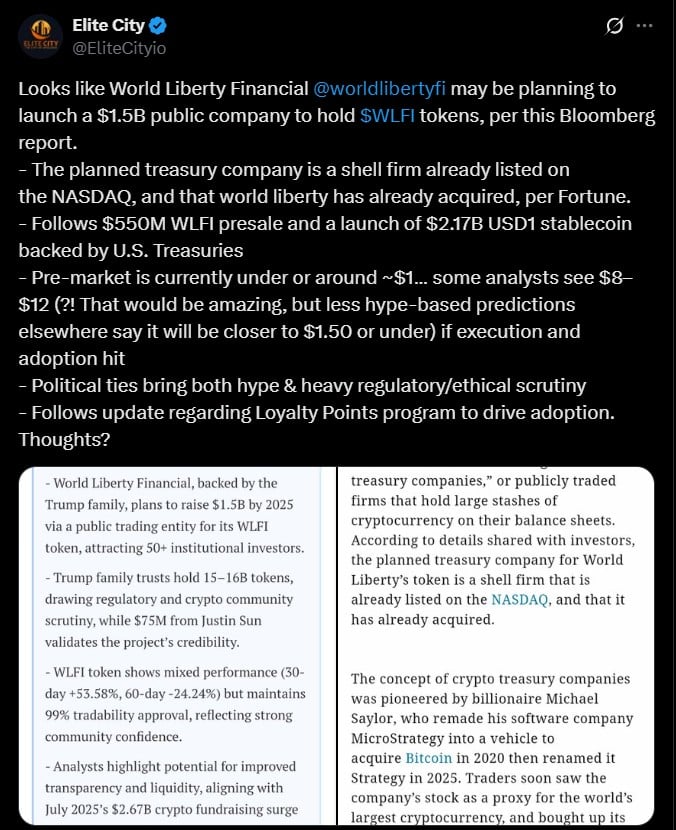

Trump-linked crypto venture World Liberty Financial is planning a $1.5 billion Nasdaq-listed company to hold its WLFI tokens. The move comes as WLFI also rolls out a USD1 loyalty program targeting high-volume traders and DeFi users.

World Liberty Financial (WLFI) seems to be taking a page from Strategy’s (prev. MicroStrategy) playbook, with rumors running rife about a $1.5 billion publicly traded company to hold its WLFI tokens.

The move could turn WLFI into a stock market proxy for token exposure – just as hype builds over its newly launched USD1 loyalty program.

WLFI eyes $1.5B Nasdaq-listed treasury

World Liberty Financial, the Trump family-backed crypto venture, is weighing the launch of a $1.5 billion publicly traded company to hold its WLFI tokens.

The proposed venture (expected to be listed on Nasdaq) would give traditional investors a stock-market route to WLFI exposure.

According a Bloomberg report, the structure is apparently still being finalized, but tech and crypto investors have already been approached, with talks moving quickly.

If it proceeds, WLFI would join a fast-growing club of digital-asset treasury firms, a segment that has raised about $79 billion in 2025 for Bitcoin purchases alone.

Borrowing from Strategy’s playbook

Investor materials suggest WLFI plans to use an existing Nasdaq-listed shell company it has acquired – mirroring the path taken by Michael Saylor’s Strategy (prev. MicroStrategy).

That pivot in 2020 transformed Strategy into a $113 billion market cap Bitcoin proxy with $72 billion in BTC holdings.

This success has seen the rise of many Bitcoin-proxy stock companies.

WLFI has already raised $550 million through two public token sales.

Backers include TRON [TRX] founder Justin Sun, who invested $30 million for 2 billion WLFI tokens and Web3Port with $10 million.

Trump himself reported $57.4 million in income from WLFI token sales in 2025.

Post Comment