Wall Street Whispers Unleashed: The $30M CZ Sell-Off That Shattered Aster’s Market – What You Must Know Before It’s Too Late!

Ever wonder how a whisper in the crypto world can set off a mini financial earthquake? That’s exactly what happened to Aster [ASTER] when a juicy rumor about Binance’s very own CZ offloading a massive 35 million tokens sent shockwaves through the market, dragging its price down a whopping 19% to a two-month low. Panic selling exploded as investors scrambled—but here’s the plot twist: those sell-off claims were later disputed, shaking up the narrative and hinting at a potential comeback. So, is Aster gearing up to bounce back toward the elusive $1 mark, or will the sellers keep the pressure on? Stick with me as we unravel the chaos behind the numbers and what might be lurking just around the corner for this altcoin. LEARN MORE

Key Takeaways

What triggered Aster’s sharp price drop to $0.85?

Rumors of Binance founder CZ selling 35 million ASTER tokens caused panic and aggressive selling.

What signals suggest Aster may recover toward $1?

Disputed sell-off claims and rising buyer interest could help absorb sell pressure and fuel a rebound.

Aster [ASTER]dropped 19% from $1.05 to a 2-month low of $0.85 before rebounding to a high of $0.93. At press time, Aster was trading at $0.92, down 7.92% on the daily charts and 18% on the weekly charts.

But why is Aster down today?

Binance founder CZ’s sell-off rumors

The crypto community was abuzz with explosive rumors that Binance Founder Changpeng Zhao (CZ) sold his Aster holdings.

According to Farzad, CZ-linked wallet sold 35 million Aster tokens worth $30.42 million. As a result, the Aster price crashed massively as investors and holders panicked and sold.

However, Aster started to recover after Lookonchain and other reliable monitors disputed these claims.

As per Lookonchian, the $34.53 million transfer of 31.84 million ASTER was between Binance hot wallets and had nothing to do with CZ’s wallet.

Aster hit by massive Spot sell-off

Significantly, following the CZ sell-off rumors, other investors panicked and turned to aggressive selling.

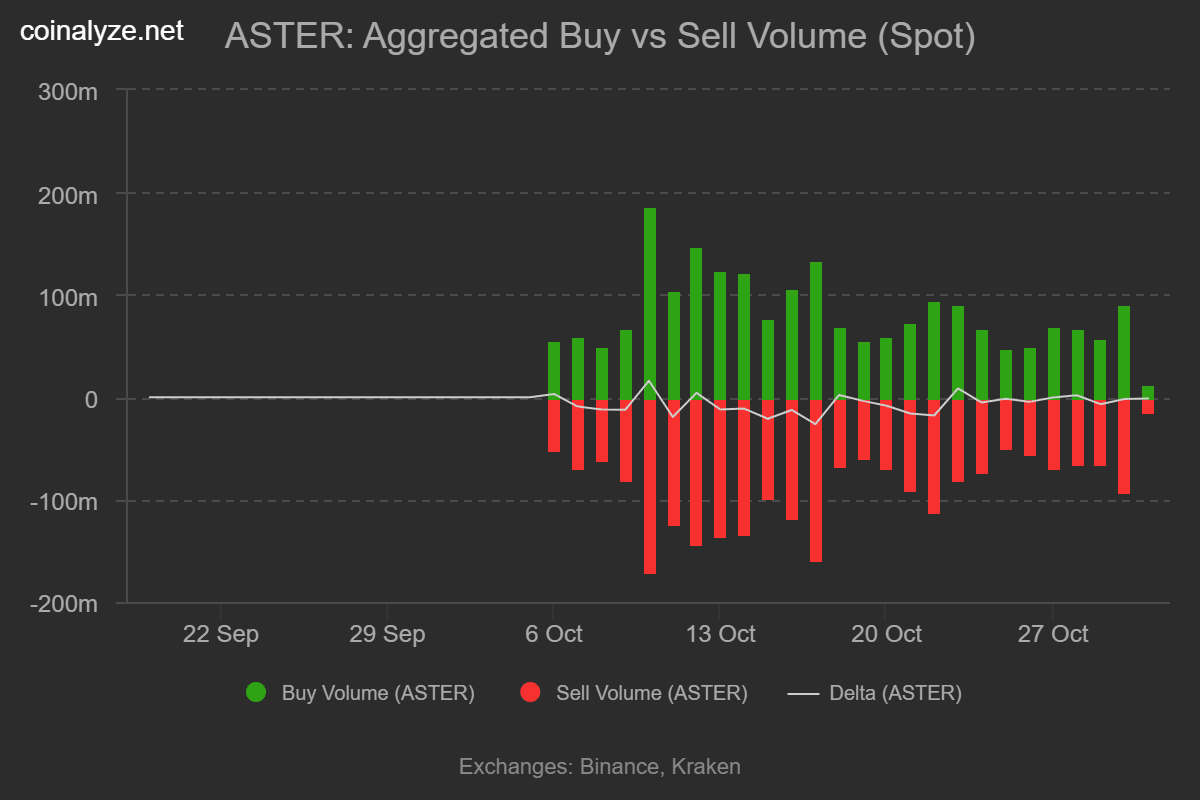

According to Coinalyze, Aster recorded 107 million in Sell Volume, as of writing, compared to 103 million in Buy Volume, over the past 24 hours.

As a result, the altcoin recorded a negative Buy Sell Delta of -4 million, signaling aggressive spot selling.

On top of that, Aster’s Top Addresses also increased their spending, offloading 35.6 million tokens.

Historically, increased selling pressure across market participants has preceded sustained downward pressure, leading to lower prices.

Futures liquidations hit a 2-week high

As the market crashed, investors in the Futures market either closed their positions or were forced to liquidate.

According to CoinGlass data, Futures liquidation skyrocketed to a 2-week high of $8.5 million. Amid this, longs worth $8.2 million were liquidated.

On top of that, Futures Outflows surged to $552 million, up from $509 million in Inflows. As a result, Futures Netflow dropped into negative territory, reaching a low of -$42 million, a clear sign of increased selling.

A sustained recovery in sight?

According to AMBCrypto, Aster declined after holders and investors panicked and sold amid rumors of Binance CZ’s sell-off.

As a result, the altcoin’s Stochastic RSI dropped from 26 to 12, at press time, signaling rising seller dominance.

Likewise, its Relative Vigor Index made a bearish crossover, dropping to -0.138, indicating strengthened downward momentum.

Typically, when these indicators drop to such levels, they signal strong downward momentum and the potential for the trend to continue.

Therefore, if sellers continue to dominate, Aster will find support around $0.9. However, if bulls retake positions and increase demand, they could absorb the sell pressure.

In doing so, the recovery trend witnessed after recent rumors were disputed will continue, potentially setting Aster up to reclaim the $1 resistance level.

Post Comment