Unlock the Hidden Treasury Secrets That Every Small Business Owner Overlooks—And Why It Could Make or Break Your Empire

Picture this: You’re steering a small business ship through choppy waters—expenses to juggle, payroll deadlines looming, surprise costs popping up like unwelcome guests—and all while eyeballing that next golden opportunity. Sound all too familiar? Honestly, for a staggering number of small business owners, managing finances often feels less like crafting a strategic masterpiece and more like frantically putting out fires. But what if I told you there’s a smarter, calmer way to handle this chaos?

“Treasury management” might conjure images of suits in glass towers, reserved for massive corporations. But let me blow your mind: this concept is a secret weapon for small businesses, too. When you get a grip on controlling your cash flow, deploying your resources like a seasoned pro, and prepping for the curveballs life throws your way, you’re laying the foundation for your business to not just survive—but thrive over the long haul.

This isn’t just theory. This guide breaks down no-fluff, practical tactics tailored for business owners like you who are ready to flip the script—from financial stress and uncertainty to clarity and confidence. Ready to elevate your business game? Let’s dive in.

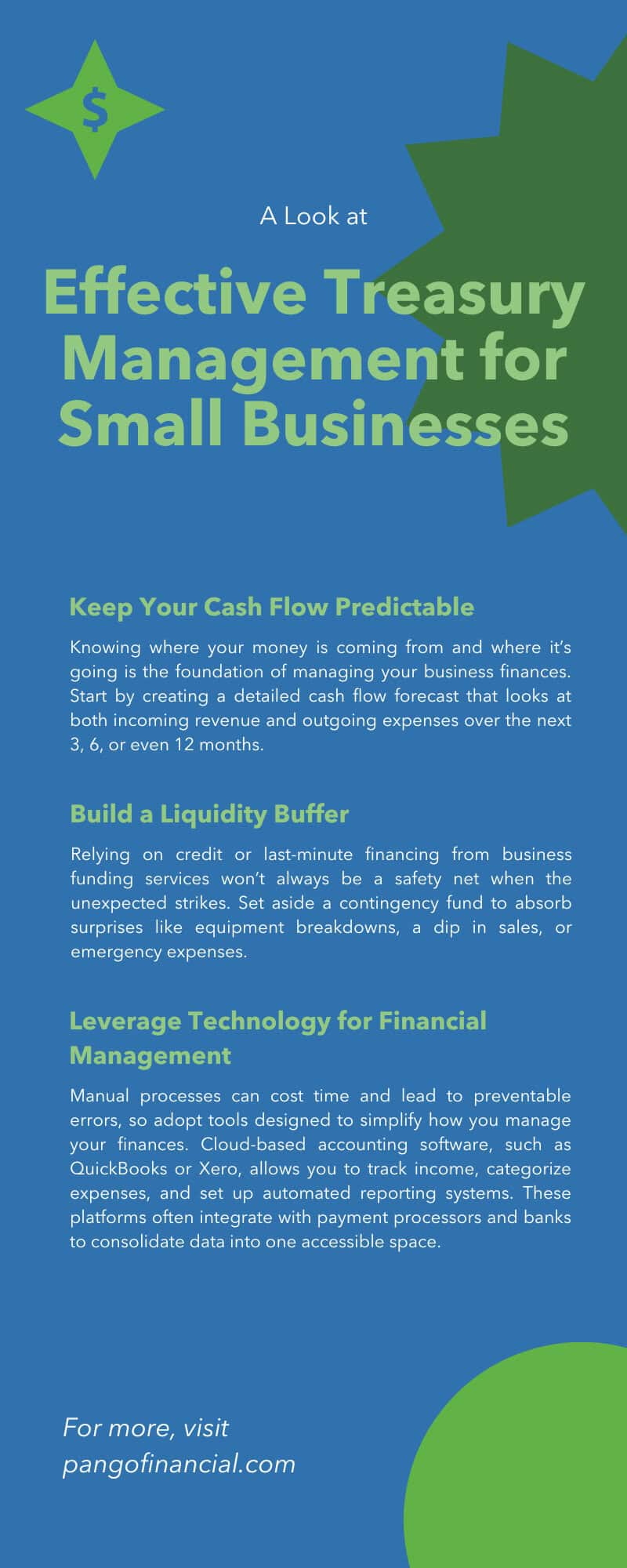

Make Your Cash Flow a Crystal Ball

Understanding the whereabouts of every dollar coming in or going out is the bedrock of financial savvy. Grab a notebook, spreadsheet, or whatever helps you focus, and map out a detailed cash flow forecast—covering the next 3, 6, or even 12 months. Slice it up week-by-week, or month-to-month to catch those sneaky trends.

Cash flows have their own personality—sometimes a rollercoaster, other times a gentle stream. Knowing when the peaks and dips hit lets you brace yourself. Got a slow sales month on the horizon? Push off that big purchase or sweet-talk your suppliers into flexible terms. Tracking money movement everywhere in your business hands you the power to make smarter calls that cut surprises right out of the picture.

Stack Up a Liquidity Safety Net

Sure, credit lines and last-minute loans from business funding services sound tempting, but they aren’t always your superhero when chaos strikes—think broken machines, unexpected dips in sales, or emergency repairs. stash away a contingency fund that can cover three to six months of your operational costs. It’s like your business’s financial parachute.

Make sure you squirrel this cash away in a separate bank account so you’re not tempted to raid it for day-to-day expenses. High-yield savings accounts are perfect for this mission—doing the work without you lifting a finger. That cushion? It’s your ticket to keeping the wheels turning smoothly, no matter what.

Call in the Tech Cavalry

Manually wrangling your finances? Oh, bless your heart, you’re inviting mistakes and wasting precious hours. Embrace technology—cloud accounting platforms like QuickBooks or Xero are not just fancy buzzwords but actual time-savers. They capture income, categorize every expense, and even automate reports. Bonus: most sync up with your bank and payment tools, making data gathering feel like a breeze.

And if that’s not enough, AI-powered forecasting tools deliver razor-sharp insights that help you see cash flow opportunities and risks like a financial psychic. Tech isn’t just a luxury—it’s your behind-the-scenes CFO, pulling strings while you focus on growth.

Don’t Put All Your Revenue Eggs in One Basket

Ever heard the saying, “Don’t bet the farm on one cow”? It’s golden advice for your income streams, too. Leaning too hard on a single product, client, or service is an invitation to financial headaches. Instead, hunt for diverse ways to pad your profits that mesh well with your customers’ needs.

Take a humble bakery: they could sprinkle magic by launching online orders or teaming up with local shops to sell wholesale goodies. And guess what? When seasons slump, having multiple income sources softens the blow.

Kiss Late Payments Goodbye: Manage Accounts Receivable Like a Pro

Cash shortages can snowball faster than you think. Stay sharp by reviewing your accounts receivable every week—know exactly which invoices haven’t been squared up. Sweeten the deal with early payment discounts or send gentle reminders to nudge late payers. Your payment terms should be clear as day from the get-go—and if folks need an extra nudge, it’s okay to add penalties.

Late payments mean less cash to cover your costs, so keeping this system tight ensures your cash register doesn’t go silent.

Post Comment