Unlocking Thailand’s Crypto Secret: Will This Sandbox Revolutionize Foreign Tourist Investments?

Ever wondered if your crypto wallet could double as your travel buddy in Thailand? Well, the Thai SEC and the central bank are cooking up something pretty revolutionary—a crypto sandbox designed exclusively for foreign tourists. Imagine converting your digital assets straight into baht and spending it locally without the usual hassle, but with a twist: direct crypto payments are off the table, so it’s all channeled through licensed operators and regulated e-money platforms. It’s a bold move aimed at marrying the thrill of digital finance innovation with Thailand’s booming tourism industry. But with innovation comes a fair share of skeptics—some folks are raising eyebrows over the readiness of the ecosystem and the potential pitfalls like money laundering. So, is this sandbox a game-changer for travelers and the crypto space, or a risky leap? Let’s dive into what’s brewing in the Land of Smiles. LEARN MORE.

A pilot program lets tourists convert digital assets into baht, aiming to modernize payments.

Key Takeaways

- The Thai SEC and central bank has introduced a crypto sandbox to allow foreign tourists to convert digital assets into baht for local spending.

- Direct crypto payments are prohibited, and converted funds must be used via regulated e-money platforms across Thailand.

Share this article

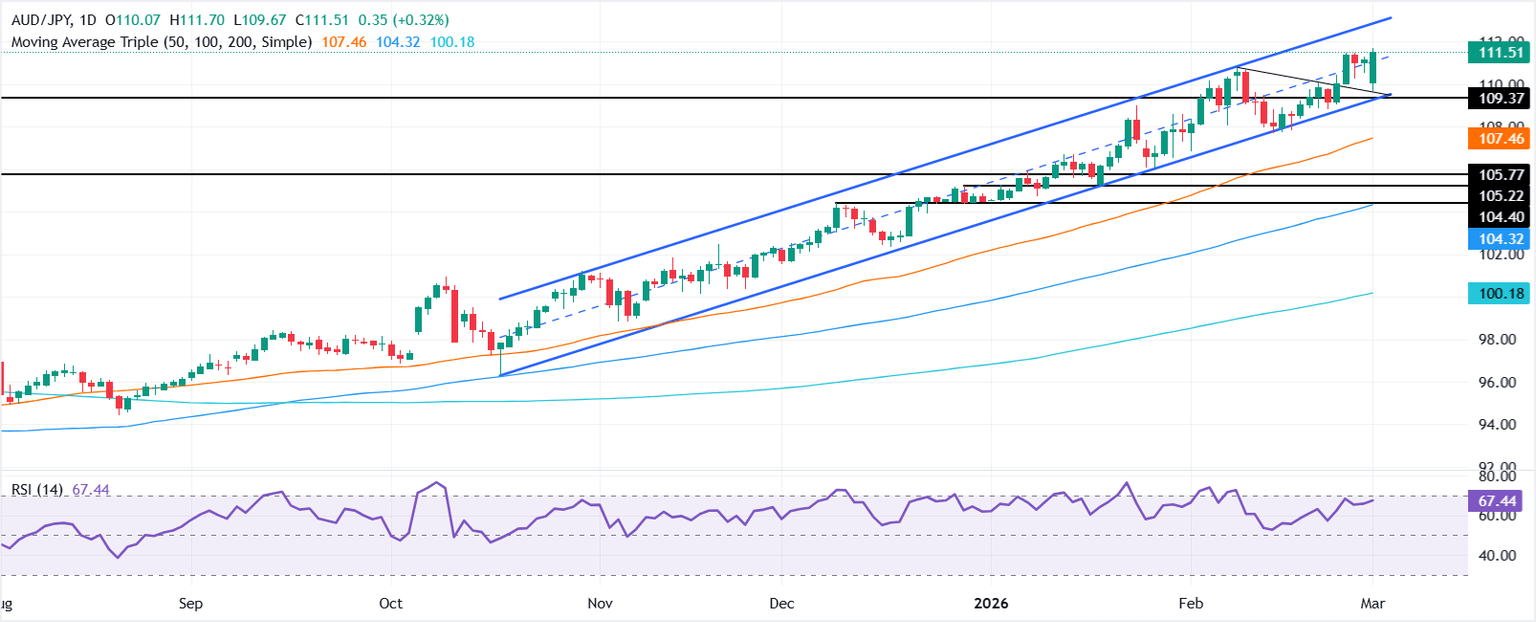

Thailand’s Securities and Exchange Commission (SEC) and the Bank of Thailand plan to launch a crypto regulatory sandbox that enables foreign tourists to convert crypto assets into baht for local spending, expanding beyond an earlier Phuket-focused initiative, the Bangkok Post reported on Wednesday.

Thailand’s new initiative, currently open for public hearing, would allow tourists to exchange crypto assets through licensed operators and spend the converted funds via regulated e-money platforms, according to the SEC.

“This crypto sandbox builds directly upon former premier Thaksin Shinawatra’s Phuket sandbox proposal from late last year. Both share the core concept of allowing Bitcoin and cryptocurrencies as payment methods in tourist areas to drive adoption,” said Nirun Fuwattananukul, chief executive of Gulf Binance.

The sandbox program allows approved operators to provide services for up to 18 months with possible extensions for licensed digital asset exchanges, brokers, and dealers.

Interested operators must comply with eligibility criteria, service scope limitations, tourist spending caps, and anti-money laundering regulations to participate in the program.

While the sandbox aims to boost tourism competitiveness through digital finance innovation, direct crypto payments are not permitted. Converted baht must be spent through approved e-money providers, enabling transactions like QR code payments.

Despite its innovation-driven intent, the program has sparked some concerns among industry stakeholders.

The Tourism Council of Thailand (TCT), a private-sector organization focused on fostering public-private cooperation, promoting quality standards, and shaping tourism policy in the country, has cautioned against rushing into implementation.

“We’re not opposed to this scheme, but the government should ensure that the entire ecosystem is prepared for cryptocurrency use before launching the program,” said Bhummikitti Ruktaengam, TCT vice president, in a statement. He noted that many stakeholders in Phuket were unaware of the public hearing currently underway.

Money laundering is also one of the key concerns, especially amid a rise in illegal foreign businesses in Phuket. Ruktaengam warned that without clear rules, crypto exchanges could be misused.

Meanwhile, tourism operators want clarity on which crypto assets are eligible and what exchange services will be permitted.

Share this article

Post Comment