USD/JPY Surges Past 153.00: Is This the Untold Signal Savvy Investors Have Been Waiting For?

Ever wonder if the USD/JPY pair is playing a sneaky game of hopscotch with traders? On Friday, it certainly seems like it’s bouncing back with gusto, nudging past that 153.00 mark and whispering that the uptrend might just be back in the game for the short term. Now, after taking a tumble that shaved off 100 pips on Thursday—a solid 0.68% dip—it’s fascinating to see buyers rush in, driven not just by instinct but the US Dollar’s close dance with the steady US 10-year Treasury note yield. Sometimes, the market’s rhythms sync in ways you wouldn’t expect, right? Diving deeper, the technical story paints a picture of resilient buyers gripping around 153.00, eyeing the 20-day SMA support at 152.52, with a cautious watch on whether the floor at 152.80 holds. If it falters, there’s a clear path down to last month’s October 29 low at 151.53. But here’s the kicker—buyers still seem to have their foot firmly on the pedal, subtly backed by the RSI. Should the pair surge beyond 154.00, the historic highs from November 4 at 154.48 and the psychological 155.00 await, promising an intriguing ride ahead. In the high-stakes arena of currency trading, staying ahead means not just watching numbers, but reading the subtle signals whispering beneath. Ready to see where this dance leads next? LEARN MORE

The USD/JPY stages a recovery on Friday with buyers claiming 153.00, an indication that the uptrend might resume in the short term. The 100-pip or 0.68% Thursday’s loss was offset by traders buying the US Dollar due to its close correlation with the US 10-year Treasury note yield, which was steady during the trading day.

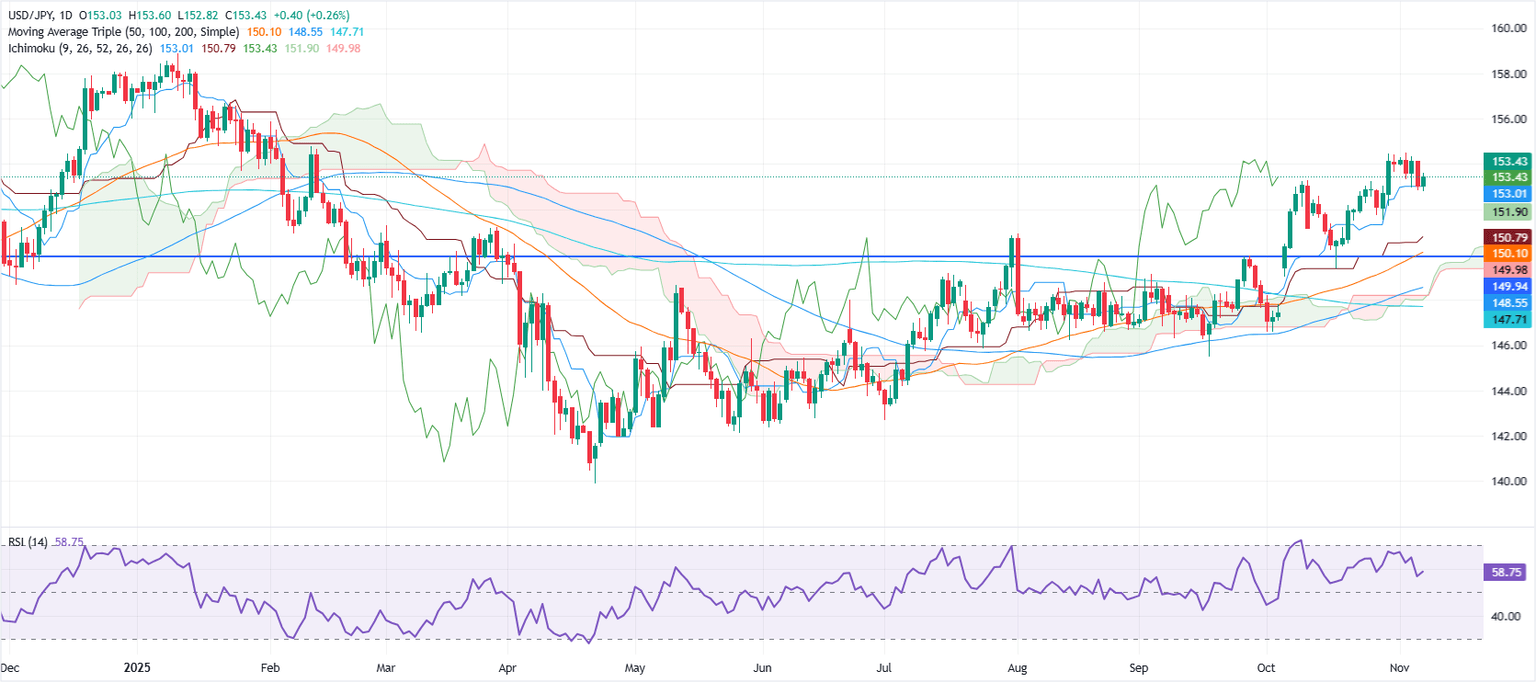

USD/JPY Price Forecast: Technical outlook

The USD/JPY technical picture shows that buyers regained momentum at around 153.00 with the next support level seen at the 20-day SMA at 152.52. Although buyers kept the exchange rate from falling to 152.80, a breach of the latter opens the door towards the 20-day SMA and on further weakness, the October 29 low lies next at 151.53.

However, buyers remain in charge as depicted by the RSI. That said, if USD/JPY rises above 154.00, the next resistance would be the November 4 peak at 154.48, followed by 155.00.

USD/JPY Price Chart – Daily

Japanese Yen Price This week

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies this week. Japanese Yen was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.29% | -0.22% | -0.41% | 0.11% | 0.76% | 1.70% | 0.05% | |

| EUR | 0.29% | 0.07% | -0.05% | 0.40% | 1.04% | 1.99% | 0.34% | |

| GBP | 0.22% | -0.07% | -0.28% | 0.33% | 0.97% | 1.92% | 0.27% | |

| JPY | 0.41% | 0.05% | 0.28% | 0.48% | 1.15% | 2.09% | 0.58% | |

| CAD | -0.11% | -0.40% | -0.33% | -0.48% | 0.59% | 1.57% | -0.06% | |

| AUD | -0.76% | -1.04% | -0.97% | -1.15% | -0.59% | 0.95% | -0.70% | |

| NZD | -1.70% | -1.99% | -1.92% | -2.09% | -1.57% | -0.95% | -1.62% | |

| CHF | -0.05% | -0.34% | -0.27% | -0.58% | 0.06% | 0.70% | 1.62% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Post Comment