Unlock the Future of Wealth: How Blue Gold Limited and TripleBolt Are Revolutionizing Gold with Tokenization—Are You Ready to Ride the Next Big Wave?

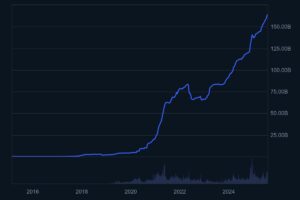

The market has already responded enthusiastically to Blue Gold’s vision. Upon its IPO, the company listed on Nasdaq at $10.00 per share and closed its first day at $20.11—a 101% gain. This success reflects growing investor appetite for companies that combine physical resources with digital innovation. Blue Gold’s debut also signals rising interest in gold as both a traditional hedge and a modern digital asset.

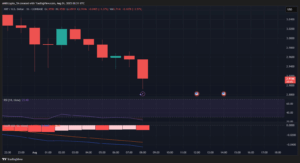

In addition to offering programmable features and on-chain auditability, BGT introduces a forward delivery model that unlocks capital before extraction. This approach offers a powerful monetization strategy for Blue Gold and a new risk-management tool for investors. The company describes the BGT not as a security but as a commodity futures utility token, which opens possibilities for use in digital wallets, payment systems, and even decentralized finance (DeFi) ecosystems.

Post Comment