Unlocking Hidden Goldmines: Why Now Is the Perfect Time to Dive Headfirst Into Multifamily Investments (We’ve Already Started)

Kathy:

Understand the debt. That is so incredibly important and so many passive investors over the past decade had no idea. They’re just like, Hey, we’re invested in an apartment and that’s all they know. So understanding the debt structure is incredibly important. Just like with that second apartment that we owned. It was the debt. I mean, we sold the building for millions more and the lenders got all the upside. It’s

Dave:

The worst. Yeah.

Kathy:

Yeah.

Dave:

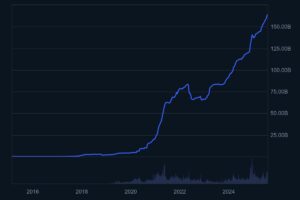

I think understanding the debt is super important. Honestly, it’s hard, but I think it’s an important lesson for those of us who started in the last 15 or so years, just seeing the changes in interest rates are super tough and they’re super hard to predict. And a lot of people didn’t see rates staying high this long. A lot of people have assumed rates are going to go down. There’s a chance they do. I think there’s a chance in the next couple of years they go up. We don’t know. And so that introduces risk into being a real estate investor. The asset class is still great. Prices still go up. We’ve seen that in the last couple of years. You can still make money in this. You just have to be really careful with debt. We talk about this all the time. There’s good debt, there’s bad debt, and sometimes variable debt can help you hit a grand slam. But think about your own risk tolerance a lot before you take out some of these things, especially in this cognitive environment. But we do have to take one more quick break. We’ll be right back. Welcome back to On the Market. I’m here with Kathy Beckie.

Post Comment