Unlock the Hidden Insurance Trap: Why ILPs Could Secretly Be Draining Your Wallet Compared to Level-Term Plans

Ever wondered what really goes on behind the scenes of those slick Investment Linked Policies (ILPs) that insurance companies keep pushing? Well, when a friend recently asked me about a specific AIA ILP for his family, I thought — let’s pull back the curtain and see what’s cooking, especially around the elusive cost of insurance. The AIA Pro Lifetime Protector II isn’t your run-of-the-mill ILP; it’s got this blend of investment and insurance that can make your head spin if you don’t understand the fine print. You’ve got choices like the Plus Death Benefit and Max Death Benefit, each with a twist on how much coverage you’re paying for—and that impacts your premiums in a big way. Now, before you just nod along, hold up — did you know your cost of insurance might actually shrink if your investment grows? But it can also balloon if things don’t go your way. So, is this kind of ILP really a “set and forget” product, or a ticking time bomb for your financial security? Let’s deep dive into the nitty gritty and unravel the truth behind those numbers — because understanding the real cost could save you heaps down the road. LEARN MORE

img#mv-trellis-img-1::before{padding-top:56.54296875%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:56.0546875%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:56.34765625%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:56.15234375%; }img#mv-trellis-img-4{display:block;}img#mv-trellis-img-5::before{padding-top:56.4453125%; }img#mv-trellis-img-5{display:block;}

One of my friend asked me about my views about a particular AIA Investment Linked Policy (ILP) for his family situation.

I gave him some of my views personally but when I read the Product Summary here at CompareFirst, it stoked me to note down about the cost of insurance.

This investment-linked policy (ILP) is the AIA Pro Lifetime Protector II. In some of the more recent ILP conversation, you may hear my CEO Christopher Tan shared that the ILP today is different compared to the past in that these ILP, named 101 ILP is mainly purely investments. Their protection is limited to either the total premiums you paid, or 101%/105% of their policy value.

The Pro Lifetime Protector II is more of a traditional ILP in that it has both investment and insurance component. The Lifetime Protector II comes with two kinds of Death Benefit:

- Plus Death Benefit: The benefit is a total of insured amount (insurance policy) + Policy value

- Max Death Benefit: The benefit is max(insured amount, policy value)

I am less interested in other aspect of the AIA ILP today but the insurance component if the Plus Death Benefit option is chosen.)

Do Be Aware of How the Term Insurance in an ILP Works

The cost of insurance you pay on a typical ILP is on a sum-at-risk model.

You pay for the cost of the sum assured you are covered. Your sum assured is based on the insured amount minus the policy value. This is the Max Death Benefit in this Pro Lifetime Protector II. In the Plus Death Benefit, you pay for the insured amount.

So what is the difference? Suppose you wish to cover for $1 million in insured amount and your policy value is now $30,000. Under the Max Death Benefit, you will pay for the sum assured of {$1 mil – $30k = $970k). Under the Plus Death Benefit, you will pay for the sum assured of $1 mil.

This means that under the Max Death Benefit option, if your policy value builds up over time, your sum assured goes down, and your cost of insurance goes down. In the Plus Benefit Model, your sum assured NEVER goes down.

The advantage of this sum-at-risk model is that if your policy value grows, typically when investments net of cost grows well, your cost of insurance goes down. If not, you will have a problem next time (as you will see).

This sum-at-risk model is also similar in your universal life policy. Your cost of insurance will be similar to this Max Death Benefit model of the Pro Lifetime Protector II.

How much premiums you pay will depend on your age.

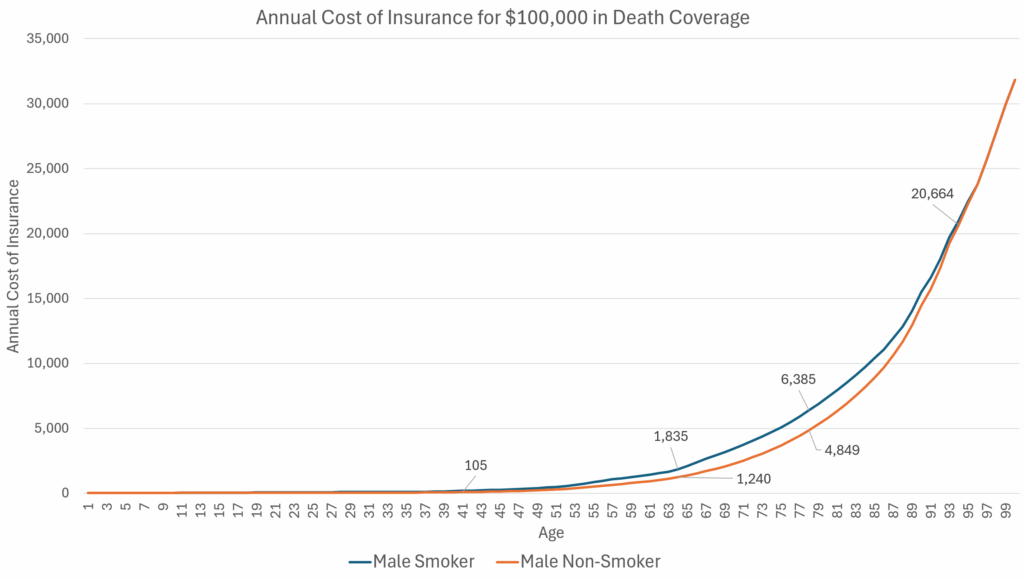

AIA provided a cost-of-insurance table in their product summary.

I translate it in chart form.

The chart below shows the annual cost of insurance for a male smoker and male non-smoker for a coverage of $100,000:

Think of this as…if your sum assured is still $100,000 at that age [x], you will pay that annual premium.

If you are 5 years old male non-smoker, and your sum assured is $100,000, then your annual premium is $43. Same if you are male smoker. This is affordable.

If you are non-smoker of age, the corresponding annual cost of insurance:

- 20: $63

- 30: $63

- 40: $105

- 50: $296

- 60: $937

- 70: $2,781

- 80: $6,326

- 90: $15,744

- 99: $31,829

This cost of insurance will be deducted from your existing policy value.

Different insurer will set their own cost of insurance. This is also some time ago and the pricing changes as well. Note that this is for only $100,000 sum assured, so if your sum assured is higher and you would like to have some sensing, you can just multiply the annual cost by how much you are covered divide by 100,000.

There are a few implications that you need to take note:

- The cost of insurance is pretty manageable when the insured is very young.

- If your policy value builds up value significantly when you are older, your cost of insurance paid goes down dramatically (perhaps to zero)

- If your policy value fails to build up as you become older, a more significant cost of insurance is deducted from your policy. This deduction, is like spending from your policy and would dramatically reduce your policy.

- If your ILP is for protection, you have to consider carefully what is your wealth protection strategy is especially if you are on a Plus Death benefit where the cost of insurance is based on sum assured and the sum assured is consistent. Typically, life insurance is to help your dependents if the insured passed away prematurely. If you have no more people depending on you, especially after a certain age, then you should rationalize and surrender the policy.

It kind of means that such policy is not always a set and forget.

The table below is the same just for female:

Now notice that the lines for both male and female smoker versus non-smoker is pretty close aside from a particular period when we are older. We will get into that later.

Here is the male of the cost of insurance in bar chart (nothing new but perhaps some of you will find this clearer):

The Premium Smokers Pay Over Non-Smokers:

I tried to take the premiums paid for male smoker minus the premiums paid for non-smoker and you get the follow chart:

Here is the female one:

What you will get is the incremental higher insurance cost between a smoker and non-smoker. If the underwriter is pricing based on the risk of dying, we may be able to tell what is the probability.

Then again, aren’t the median life expectancy around 84 for male and 86 for female? I don’t know but I interpret that after 85 whether you smoker or non-smoker, your chances of dying is kind of almost the same already.

The premium for female smoker is lesser!

Epilogue

If you look at the chart, you may understand that there is no free lunch if you wish to cover till 99 years old. When the insurer charge the cost of insurance, based on age, you are basically paying for your death benefit.

The jackpot is if a person passes away earlier but I wonder if anyone wants that kind of jackpot.

Many already have a negative view of ILP and they might be skeptical about why an ILP would charge this way. As I said, an ILP is not the only insurance model charged this way.

Universal life also follows this sum-at-risk model.

The advantage is that you pay for how much protection that you want. If you wish to hedge your life risk when there is a low probability of dying but the financial impact is significant to your family, but are confident that a diversified equity portfolio will capture the return over time, this insurance model is very efficient than just using level-term insurance.

It allows an automatic coverage adjustment to make up for the portfolio deficiency.

The risk is if the investments don’t work out. And cost affect investments.

If you have a gripe about things, then you should be unhappy about the right thing, which is the structure, the active management of investments, the high investment expense and not the wrong thing.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment