Trust Wallet Token Skyrockets — But Here’s Why Retail Investors Might Be Walking Straight Into a Trap

Trust Wallet Token’s wild leap from $0.70 to $1.49 after months of quiet consolidation is the kind of breakout that makes you sit up and scratch your head. What’s driving this sudden retail frenzy across Spot and Futures markets, with activity crowded enough to raise the “too many retail” alarm? It’s almost like watching a packed stadium where every fan thinks their team’s about to score—excitement is through the roof, but will it hold once the frenzy cools? The Spot Taker CVD points to eager buyers in the ring, but those creeping chart gaps and a 22% retracement suggest the token might be gasping for air before its next sprint. So, the million-dollar question: Is this rally just a quick burst of momentum orchestrated by retail traders, or the start of a sustained climb with deeper market players ready to step in? Let’s dive into the layers beneath this surge and parse out what lies ahead for TWT’s price dance. LEARN MORE

Key Takeaways

Why did Trust Wallet Token surge?

The breakout to $1.49 from $0.70 came after months of consolidation, with Spot and Futures showing “too many retail” signals.

What’s next for TWT’s rally?

Spot Taker CVD favored buyers, but a 22% retracement to $1.16 and chart gaps hint at a correction toward $1.00–$1.10.

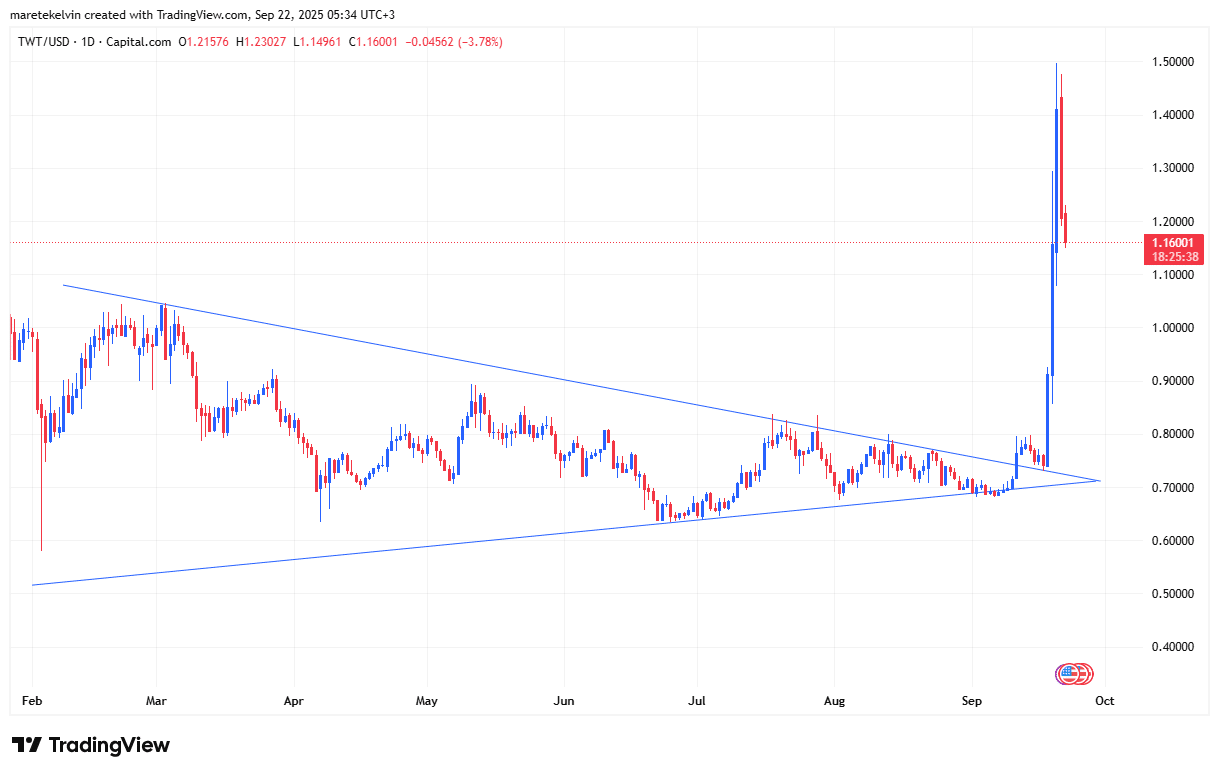

Trust Wallet Token [TWT] staged a sharp breakout from a long consolidation and hit $1.49 on the 19th of September before easing to $1.16 on the 21st of September.

The move came after prices compressed inside a symmetrical triangle for months, with February through early September marked by sideways action.

This breakout shifted TWT’s market structure firmly upward. Yet, with retail traders driving most flows, questions surfaced about the rally’s durability.

Retail traders take the lead on Spot, Futures

CryptoQuant data showed Spot retail activity surged, with trading frequency clustering in the “too many retail” zone.

The same pattern appeared in Futures, where contracts saw a wave of high-frequency retail positioning near $1.20–$1.40.

That alignment suggested the breakout was retail-led across both markets. Historically, such setups produced momentum bursts, though they also faded when enthusiasm cooled.

Now, the big question is, which positions are retail traders taking in the market?

Spot Taker CVD added more clarity. It tilted green, meaning buy takers outweighed sellers.

This suggested that most retail traders are opening long positions, giving TWT strong upward pressure. Historically, this kind of activity has fueled short bursts of momentum.

Signs of overheating

Still, caution may be warranted.

The gaps formed during the rapid rally on the daily chart, leaving TWT exposed to a correction. Retail-heavy moves often reversed quickly when profit-taking began or when liquidity thinned.

In other words, while the aforementioned structure favored bulls, it left the TWT vulnerable to a snap correction.

The next move for the token will depend on whether retail enthusiasm holds or whether selling pressure builds before institutions or whales step in.

If buyers sustain control, bulls may attempt another run. But if profit-taking accelerates, TWT could dip back toward the $1.00–$1.10 zone before finding support.

Post Comment