Unlock Hidden Cash: The Untold Secrets of Liquid, High-Interest Savings That Wall Street Doesn’t Want You to Know!

Ever wondered where your cash really should be parked in today’s whirlwind financial landscape? I’ve been wrestling with that question myself, realizing it’s high time for a thorough audit of my cash holdings. Holding onto cash isn’t inherently bad, but what keeps me awake is the nagging thought: Am I missing out on better opportunities by settling for meager returns?

You see, treating your entire wealth as one grand portfolio changes the game. It’s about balancing risk and reward—focusing on the “big rocks” instead of sweating the tiny inefficiencies. Sometimes, chasing an extra 0.3% return in a chunk of your portfolio can make a bigger impact than you think. But where exactly are the market yields today? And how do popular options like fixed income funds, savings bonds, or hurdle savings accounts stack up against each other?

Stick with me as I break down the yield curve, peek into term premiums, and sift through the best places to stow your liquid cash—without losing sleep over missed opportunities or liquidity hassles. Ready to dive in?

img#mv-trellis-img-1::before{padding-top:68.65234375%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:10.546875%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:25.1953125%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:117.43119266055%; }img#mv-trellis-img-4{display:block;}img#mv-trellis-img-5::before{padding-top:109.05218317359%; }img#mv-trellis-img-5{display:block;}img#mv-trellis-img-6::before{padding-top:143.01675977654%; }img#mv-trellis-img-6{display:block;}img#mv-trellis-img-7::before{padding-top:101.48662041625%; }img#mv-trellis-img-7{display:block;}img#mv-trellis-img-8::before{padding-top:80.46875%; }img#mv-trellis-img-8{display:block;}img#mv-trellis-img-9::before{padding-top:95.5078125%; }img#mv-trellis-img-9{display:block;}img#mv-trellis-img-10::before{padding-top:252.45901639344%; }img#mv-trellis-img-10{display:block;}

I decided that it is high time that I do some audit of where I would hold the cash holdings that I have.

I don’t think I would always hold so much cash in the future but I am concern less about holding too much or too little cash but if there were a lot of missed opportunity costs.

I believed that if we view most of our wealth as a gigantic portfolio, making higher returns in certain allocation of our portfolio will outweigh the inefficiencies of 1% versus 1.3% p.a. returns in a 20% allocation.

Making sure that we take appropriate risks if we view our money in a gigantic portfolio is focusing on the big rocks instead of sweating over the smaller ones.

However, it is always good to audit the landscape to make sure that we are not missing out on much.

Where Are We in The Yield Curve?

We check the yield curve because the curve will give us a sensing what is the market yield if we invest in risk-free fixed income at various tenure.

It allows us to know the hurdle rates.

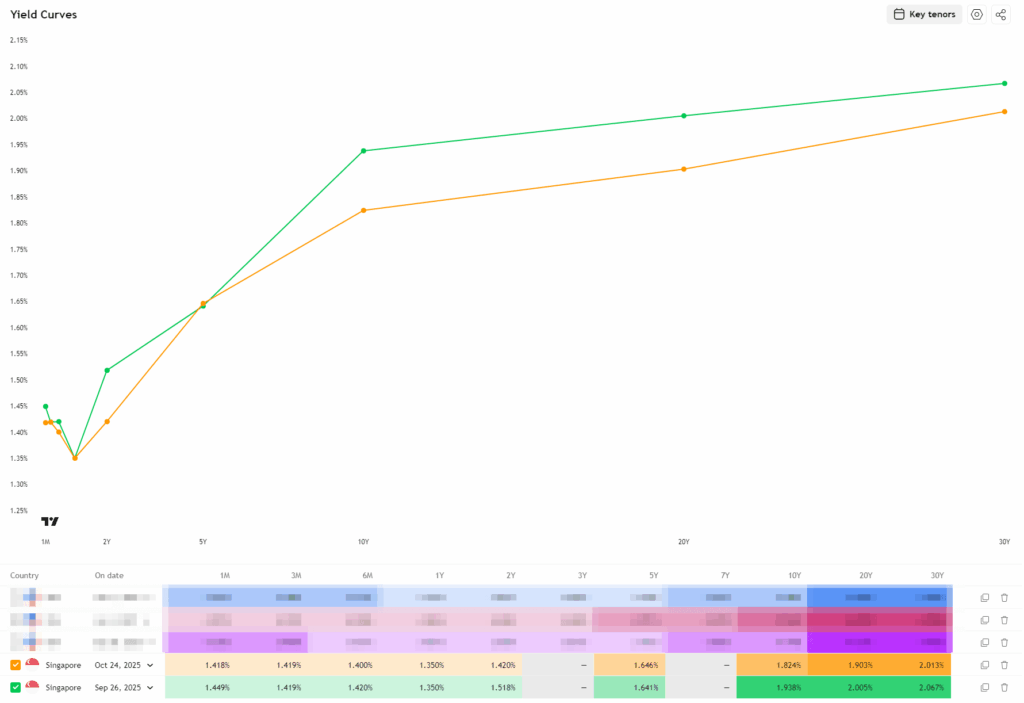

The chart below is taken from a tool in Trading View:

I plotted the yield curve for two time periods, on Friday and a month ago. A lower curve relative to a month ago shows that interest rates are dropping.

The current yields:

- 1-month: 1.4%

- 3-month: 1.4%

- 6-month: 1.4%

- 1-year: 1.35%

- 2-year: 1.4%

These are government yields and if you go for something lower quality, such as investment grade or even junk, there will be a credit premium which boost the return, but also means you take on higher risks.

I can Tolerate Only Tolerate As Long As 2 Years in Term Premium Tenure

I could have listed out market interest yields of longer tenure in the previous section but I decide to stop at 2-year because that is as far as I can tolerate where to park my spare cash.

Term premium refers to the added return that we could earn if we choose to invest in longer tenure instrument. There is a premium because we are taking on added time risks. If we put our money away longer, we may lose out to uncertain degree of future inflation, or opportunity cost so by right we should be compensated with a higher degree of market interest. But locking in longer is a real risk because you may or may not be adequately compensated by enough term premium.

If I park in a fixed income fund that averages a 2 year tenure:

- I won’t know my exact returns.

- The returns should be around the yield-to-maturity if I hold for {2 x duration – 1}

- I would be earning the [market risk-free yield + credit premium] if I invest in a fixed income fund that has an investment grade rating.

- In the short term, there can be losses but the losses would be very small and manageable for my own personal situation.

I am not asking you to follow what I do and am just penning my thoughts.

The yield that we should be getting now is around 1.4% plus some credit premium which I think is 0.3-0.4%. Likely a total yield of 1.7% to 1.8% p.a.

Fast Review of the Popular Short Term Fixed Income Funds and Money Market Funds Out There

If you wish to view the data, you can see in my Google Spreadsheet here.

The table below shows some of the popular short term fixed income funds out there:

The idea is to see how far the yields are relative to the market yield. The Fullerton SGD Cash Fund is a latest week yield and it shows 1.4%. Pretty close to the government market yield.

The two fixed income funds, United SGD fund, and LionGlobal Short Duration ETF has a higher yield to maturity with Effective duration that is lower and north of 2 years.

I think the higher yield-to-maturity may be a little misleading given how old both factsheet data is. This is the shitty thing about local unit trusts. Their factsheet information disclosure sucks.

The LionGlobal Short Duration ETF shows a yield-to-maturity of 3.18% in the July factsheet. The corresponding 2-year government yield then was 1.7%. So it looks like there is a 1.5% credit premium.

I do expect that if we were to buy the LionGlobal Short Duration ETF today, the yield-to-maturity is closer to 2.9%.

Not too bad for SGD yield.

That would be where I am likely gonna park my money, if i am not investing it and will do that in Crystalys, which is in IBSG.

Now let us look at the Singapore Savings Bonds.

Singapore Savings Bonds

I have been updating readers since 2015 (10 years) about the rates of Singapore Savings Bonds.

You can find the latest one here:

I always find Singapore Savings Bonds appealing because

- You can put away as much as S$200,000.

- You can take out anytime with 30-days of liquidity lock.

- The interest rate reflects the market risk-free interest rate of SGD

If you look at the recent rates you would kind of agree:

If I withdraw after 1 year it is 1.39% and if I keep 10 years it is 1.8%. It is 1.5% if I keep for 5 years.

I like the Singapore Savings Bond for its fuss free nature.

But I would still need to sell and then transfer in to IBSG if I need to redeploy the money. Something that I should always consider.

Now let us look at the Hurdle Savings Accounts

What Are Hurdle Savings Accounts?

Hurdle savings accounts should be a term Kyith came up with.

They are a set of accounts that allows you to earn a higher interest if you bank with a single platform.

You can find these accounts as DBS Multiplier, SCB Bonus Saver, UOB One, OCBC 360 as an example.

The Hurdle Accounts are good for a few reasons:

- You will find yourself needing some banking services anyway so can you see if it is a good idea to do everything within one house?

- You will need to have some intermediary bank if you deploy all your money to investments with other accounts.

But they are limited in that

- the financial institution will want you to bank a lot with them so there are higher incentives for those banking areas they wish to grow.

- and those are the areas where traditionally you SHOULD NOT bank with financial institutions because the fees are not worth it or they may not offer good advice.

- the bonus hurdle interest is on a limited amount of money (there is a max limit)

The financial institutions adjust the bonus hurdle interest as interest rate goes up and down.

There should be no efficiencies there in that the rates should be close to the market interest rate.

So let us go through them.

UOB One Account

UOB One Account has always been my staple hurdle account because the hurdles are easier to hit.

- You either credit salary + 3 GIRO Transactions

- or Credit salary + spend $500 on eligible credit card

I have summarized the hurdles and the blended interest you can earn if you do each of those hurdles in the table below:

Again you can find the tables in the spreadsheet I linked above.

Hurdle 2 is the most applicable for me. Majority of the hurdle is on the first S$125,000 unless you do Hurdle 3.

I also use the UOB One credit card the most.

Since I am looking to put S$100,000 or less, I am looking at around 1% for Hurdle 2 and 1.5% for Hurdle 3.

Don’t think I am missing out much compare to LionGlobal Short Duration ETF. If I transfer most of my money into the LionGlobal Short Duration it will free me up not having to use only the UOB One Credit Card.

You can hit the $1,600 salary credit if you transfer $1,600 from another savings account monthly with a “SAL” tag. You can do that from the DBS account, where they can allow you to tag it as a SAL.

OCBC 360 Account.

My second go to account.

Here is the summary:

The way to view the Hurdles I listed is a little different from the UOB One table. Each Hurdle is an individual hurdle, and if I can bank with OCBC all 4 hurdles, then I should add them up, except the amount above $125,000.

If you do salary credit only, OCBC is pretty decent. If I am looking at S$100,000 or less, its around 1.2% to 1.5% just on that. Since if you increase your average daily balance by S$500 through salary credit if you don’t transfer out, you earn Hurdle 2 as well.

I don’t use OCBC credit cards but their hurdle is not particularly high.

There are a few hurdles that I failed to list out which is to insure and invest with them (not advisable most of the time.)

Hurdle 4 is interesting. You get 2% on your first S$100,000 if you lock in S$250,000.

But you can see the blended rate is around 0.70% because you have to account for the money locked but don’t earn that much. So Hurdle 4 is out.

If I am looking at Hurdle 1 + 2 realistically, we are talking about 1.6-1.8%.

Slightly higher than UOB but not by much.

I will have to credit my salary somewhat and OCBC looks to be a good fuss-free choice.

DBS Multiplier

I did not do a table up for DBS Multiplier because I think it is less applicable for me.

DBS’s advantage is in that if you:

- Have regular dividends as income coming in.

- Home loan if you bank with them.

- Credit card spend.

You can hit many of the categories and the bonus interest is applied on the first S$100,000.

It is not a pure income credit which means if you have $25,000 in income coming in + salary credit, you can hit the >= S$30.000 interest and earn 4.1% p.a. Even some of the lower tier interest is much higher than OCBC and UOB if you realized it.

I would qualify for the first one Income + 1 category and likely not be above S$15,000 monthly, so the applicable amount is 1.8% on the first $50,000.

This is definitely higher than OCBC and UOB but may not be higher than the potential of LionGlobal Short Duration ETF.

In the past, people can still game the system by transferring S$30,000 and tag that as “SAL” or “SALARY”. I am not doing that and coincidentally, my DBS savings account is pretty bare.

Bank of China (BOC) Smart Saver

BOC has always been an interesting one because for the longest time they give the highest interest without needing to jump through the most hoops.

The most appealing part (even currently on BOC) is that the first $1 million is 0.80% p.a. And if you fulfill any one of the requirements of Card Spend, Salary Crediting or Payment bonus, you get 0.60% p.a. extra if you have between S$100,000 to S$1,000,000. That makes it a total 1.40% p.a. for the amount above $100k!

Very lucrative if have a lot of money to store.

Their main hoop is to be tolerant of their platform hahahaha.

The way to read the BOC Smart Saver’s table is same as OCBC.

You see which hurdle you can hit and you add them up, below S$100,000 and only take hurdle 1’s interest if it is above S$100,000.

I think it is attractive if you can spend at least S$750 on credit card which would boost the interest you earn to 1.7% (for the first $100,000).

BOC account is good if you have more than $100,000.

Unfortunately, for what I do I might not hit 1.7% (only if I want a BOC debit or credit card and can spend S$750) and so based on Salary credit I did not missed out on much.

Now lets move on to Trust Bank

Trust Bank

At first I thought 2.5% is either a bunch of unit trust funds or it is really attractive.

Until we take a look at the hurdles and realize it ends up pretty similar.

Trust Bank provides us with a calculator but I am not sure why the value is always fixed at “on first S$1.2M*”

There are interesting hurdles that you might be able to hit but don’t think they will work for me.

Chocolate Finance

First and foremost I don’t like Chocolate Finance because they fxxk with my ex-colleague Seth, which I find totally not his fault.

Imagine you are suppose to be a finance platform and let’s say my colleague Seth’s influence is so great that they caused a mass withdrawal.

You are telling me you didn’t plan for this kind of loading when you decide to give those kind of marketing incentives, such as near instant withdrawals of first S$20,000?

My fellow blogger AK71 has a bigger influence in what he buys or sells. People follow his picks. When he sell, I never seen this kind of pandemonium and you are telling me one Seth caused this?

Think about this: I think the viewers most of them are smart enough to see the reasoning. To take action, against the high interest they could earn from the platform takes a lot. If what Seth shared is illogical, doesn’t make sense or plain stupid, people will just called him out for it and not take any action.

Bear in mind, I am aware of what caused the Silicon Valley Bank (SVB) collapse was a bunch of tech C-suites, who communicates mainly in chat groups. You can read it here.

These important decision makers are the main influencers and they don’t have normal social channels. And yes they did caused the collapse.

But is there the MAIN reason of the collapse or should the entity take a significant part of the blame for their practices?

Platforms like this thread the fine line between the incentives they give so that it looks lucrative for us to come on their platform but yet don’t kill themselves.

We also have to manage the fine line at Havend so it is not something we don’t empathize with.

In any case this is how Chocolate Finance look:

Chocolate finance currently provide 2.5% p.a. returns on first $20k, 2.2% p.a. returns on next $30k and UP TO 2.2% for the rest.

This one look the best… but you got to know what drove these returns. They invest in

- Dimensional Short-Term Investment Grade Fixed Income SGD Fund (DSF)

- UOBAM United SGD Fund (USF)

- Fullerton Short Term interest rate SGD Fund (FST)

- LionGlobal Short Duration Bond SGD Fund (LGF)

- Amova Short Term Bond Fund (NST)

Basically about the same short term fixed income funds we talked about. When the yield to maturity falls, be sure that Chocolate Finance will adjust accordingly.

So why not just invest in them directly? It is up to you.

Epilogue – Thoughts about Min-Maxing

Min-Maxing is a term that people use for someone who is trying to optimize between what is very low and what is very high to find the sweet spot.

We all know that its not just about returns, but also the degree of liquidity we need, what is the role of the money in our bank accounts.

And so Min-Maxing is a way to find the best spot for ourself.

I am one who don’t really min-max when the underlying is safe money.

This liquid savings interest audit is the degree of Min-maxing that I am willing to do. I think its always healthy to spend a moment, in a year to do this.

This is not too much effort.

But we should be aware what drives most of the growth and income of our portfolios is going to be higher risk stuff.

The min-maxing should be thinking about your financial goals, and how much you need to commit/fund them.

That is ultra important.

I think I didn’t missed out on some great deals if I wish to keep my liquidity around S$50,000.

That is like earning between 1% – 2.4% of a 2.1% allocation.

Hope this is helpful for you.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment