Unlock the Hidden Power of the Russell 2000: Why True Diversification Is Your Secret Weapon for Massive Returns

Ever wonder why some tiny slices of a gigantic pie can pack such a punch in your investment returns? It’s like discovering a hidden gem in a sea of stones—where a handful of small-cap stocks skyrocket, lifting the entire index on their shoulders. Recently, I dug into some compelling research from Verdad and insights shared by Yet Another Value Blog that shine a spotlight on this very phenomenon, teasing apart the dance between concentration and diversification in capturing those elusive long-term gains. The Russell 2000, for instance, has outperformed its smaller cousin, the S&P 600, but here’s the kicker: just 6.8% of its stocks were responsible for a staggering 61% of its returns in one quarter. This raises a fascinating question: Should investors chase the few shining stars, or settle for the steadiness of the many? Join me as we explore how a small group of winners can dominate performance, why profitability and debt levels complicate the picture, and what this all means for your portfolio strategy—because sometimes, the biggest gains come from the smallest spots. LEARN MORE

img#mv-trellis-img-1::before{padding-top:53.02734375%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:37.20703125%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:65.12%; }img#mv-trellis-img-3{display:block;}

Recently, I cited research from Verdad the capture of returns between concentration and diversification.

Diversification (vs Total Concentration) – It is also About Capturing Long Term Returns.

Yet Another Value Blog provide a data point that emphasize this. [Read Black box risk and $GECC]

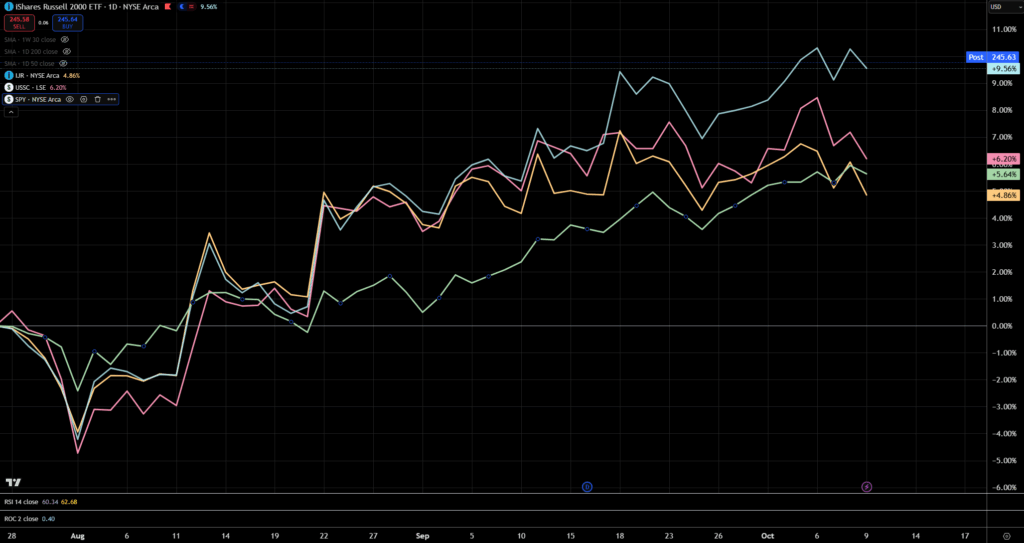

The chart below shows the total performance (price + div) of a few index funds:

- Light blue: IWM (Russell 2000 index) – 9.6%

- Light green: SPY (S&P 500 index) – 5.6%

- Light orange: IJR (S&P 600 index) – 4.9%

- Light pink: USSC (MSCI USA Small Cap Value Weighted ETF) – 6.2%

The Russell 2000 have done much better than the S&P 600 (and possibly the other two that I provided here). But what have driven the performance?

Andrew from Yet Another Value Blog brought out a table that adds color to the attribution of the performance:

The top 20 best performing Russell 2000 stocks forms just 6.8% of the Russell 2000. You can see how small they are.

But this 6.8% drove 61% of the Russell 2000 returns in the 3rd quarter.

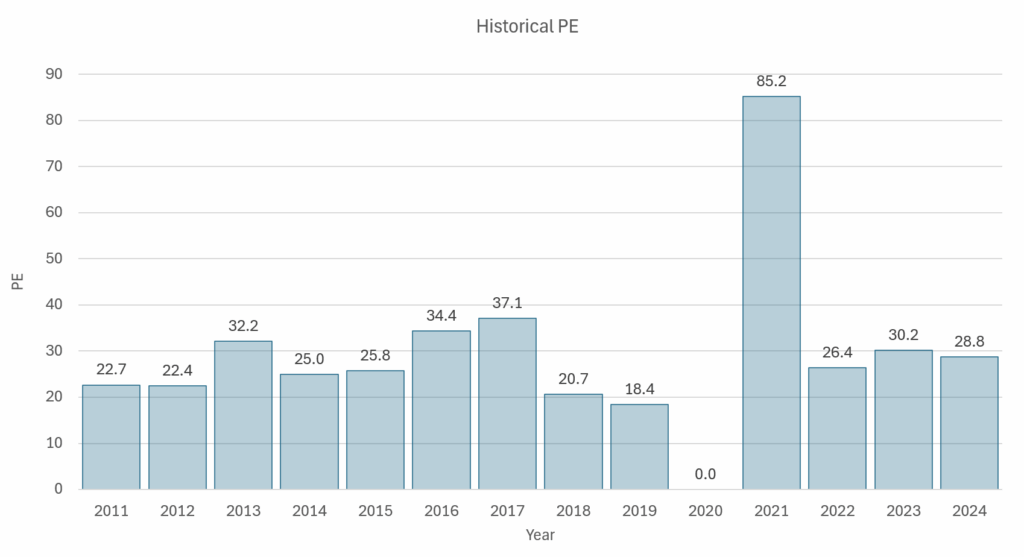

The EV to EBITDA shows how pricey these stocks are. Can see how many of them don’t even have positive free cash flow estimate in 2026.

Schwab’s Liz Ann Sonders provide more color on the make up Russell 2000:

The Russell 2000 became very unappealing because it is made up of:

- A lot of unprofitable companies (one of the mandatory criteria to be in the S&P 600 is profitability).

- They are high debt.

- Good performing companies leave the index.

By excluding the unprofitable companies, and having only the profitable companies we get the performance as we seen now when the nascent start doing well.

It might also surprised people that despite such small allocations, they could drive so much of the performance.

Those investing in venture capital strategies would understand that much of the performance is driven by a few small but very big winners.

Well the winners:

- Bloom Energy: 149%

- Credo: 49%

- Kratos: 64%

- Echostar: 157%

- Coeur Mining: 120%

- Oklo Inc: 83%

- Rigetti computing: 202%

- Ionq: 79%

- Rambus: 57%

- Hecla: 114%

This is the performance for the quarter.

The profitable small cap S&P 600, or Dimensional, Avantis, USSC small cap value strategies would have less of this. They may have some but they will also have the small number of stocks that drive the returns.

What investors may not be able to see is whether you could foresee, then analyze, correctly choose and have these top performers before they start moving.

The process of avoiding the poor performers might leave out the big winners.

The S&P 600 is an example of that. Most of you would tell me you want profitable companies, and you won’t have these in the portfolio.

Perhaps this is a sign of a bubble. I don’t know.

You can see how diverse the group is.

I think this gives a good color of what you will get into if you hold 2000 companies:

- Many companies will just not do well.

- Some will do exceptionally well and graduate to mid caps.

- Some mid caps would do poorly and enter this space, and they may revert to the mean.

- New companies will come up.

We just got to acknowledge that we might not be very certain how the returns will be.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment