Unlock the Hidden US Sectors Poised to Explode in 2026 — Are You Ready to Cash In?

Investing in a diverse basket of equities sounds like a no-brainer, right? But here’s the kicker: how many of us truly grasp what lies beneath those shiny ETFs or unit trusts? When you hold just 10 stocks, you might dig into cash flows, earnings growth, or valuation to gauge their health. But throw a hundred or more into the mix, and suddenly, fundamental analysis feels like trying to untangle spaghetti in the dark. This disconnect is probably why passive investing has captured so many hearts — it frees us from fundamental homework. Yet, there’s a sneaky little problem: watching prices climb relentlessly doesn’t always translate to confidence in deploying fresh capital. Instead, many end up frozen, asking themselves: “What exactly am I invested in, and is it really worth it?” That gnawing doubt? It’s a crisis of confidence disguised as price anchoring. So how do we break free from this psychological freeze and embrace disciplined investing over the long haul? Let’s dive deep and unpack the subtle challenges behind seemingly straightforward passive portfolios. LEARN MORE

img#mv-trellis-img-1::before{padding-top:35.022026431718%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:64.35546875%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:64.453125%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:64.2578125%; }img#mv-trellis-img-4{display:block;}img#mv-trellis-img-5::before{padding-top:64.0625%; }img#mv-trellis-img-5{display:block;}

One of the harder transitions that I have to make when investing a basket of very diversified equities is to consider how fundamentally tethered they are to reality.

If you invest in 10 stocks and are a conscientious investor, you could do a review of the cash flow and earnings growth, how expensive they are and have a good sensing. But if it is a basket, most people don’t have an idea how to do it.

But that may be why this systematic passive investing is appealing for many investors because they don’t need to do this fundamental job.

But what usually happens for them is:

- They just see price keep going up and up.

- They start price anchoring because they have no idea what an ETF or unit trust is tethered to.

- And then they start getting cold feet about putting excess capital to work.

This is how I describe what the layman is telling me. This can be readers, can be the clients of the client adviser that I overheard at the pantry.

I think there are always going to be some difficulties in investing that you cannot avert. While a basket of index stocks is very diversified, you have to live with not being able to make sense of it.

But in a way, not being able make sense of it is a greater problem when something isn’t doing well because how do you remain confident to dollar cost average, or take this opportunity to put new money into it.

I kind of think that many people got into passive index investing because they have an impression this is a strategy that would always do well and this problem that I just mention, or a crisis of confidence, would not happen to them. Well things keep going up and you don’t dare to put money to work is also a crisis of confidence.

So how do you overcome that?

I think that is your own problem and you got to find a way to figure it out. If you have a client adviser, especially one at Providend, you might want to tackle this together with him or her. Me? I can always tackle this with the adviser that is assigned to me but we have to deal with all these things before my adviser’s actual clients calls him up to tackle these seeming psychological issues.

So I am left to solve my own problem (and hopefully if my own adviser reads this, it might help him coach his own clients).

Sour Grapes

There seems to be a FOMO feeling recently because what we observe is only the large cap tech doing very well.

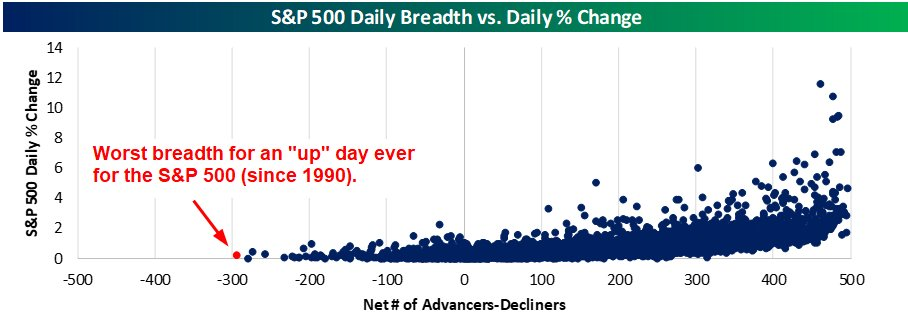

We all complain about this thing as “narrow breadth”.

I shared this chart of the number of advancers in S&P 500 minus the number decliners the day before and that red dot show what happen the night before (Tuesday this week) even though it is an update.

Basically, these two weeks feels rotten because most stocks don’t do well but the index keeps going up.

You get the feeling only the Mag 7 did well and that is the place to be.

A tough thing to do is to prevent yourself from mentally overriding a lot of the mental frameworks you have build up by your feeling about what you experience in investing currently.

It is equally tough to remember that there will be times when some of your stocks, or certain regions, or certain sectors feel rotten and their time may come. At a certain point, your Singapore small caps are not work. So is Hong Kong, or China, or Emerging markets. And for some of us if you are in energy or healthcare stocks.

The easiest conclusion your mind will jump to is “these are shit stocks and I am not invested in good stocks” and this may be what breed investing shame and the FOMO feeling.

Jeff deGraaf of Renaissance Macro Research called what we are observing more as sour grapes.

He explains this at 21 min.

If the Russell 2000 is in an uptrend, we don’t have breadth problem if the smallest 2000 stocks are in an uptrend. This was not the case in 1999 during you-know-what-happen. You have most of the market moving lower, when only a small number of stocks that are moving higher. What we are seeing is that most of the stocks are going higher but not as high as concentrated number of stocks.

This is sour grapes behavior.

One area that I am trying to make sense of is to pay attention and understand things like business cycles better. Not so that I can time it but really… to understand it.

And the key thing I wish to understand more is whether is it a time when materials will have their day, energy will have their day. Admittedly, this was less required for me when I was investing in individual companies because I happen to tough these stuff less.

But if my currently portfolio is made up of IT, industrials, financials, small caps, mid caps, non-US, energy, shipping, understanding them better helps.

And I think the answers is “their time will come but just about when”

That statement above may not be a very satisfying answer but if you are invested in a basket of diversified equities across regions for 20 years, that is a feature that you can tolerate… provide that is true.

And if that is the truth, it helps create patience for your investment and gives you conviction to buy sectors, regions on the cheap.

But if you don’t think that statement is true, or are not convicted about it, the uncertainty will prevent you from keeping with your strategy and FOMOing into things that may be turning down.

Before I leave this section, and while I am sharing this RenMac video, this comment made by Neil Dutta, their resident business economist is quite interesting:

In the long history of business cycles, there has never, ever been a time when consumer spending declined in front of an economic slump. Sometimes, consumer spending expands during a recession. Thus, it might be a poor idea to look at consumer spending as a leading indicator to an economic slump. Typically you get a better signal from the residential investment side. Neil says that the secret truth among the economist fraternity is that economic indicators are not good leading indicators.

Neil prides himself to be different from his economist peers by trying to use economics in an applicable manner to make money instead to be mired in theories.

Rebalancing in a K-shaped Economy

I was watching this interview of Mike Wilson, CIO and chief US equity strategies at Morgan Stanley at Risk Reversal podcast:

Mike got a lot of stick for making two to three years of bearish calls and got them largely wrong. But if you see what he says for the past 2 years they been largely on the point. This goes to show how difficult it is to put out a thesis and lived with it.

His stance for the past year has been that April was the low and all the data shows we are at a start of a new business cycle. And of course, there are enough people using his call as a contrarian indicator.

I think is whether you wonder if all business cycles are like the past 5 years where we have so many things squeeze into them (a pandemic, by a recovery, high inflation, dealing with high inflation). If the past five years is less normal, or the 10 years prior of low interest rates are less normal, can we have an extended period where we have normal business cycles?

That would mean normal interest rates that is not rock bottom. Mild to slightly high inflation.

Jeff deGraaf of Renaissance Macro also talk that many of these indicators seem to point to an environment that is pre-2008.

Here is what I gather from Mike’s interview:

- We are in what Mike call a rolling recession. We seen parts of the economy such as housing slumping, small business slumping already. It is just that when we factor in where the magnitude of the spend, which is with the higher income, they been aided by the wealth effect of higher interest rates, and higher paying jobs to continue to consume.

- If we can take out the capital expenditure from AI spend, the GDP or the economy figure will look pretty different.

- This is why the US S&P 500 that is not AI, the mid caps, the small caps have largely earnings stagnation for the past 3 years. The equal-weight S&P 500 index is making all time low relative to the cap-weighted S&P 500 index. Morgan Stanley show that for the past 3 years, the median earnings growth of the Russell 3000 is negative.

- A lot of the policies that this administration is trying to put in place is to rebalance the economy in a way that more may benefit:

- Improving the mix between import and exports.

- Tariffs tries to improve the above, but also solve the problem of too much consumption and not enough capital expenditure. This is why there are policies put in place for companies to spend and get tax breaks.

- A weak dollar policy.

- Deregulating the banks especially will rationalized the limits at the regional banks which were too stringent.

- Restrict immigration to reduce competition at the lower levels so that we see higher hiring and better wage growth at the lower levels.

- We might not have seen strong visible signs that these policies are work but market will forward prices things before the earnings per share actually show up.

- Morgan Stanley’s data is seeing that the earnings growth is just starting to turn up. Morgan Stanley’s data shows the companies have better operating leverage because they have gotten much more efficient because they haven’t been hiring much.

- Most of the job creation in the past three years were mostly in the government. Instead of government spending all the money, hiring, they want to incentivize the private to release and make corporate spending and provide liquidity to the economy. The factors we point to below can inflect the stocks higher, just as well as mild inflation (which is good for stocks).

- Morgan Stanley does see a prospect for a 13/14% earnings growth in 2026, but if we have mild inflation, we may see 20% earnings growth.

- The problem with the BLS data is its always late and always need to be revised. Mike Wilson says the data shows massive job cuts in March and with the updated revision of the labor data, we can say the trend reverse in April.

- US unemployment rate of 3-4% is lower than the average, which tends to be in a 5-6% range, so the market can accept a return to 5-6% norm unemployment.

- AI is a force that will affect more white collar jobs, which are the jobs that have been doing relatively better for much of the past three years.

- If the market realize that they are the right policies that will improve the economy, investors may see equities as a better inflation hedge than gold.

- What may benefit in 2026, may be the area that doesn’t do well in 2025:

- The top companies used to be asset light, and now they are spending on capital expenditure and there may be a wave of capital expenditure that is to incentivize more of the smaller businesses for 2026.

- The key is to get a little wage inflation, which will spur spending even in the energy space.

- We are starting to see loan growth pick up in the lower quality, regional banks. They are lending to the small medium businesses, small caps and mid caps.

- The regional banks should do better with the wave of mergers and acquisitions activity and deregulations. The regional banks are the level of banks which have kept the reserves higher than what they actually need so deregulation would free up resources for the banks to put them to work. Policies that favor the regulated banks rather than deregulated entities may be a reason why those shadow banking stocks have not been trading so well recently.

- The companies that build out the compute may already be fully priced.

- They upgraded healthcare in September because they see that the policies that RFK Jr talked about was more managed, there are transactions happening, and healthcare is cheapest that they have ever been even compared to dire periods during Hillary Clinton’s time and the 2000s.

- Transportation is also an area that has been dead. The Morgan Stanley team will be monitoring on whether there is a pick up in activities and if they do, there may be signs of recovery. The industrials that may do well next year may be the kind of industrials that relates to the general economy which have not done well.

Mike’s number one concern used to be the trade situation but now it is more of whether the market has enough liquidity such that the market doesn’t break.

The Fed is paying attention to the stress in the Repo market and they don’t want a similar situation like 2018 where they have to come into the market to do another quantitative easing (QE) so they are ending quantitative tightening (QT).

There can be correction even in the 10-20% range. Markets can correct based on price.

But what we are talking is about how the business cycles behaves and how earnings per share behaves individually as a sector and as an aggregate.

I think there are signs that we can watch. The line between slow growth and recession is rather fine.

What i am trying to wrap my head around is: If many parts of the economy is in such a slow down for so long, then isn’t that the recession that Mike is referring to? And what will happen if there are some liquidity injections there?

I think that is all possible, and there is a lesson to be learn if I do see a recovery in the main US economy, and how the various sectors react to it.

Ending Off with Some Charts

You will be lead to believe that its only the narrow Mag 7 that did well.

The chart below plots the Small Cap tech since July against the large cap tech:

But to many people “tech” is only the Amazon, Microsoft, Nvidia, Meta and Apple.

The rest are not tech. I think it is more like… they don’t dare to invest in individual tech companies, but they like to say tech is the future.

Hopefully this will kind of shock people into thinking every small cap is shit.

For investors of my generation, we would remember how shit Greece got. The yield on Greek government bond got as high as 20%.

These money stories are more memorable if we remember where we were. It came as a shock to us when the yield of the Greek government bonds went negative a few years ago!

And I think the lesson to ourselves is how we see “permanence”.

It is quite easy for us to be so absorbed into thinking the market behaves like what happen in a full 2025.

If we zoomed out, that is not the case.

The chart above is the Global X MSCI Greece ETF, adjusted for dividends. You can see the part my generation remembers (2012 to 2016).

I think that is tough. A 74% fall.

But as you can see, the price, adjusted for dividends recovered. We are about 10% above the highs… maybe after 11 plus years. That is less than 1% return.

The ETF did almost 60% this year.

I think what many don’t want to go though is that pain. You cannot imagine how it feels like in those 2016 to 2023 years and most would have given up hope.

But if we say that equities is a 20-year duration instrument if you want to harvest decent returns, 11 years is still…. short.

And one of the reasons I am interested to understand the link between business cycles, earnings yield and earnings growth is understanding may create enough calm and patience to harvest the returns.

I leave you with two charts to see if the market is flashing danger:

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment