Liquidity Ratios — What’s The Deal?

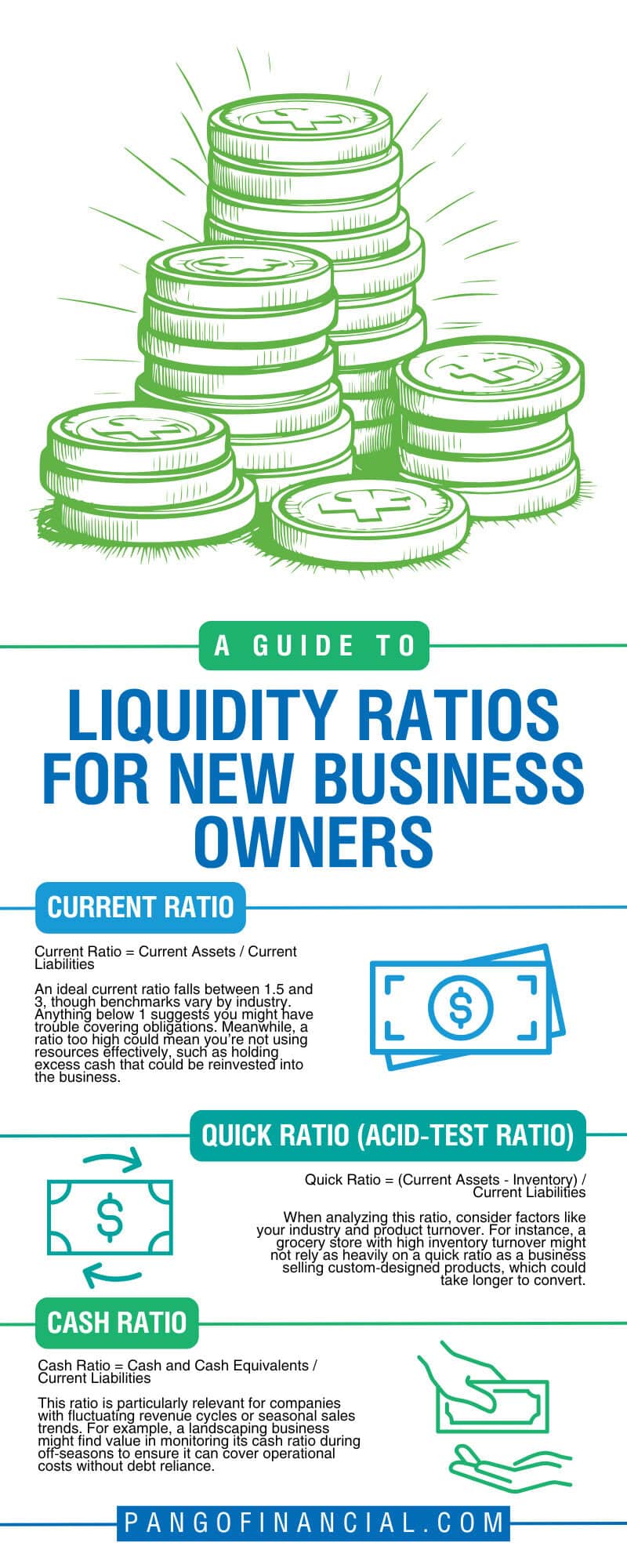

At their core, liquidity ratios gauge your ability to pay what’s due in the near term, using what’s at your fingertips—cash or assets you can turn into cash pretty fast. Picture this: paying suppliers, covering payroll, and tackling any other immediate debts. These ratios slap a financial snapshot in your hand telling you, “You got this,” or “Watch yourself…”

If you’re a newbie business owner, I can’t stress enough how critical these tools are. They throw a spotlight on where you stand financially right now—and alert you to cash shortages lurking in the shadows. Plus, lenders and investors? They love these ratios. A healthy liquidity position tells them you’re stable, reliable, and less likely to be a financial rollercoaster. It’s like showing up to a date dressed to impress.

Post Comment