Unlock the Secret Financial Gauge Every New Business Owner Must Master to Survive and Thrive

Starting a new business? Oh boy, where do you even begin? Seriously, it’s like spinning plates—marketing, operations, product development, and somewhere in the chaos, your financial health needs a spotlight too. That’s where liquidity ratios sprint to the rescue. Think of them as your business’s financial pulse check—simple, yet incredibly revealing. They tell you if you’ve got enough quick assets to cover those pesky short-term bills knocking at your door. It’s the nope-or-yes moment for paying vendors, employees, or just keeping the lights on.

But hey, don’t get me wrong—figuring out liquidity ratios isn’t just punching numbers into a calculator. It’s about unlocking a secret weapon to direct your business ship with confidence. Slow season cash flow struggles? Dreaming of that next big venture? A clear grasp of these ratios shines a flashlight on your financial landscape, helping you dodge pitfalls and spot opportunities like a pro gambler at the table.

So, buckle up. This guide breaks down liquidity ratios without drowning you in jargon. I’ll show you how to calculate them, what they really mean, and how to use this intel to keep your business finances rocking solid. By the time we’re through, you won’t just guess your business’s health—you’ll know it, deep down.

Liquidity Ratios — What’s The Deal?

At their core, liquidity ratios gauge your ability to pay what’s due in the near term, using what’s at your fingertips—cash or assets you can turn into cash pretty fast. Picture this: paying suppliers, covering payroll, and tackling any other immediate debts. These ratios slap a financial snapshot in your hand telling you, “You got this,” or “Watch yourself…”

If you’re a newbie business owner, I can’t stress enough how critical these tools are. They throw a spotlight on where you stand financially right now—and alert you to cash shortages lurking in the shadows. Plus, lenders and investors? They love these ratios. A healthy liquidity position tells them you’re stable, reliable, and less likely to be a financial rollercoaster. It’s like showing up to a date dressed to impress.

Let’s Paint a Picture:

Imagine you have $20,000 in short-term debt but $30,000 sitting in liquid assets—cash, invoices due, inventory you can quickly sell. Crunch the liquidity ratio numbers, and voila—you see if you can pay those debts without breaking a sweat.

This kind of clarity isn’t just comforting—it’s the backbone of wise decision-making. Wondering when to expand? Or maybe hold back on spending till the numbers look better? Liquidity ratios give you that edge—they’re your financial compass in the wild startup jungle.

The Big Three Liquidity Ratios You Can’t Ignore

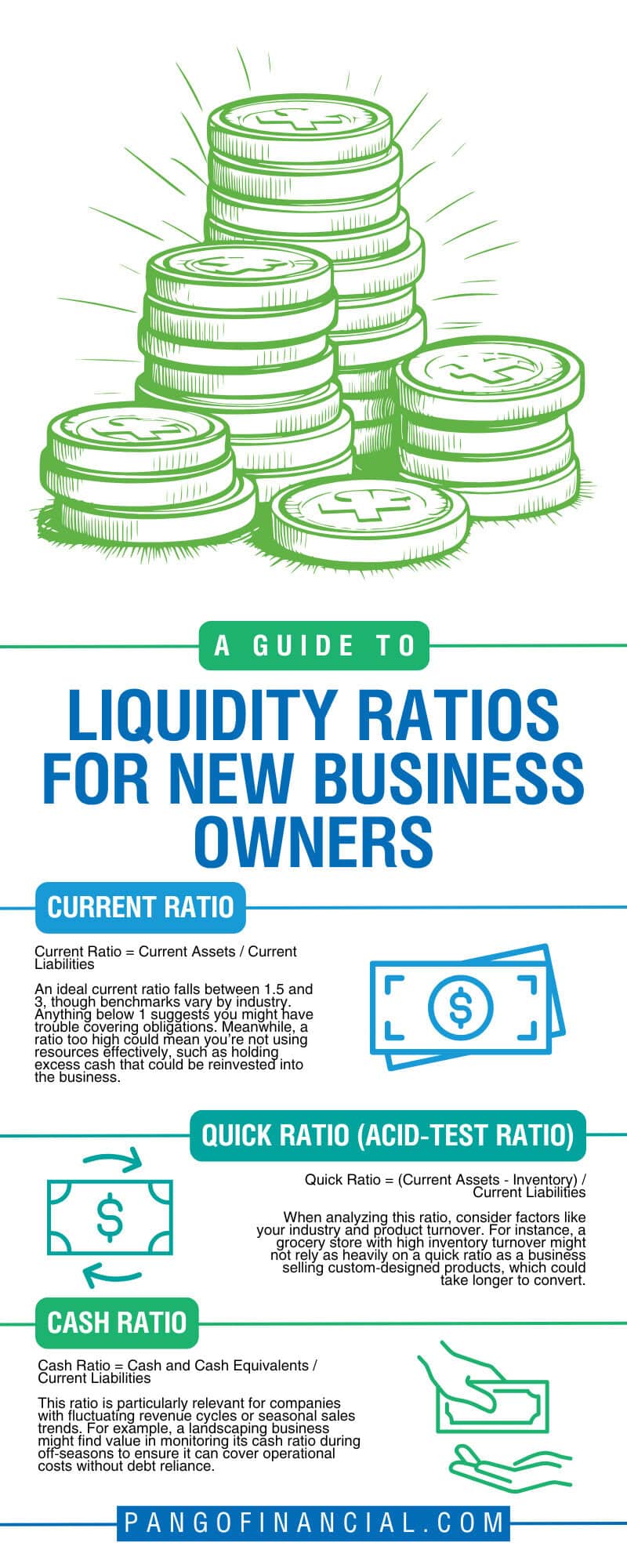

Current Ratio

This one’s kinda the big picture view. It measures all the current assets you have against the current debts you owe. Here’s the no-nonsense formula:

Current Ratio = Current Assets ÷ Current Liabilities

Say you’ve got $50,000 in current assets (cash, money owed to you, stuff in stock), and $25,000 in current liabilities (what you owe soon). Your current ratio here is 2. Meaning, for every dollar you owe, you’ve got two in assets—a nice, comfy cushion.

A current ratio between 1.5 and 3 usually means you’re in good shape. Slip below 1, and that’s your sneaky warning bell—you might struggle to pay bills. But wait—too high a ratio? That could mean you’re hoarding cash instead of putting it back to work growing your business. Balance is key!

Quick Ratio (The Acid-Test)

Let’s get a bit more selective—this ratio trims out inventory because, well, it’s not as quick to convert to cash for some businesses. Especially if you’re selling niche products that don’t fly off the shelves.

Quick Ratio = (Current Assets – Inventory) ÷ Current Liabilities

So, if you have $30,000 in assets but $10,000 is inventory, and owe $20,000, your quick ratio is 1. That means you’ve got just enough liquid assets to cover debts without sweating it.

But remember, industry matters. A grocery store with high turnover might not freak out over a lower quick ratio. But a bespoke furniture maker? Different story—they need to watch this closely.

Cash Ratio

This one’s the

Post Comment