US Regional Banks Are Faltering — Here’s Why the Next Silicon Valley Goldmine Is Just Around the Corner

Well, this week has been nothing short of a rollercoaster for the portfolio — and not the fun kind where you throw your hands up and scream with excitement. Instead, it was the kind that had me scratching my head over the fallout from First Brands and TriColor, two companies that turned the small regional banking sector on its head with their bankruptcy dramas and questionable loan collaterals. You’d think the economy could use a little more stability by now, but with consumers tightening their belts and the auto sector wobbling, it feels like we’re just starting to glimpse how many hidden “cockroaches” might be scuttling around under the surface. So, the big question on my mind: are we on the brink of a systemic financial crisis, or just witnessing another chapter of the market playing its usual drama? I dug deep into expert insights, recent earnings surprises, and the structural resilience—or fragility—of banks to piece this puzzle together, and trust me, the story is as nuanced as it is eye-opening. Ready to peel back the layers? LEARN MORE

img#mv-trellis-img-1::before{padding-top:57.32421875%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:57.03125%; }img#mv-trellis-img-2{display:block;}

This week has been a very topsy-turvy week for the portfolio.

Not only did it not benefit from the run in small cap because it lacks those companies with no earnings companies that focus on uranium, quantum computing, former crypto mining companies, it drew most of the fallout from the bankruptcy of First Brands and TriColor.

Halfway into the week, the portfolio benefited when Fed Chair Jerome Powell indicate that the path going forward are likely to be lower rates.

What dominated the headlines was what happened at First Brands and Tricolor. The former is an auto-parts company that filed for bankruptcy protection. Tricolor filed for Chapter 7 liquidation ( as oppose to chapter 11 restructuring). Turns out that the collateral when they borrow from private credit may have fraudulently double pledged.

The whole banking sector, particularly the small regional banks were taken down because

- They seem to have exposure to the debts of these firms but could not catch anything until the borrower could not make payments.

- The market wonders just how many First Brands and Tricolor is out there and how many financial institutions are impacted. This creates uncertainty and the market tries to find a new price (read that as lower) of this whole group of smaller banks (and also larger banks)

An investor who tries to tie all this together may point out that the reason all of these were revealed was because of the weak economy. The consumer does not have money to spend and therefore have to choose where they spend the money, and this affected the auto sector.

Given that the data also shows weak housing and construction sector, we may see a lot more cockroaches uncovered.

Is this the start of a systemic financial crisis similar to 2008?

I think one thing many didn’t realize is that the GFC in 2008 was such a shock that the banks were built into a system to handle the downside risks. If you read my piece on First Citizens Bancshares and how they got Silicon Valley bank for dirt cheap, you would get the idea that they practically expect some banks to fail and design a system to handle when banks fail. (We haven’t even reached that point of talking about failure yet!).

In this podcast, two bank analysts who specialize in analyzing banks explains the degree of safety in the bank structures: How Sturdy are the US Banks and Private Equity Going into the Next Recession?

Even Jefferies, which is one of the main character who are caught in the First Brands saga, may just take a hit to their net income. Taking a hit to net income versus being massively impaired are very different things.

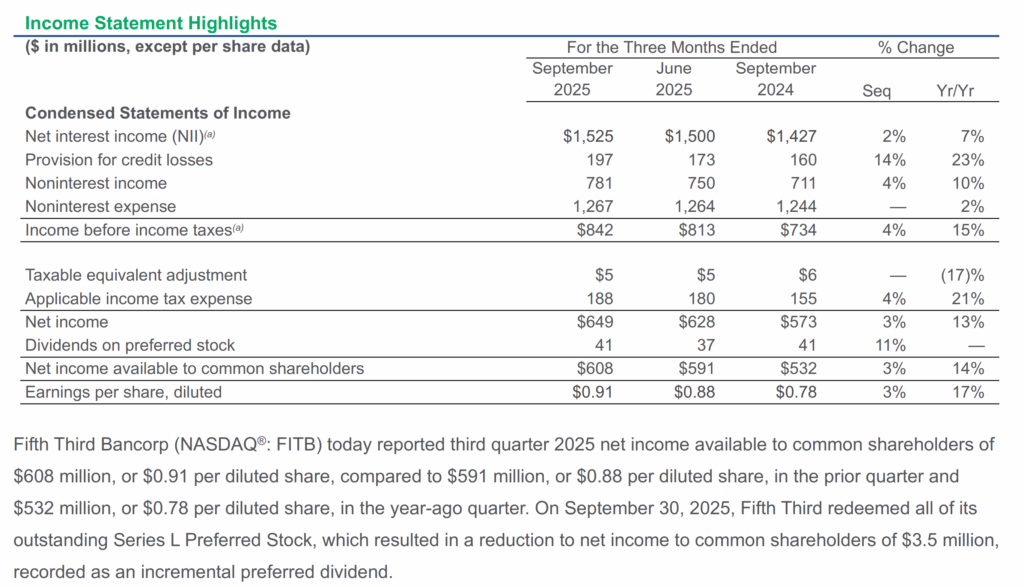

Fifth Third Bancorp (FITB), which made an asset-backed loan of US$200 million to Tricolor, had to write off 100% of their loan to Tricolor. But they just announced their third quarter results this morning.

Even factoring in this write-off, Fifth Third’s net income still looks good!

The net charge-offs, which is the amount of money from loans written off minus the amount that they could recovered jumped. But every quarter there were similar written off money.

What people are afraid of is this becomes systemic or that we have a whole bunch of frauds in the private credit space. I think fraud is one thing, poor business is another thing, lax underwriting and loan origination standards is another thing.

I think there may be more bad eggs and we will see them come out but the system may show that we can handle them pretty well. I was puzzled with the small numbers thrown about and people crying father and mother over the numbers that I wonder did I not understand things that well.

Anyway, I shall not say much. Here are some good resources on these issues to help you making your investment decisions:

The Bank Stock Rout: Facts vs Fiction | The Weekly Wrap

Steve Eisman was one of the main guys who discovered that the standards were pretty poor during the housing crisis before GFC and became famous for it. His podcast is great even for the beginner because of his willingness to dumb things down as much for the everyday men.

In his weekly wrap, he reviews the earnings this week and this week is all bank earnings. And he should know more than most about bank earnings to pick out red flags.

Key Summary Points

- Large Bank Performance: The major banks reported strong third-quarter earnings, generally beating expectations [02:54]. This performance was driven by robust investment banking and trading results, signaling a potential M&A boom. Eisman suggests owning Goldman Sachs or Morgan Stanley to play this trend [03:17].

- Credit Quality: Overall, consumer credit quality was fine, and loan loss provisions were okay. There is evidence of credit deterioration on the commercial side, notably at JP Morgan (commercial non-accruals up 33% year-over-year) and Citibank (up 119% year-over-year) [04:37].

- Isolated Issues: Problems at two regional banks, Zions and Western Alliance, due to a single fraudulent borrower, appeared to be isolated incidents and were not indicative of a systemic regional bank problem [05:51].

- Regional Bank M&A Wave: Eisman believes the industry is on the cusp of a major merger and acquisition (M&A) wave among regional and community banks [13:03]. This is driven by high post-Dodd-Frank regulatory and technology costs that are difficult for smaller banks to absorb [12:11].

Reading the Credit Cycle

The most critical takeaway is how the current situation differs from the Great Financial Crisis (GFC). Eisman is data-driven [06:31] and concludes:

- Normal Cycle: “Right now I think we are in a normal cycle” [08:20]. In a normal cycle, credit quality deterioration is a lagging indicator; it happens after a recession begins and companies start layoffs, leading people to lose their jobs and struggle to pay loans [07:55].

- GFC Anomaly: The GFC was different because widespread credit deterioration from abysmal underwriting standards occurred before the recession [08:05].

- Current Conclusion: Because the current data shows only marginal deterioration on the commercial side and consumer credit remains sound, the issues are “not enough to actually cause a recession or indicate that a recession is about to occur” [08:31]. The data does not currently signal an imminent crisis.

The Survival of Regional Banks

A secondary, but major, lesson is the structural challenge for smaller financial institutions:

- Too Small to Succeed: Eisman references a speech by Secretary Scott Bessent, who suggested that Dodd-Frank may have made it “too small to succeed” for many banks [12:03]. The rising costs of technology and regulation have created a competitive disadvantage for regional and community banks, forcing them to merge to compete with larger institutions [12:27].

- Management Obstacle: For investors in regional banks, the lesson is that while consolidation is the necessary outcome, it is complicated by the fact that some CEOs “just love being CEOs too much” and may resist selling the bank, even when it is in the best interest of their shareholders [14:43].

Financial Crisis, Fiscal Stability, & Green Stocks on Red Days

The second resource was the detail breakdown by Unemployed Value Degen, who usually does very deep work in small, neglected stocks betting on multiple expansions.

Financial Crisis: A False Alarm Driven by Fear

He argues that the recent market selloff and banking fears do not signal an impending financial crisis on the scale of 2008, asserting that the panic is largely an overreaction based on isolated incidents and post-crisis trauma.

- Initial Shock and Search for Fraud: The panic began with Fifth Third Bancorp revealing a $170–$200 million loss on a fraudulently double-pledged asset-backed loan (Tricolor). This prompted nearly every major bank to launch an emergency review of its loan books, leading to the discovery of other issues, such as a $50 million bad loan at Zions Bank. The market is highly sensitive, interpreting each discovery as a “cockroach”.

- Absence of Malinvestment: A genuine financial crisis is usually precipitated by a credit cycle causing structural malinvestment (excess capacity, crushing asset values). The malinvestment resulting from the long period of zero interest rates post-2008 was mostly in Software as a Service (SaaS), which was largely equity-financed and therefore did not significantly affect bank balance sheets.

- Fraud is Not Systemic: Fraud exists but is not widespread enough to collapse the system. Data from Suspicious Activity Reports (SARs) filings for mortgage fraud are well below the peaks seen leading up to the 2008 crisis. Crucially, mortgages, the largest segment of bank balance sheets, are currently stable due to high homeowner equity, and the problem-area of Asset-Backed Securities (ABS) makes up only a small fraction (around 3%) of total commercial bank assets.

- The Real Danger is Fear: The banking system is fundamentally in good shape. The greatest risk is a self-fulfilling prophecy where “fear itself” (saliency bias) leads to a liquidity crisis. This occurs if interbank lending freezes due to fears of counterparty risk, forcing government intervention. Signs of this fear include an increased Secured Overnight Financing Rate (SOFR) and investors buying Treasuries instead of depositing money in banks.

Fiscal Stability: A Surprisingly Positive Trend

This part is less related but he focuses on U.S. government finances, arguing that the fiscal situation is improving faster than is publicly reported, which will have massive implications for future interest rates and the economy.

- Deficit Improvement: The fiscal year 2025 data (ending September) showed unexpected strength. September 2025 closed with a $198 billion budget surplus, a significant improvement over the prior year. While the full-year deficit only saw a modest drop, the period from February through September 2025 was $365 billion better than the same period in 2024.

- Sustainable Path: The author projects that the combined effect of an improved revenue situation and the potential reversal of the Federal Reserve’s policy of halting interest remittances to the Treasury (a possible savings of $150 billion) could reduce the fiscal 2026 deficit to less than $1.2 trillion. This trend indicates the U.S. government is on a more sustainable financial path.

- Impact on Interest Rates: Market realization of this improved stability will put downward pressure on U.S. Treasury rates. The author predicts the 10-year Treasury rate will fall to no higher than 3.5% by the end of 2026, aligning more closely with European rates.

- Economic Boom: Lower Treasury yields will translate into a lower cost of borrowing for consumers. This is projected to bring the 30-year mortgage rate down to around 4.9% by late 2026 or early 2027, which would “unfreeze” the housing market and trigger an economic surge via home equity loans and increased durable goods spending.

I have tried to go through the US Department of Treasury Final Monthly Treasury Statements, which shows the receipts and outlays of the US Government and most of the numbers checks out.

Things might not always be that bleak as some think.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment