Unlocking Hidden Goldmines: Why Now Is the Perfect Time to Dive Headfirst Into Multifamily Investments (We’ve Already Started)

Dave:

Short term.

Kathy:

So a lot of people got in trouble with those. So we’re not, we’re going to raise enough cash that we’re not going to have to do that. We could do the renovation with the cash and it’s not going to be this knockout of the park thing that multifamily was doing in 2021, but that’s okay. People aren’t expecting that.

Dave:

And so when you refinance it, are you getting a balloon? Is it a traditional commercial loan? Traditional,

Kathy:

Yeah, traditional commercial loan.

Dave:

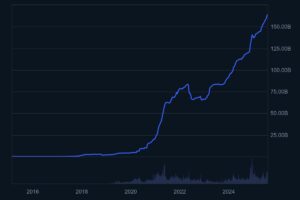

Okay. That’s awesome that you got that commercial debt. My fear about commercial real estate right now, I went into 2025 being like, I’m going to just buy for myself 20 unit something somewhere, and that will be a great retirement piece for my portfolio. And I’m still interested in doing that. But in the recent months, I’ve just gotten very wary of long-term interest rates. I am fearful that 3, 5, 7 years from now, interest rates are going to be higher than they are now. And I know not a lot of people think that, but I am fearful of that. And so I worry about any sort of variable rate debt, even if you’re getting a good deal right now for me, as someone who wants to hold onto this for 20 years, I worry that I would have to refinance at a much higher rate. I’m wondering if you think about that at all or since you’re syndicating, you’re going to try and sell this off in a couple of years or how you think about that risk.

Post Comment