Unlock Hidden 16% Gains: The Hyperliquid Shorting Strategy Wall Street Won’t Tell You About!

Ever wondered if a 16% drop might actually be a gift wrapped in disguise? Hyperliquid [HYPE] has been playing a fascinating game of price ping-pong between $36 and $50 this quarter, sparking juicy swing trade chances that neither bulls nor bears can ignore. Now, with short sellers already cashing in on a 16% gain after a sharp rejection at $50, it begs the question — is the pullback ready to stretch even further? Bears seem to think so, eyeing the $36 floor like it’s a lucrative hunting ground, while savvy long-term spot buyers might just find a bargain lurking beneath the chaos. With technical indicators flashing ‘sell’ and fundamental metrics hinting at undervaluation, HYPE is definitely throwing mixed signals that keep the trading floor buzzing. So, are you gearing up for another round of shorting gains, or is this the calm before a bullish storm? Let’s dig deeper. LEARN MORE

Key Takeaways

HYPE dropped by 16%, with technicals suggesting that an extended pullback could offer more shorting opportunities.

Hyperliquid [HYPE] has been offering juicy swing trading opportunities within its $36-$50 price range in Q3. In fact, at the time of writing, short sellers were up 16% after a price rejection at the range-high of $50 in mid-August.

Still, the bears could pocket extra 16% gains if HYPE’s pullback extends to the range lows at $36. There may be nuances for bears and long-term spot buyers seeking a discounted window though.

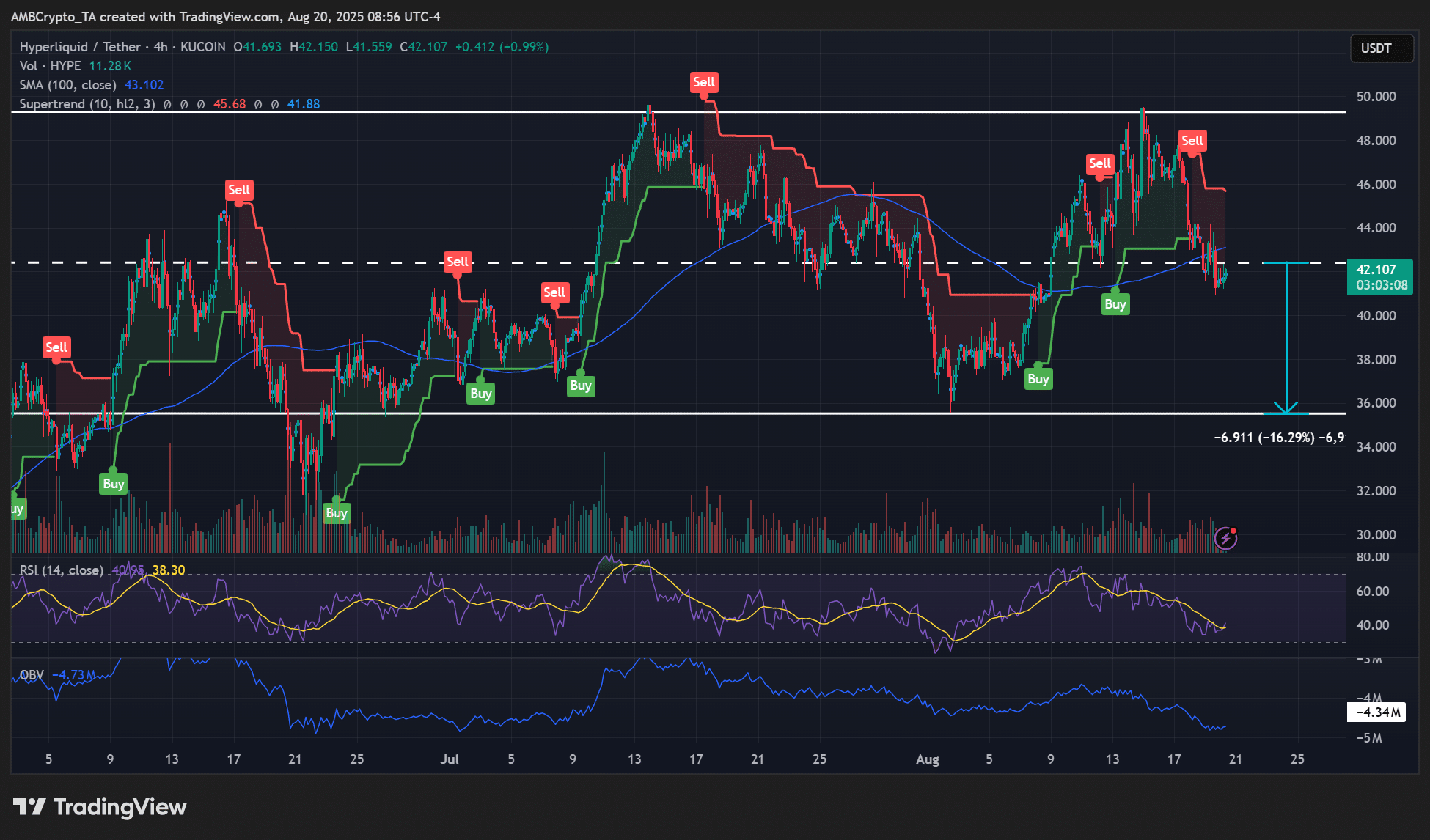

Supertrend flashes firm ‘sell’

On the 4-hour chart, the RSI and OBV reinforced weakness and market edge for bears. Additionally, the price dropped below the mid-range of $42 and any more daily candlestick closes below the level could further confirm short sellers’ edge.

If so, further retracement to $36 could offer another shorting opportunity. Especially if Fed chair Jerome Powell’s position during Friday’s Jackson Hole Symposium leans hawkish.

The 30-day liquidation heatmap also supported the aforementioned scenario.

On the lower side of the price action, pockets of liquidity and price magnets existed at $40 and $37.3. On the upside, the magnetic zones were at $45 and $50.

As such, a liquidity sweep for the lower magnetic zones could reinforce the shorting bias. However, a strong reclaim of the mid-range might invalidate the short thesis.

HYPE is undervalued?

That said, for long-term buyers, HYPE may be currently undervalued based on the SWPE (supply weighted profit to earnings ratio).

The indicator gauges HYPE’s market cap to its protocol earnings. However, the earnings also drive the HYPE buyback program. Hence, lower values could allude to strong demand and undervaluation.

At the time of writing, SWPE had a reading of 3.19 – A sign that HYPE’s value was still undervalued for long-term spot buyers.

To put it simply, HYPE appeared to be flashing mixed signals. From a fundamental point of view, it may be a great buying opportunity. However, on the price chart technical side, the altcoin’s sustained stay below the mid-range might offer extra shorting gains for short-term traders.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Post Comment