Also, the simple calculator I’m using doesn’t increase service charges, which is clearly unrealistic too.

Using these ballpark figures, a 3% annual growth in prices (maybe optimistic) and matching rent rises (more credible, with inflation) yields:

Ouch! Who needs dodgy alt-coin pump-and-dump schemes when you can lose money with good old bricks and mortar?

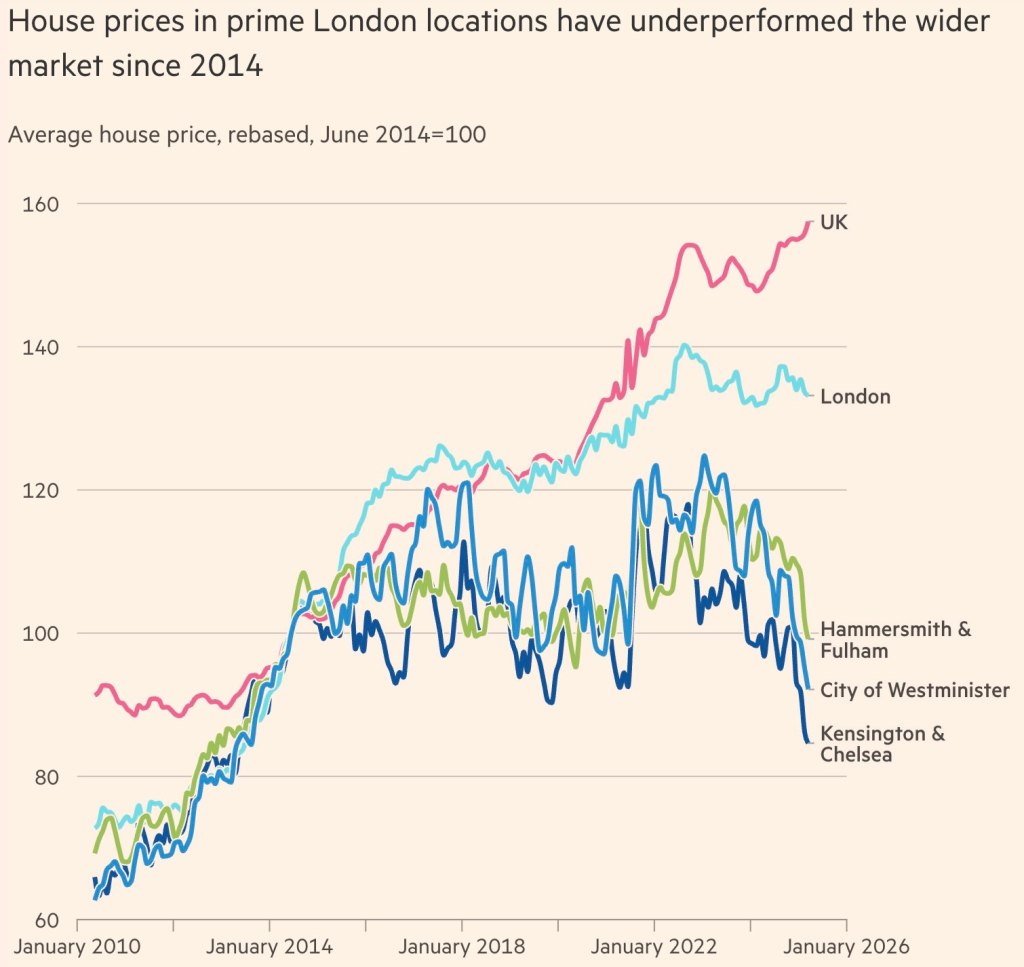

But wait – buying into prime London is all about capital gains. And I am assuming 3% growth (left-hand side of table).

Even then – and with leverage – after a decade we have a 2% annual return on investment:

Post Comment