Unlock the Secret Wealth Patterns: What 20 and 25 Years of US and Global Returns Reveal About Your Financial Future!

Ever wondered what a diversified equity portfolio looks like if you stretch the timeline beyond those flashy 5-year snapshots? Well, my Telegram buddy James nudged me with that very question, asking for a deeper dive—something that captures the twenty- and twenty-five-year returns instead. Let me tell you, peeling back the layers on these longer-term charts reveals some intriguing behavior—almost like treating a basket of stocks as a “pseudo fixed income” with a 20 to 25-year maturity. Sure, the returns aren’t etched in stone; they oscillate and surprise you. But here’s a quirky insight: even the lowest 25-year compound return on these indexes turns a cool million into roughly four million—that’s some magic of time and patience. Depending on the window you look through, the top dogs shift from large-cap growth to small-cap winners. So, what’s the real takeaway for investors who crave a panoramic view of market performance? Let’s unpack this treasure trove of data together and see what lessons lurk beneath those multi-decade numbers. LEARN MORE

img#mv-trellis-img-1::before{padding-top:91.2109375%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:60.3515625%; }img#mv-trellis-img-2{display:block;}

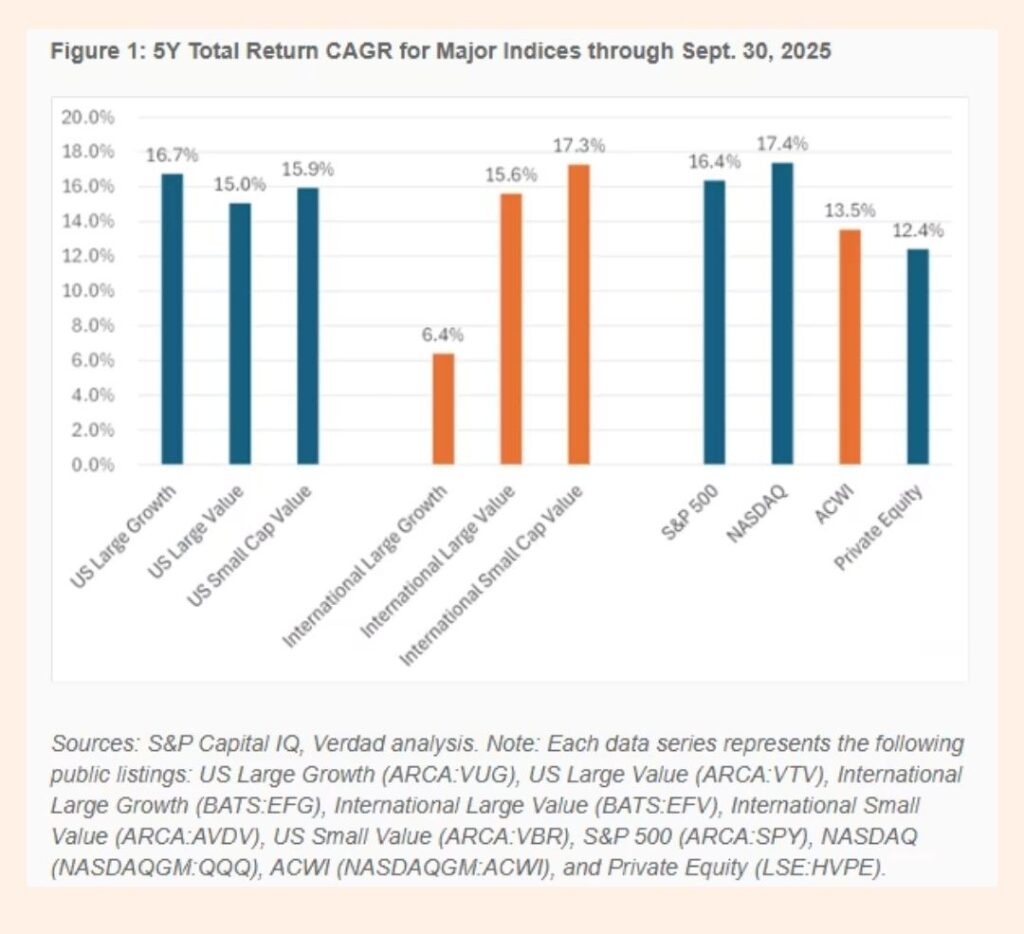

I have a Telegram group member James who asked if I have longer tenure returns data for this 5 year chart:

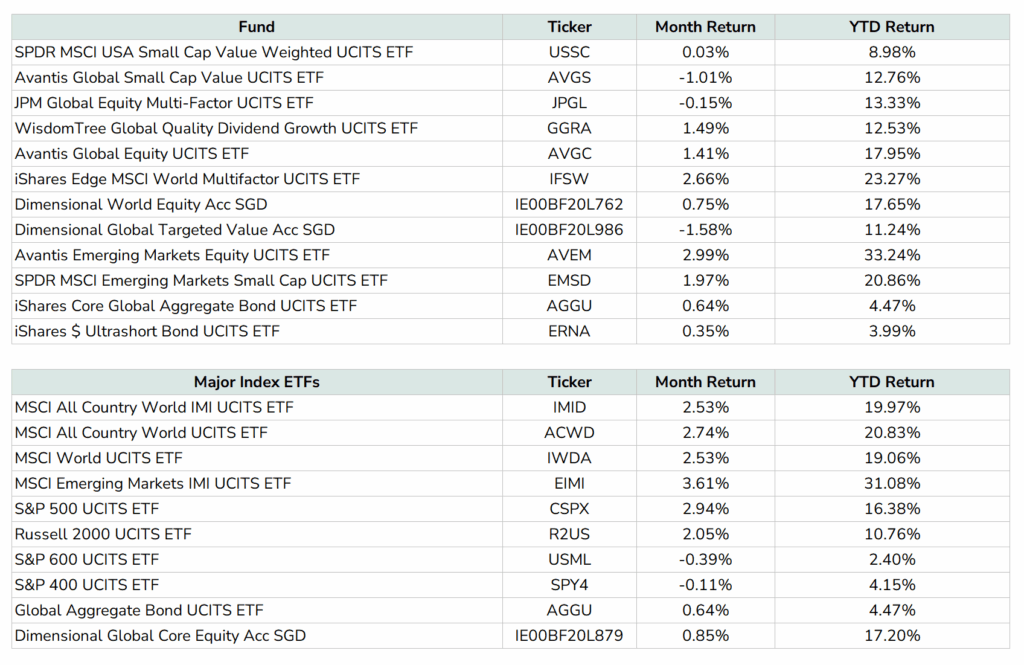

I am not going to do for all but here are the total and annualized 20 and 25 year returns for indexes representative of much of these indexes:

I presented both the cumulative returns and annualized return.

If you look at this data, it kind of tell you that a basket of diversified equities is like a 20-25-year duration pseudo fixed income security.

You are not sure what kind of returns you gonna get. The weakest 25 year return here is 201% or 5.7%.

$1 mil grow to $4 mil at a 25-year 5.7% p.a. compounded rate.

You also see which look-back window you use is important. If it is 20 year, Large cap growth is the best and International large & mid cap blend and value did the worse.

But if you use 25 year, the best is US small cap and US small cap value. The worse is International Large & mid cap growth and mid cap & small cap growth.

Hope the data is useful.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment