Unlocking Hidden Goldmines: Why Now Is the Perfect Time to Dive Headfirst Into Multifamily Investments (We’ve Already Started)

Kathy:

Dave, you’ve been really, really very accurate on your predictions for rates. So why do you think they’re going to be going up over the next 10 years?

Dave:

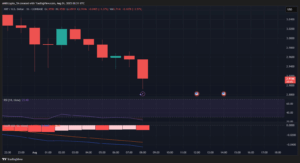

I’m scared. Basically, I guess there’s two big concerns. One is the idea of Fed independence. We’ve seen President Trump, Jerome Powell have been arguing a lot yesterday.

They were fighting on live TV if you watched that. And I think there’s arguments for and against Trump wanting lower interest rates. I think he wants to stimulate the economy. He wants to lower the interest rate on our national debt. So our total debt service goes down and Powell wants to protect against inflation. But regardless of which side you’re on that the fight between the president and the Fed I think is a really detrimental thing. And we’re seeing that in the market because traditionally there has been something called Fed independence. Some people don’t agree with this, but I think it’s really important that the Fed operates independent from the political entities. And the Fed is by no means a perfect entity. I’m not saying that at all.

But one of the reasons why the US gets low interest rates like we do, is because global investors just believe in the US system. And if they start thinking that there’s going to be political motivation for changing interest rates and in the bond market that can push bond yields up, even if the fed cuts rates. There was an article in the Wall Street Journal today about how even if Trump does Fire Powell, he might not actually get what he wants. He could fire Powell, they can cut rates and mortgage rates might go up. That is actually a relatively realistic scenario. And so

Post Comment