When Crisis Strikes, Will You Smash the Glass or Miss Your Golden Opportunity?

What a wild ride tax talk has become lately! Just when you think the public’s heard it all, someone floats the idea of dusting off the 200-year-old window tax — yes, the one that literally taxed sunlight. Imagine the irony in a world of gleaming skyscrapers and sprawling bifold doors. It’s almost laughable… until you realize governments might actually be considering it as a cash cow. Meanwhile, whispers about hiking income taxes — the very proposal ruled out before the last election — are creeping back into the spotlight. Could Rachel Reeves and Keir Starmer really be ready to eat their manifesto promises, driven by the hefty £100bn Brexit bill and a £40bn revenue black hole? Or is this just another round in the cynical political game of tax scare tactics? With the Budget looming on 26 November, the stakes couldn’t be higher — and the public’s patience wearing thinner than ever. Buckle up; this year’s fiscal drama might just steal the show. LEARN MORE

What caught my eye this week.

We’re at the point now where about the only potential tax hike that hasn’t been run past the committee of public opinion is a revival of the 200-year old window tax.

Don’t laugh! It could be a real revenue spinner in our era of skyscrapers in the City and bifold doors in the suburbs.

In the meantime, a rise in income taxes in the upcoming Budget seems to finally be – maybe – on the agenda.

Yes, those same higher income taxes that were ruled out ahead of the last election.

I have my doubts, but who knows. Perhaps Rachel Reeves and Keir Starmer believe the situation really is dire enough to warrant breaking the pledge? It’s already motived them to lift their silence on the £100bn hit to the economy – and the resulting black-hole-sized £40bn shortfall in state revenues – that Brexit has cost us.

Or maybe Labour thinks they might as well be hung for a sheep as a lamb, considering the kicking they got anyway for dancing around taxes on ‘working people’ with the last budget?

Or maybe it’s just another ill-advised attempt to scare us with a worst-case scenario so that the real medicine doesn’t taste so bad.

We’ll find out on 26 November. But hell will hath no fury like the voting public if income tax rates rise by a bald 2p in the pound without a ‘sterilising’ 2p cut in National Insurance – which would undo much of the revenue-raising potential anyway.

And cutting national insurance won’t help the legions of vote-happy pensioners…

A stitch in time

I happen to believe that from a bunch of very unpalatable options, just hiking the basic rate of income tax and getting on with it wouldn’t be the worst.

But that would be partially on the grounds that it’s such a game-changer that it could have quashed the rumours and uncertainty caused by chipping away at absolutely everything else – from pensions, ISAs, dividends, and capital gains to property and the rest – to the sidelines.

However we’ve already had another three or four months of uncertainty. It’s made people save more, spend less, dither about moving house, and thrown yet more sand into the wheels of our lacklustre economy.

Worse, we’ve already had last year’s employer’s NI hike. Which had exactly the effect everyone predicted it would on youth employment, and on the health of the hospitality sector too.

If a bandaid was going to be ripped off then 2024 was surely the better time to go for it.

Rumour treadmill

Here’s a flavour of this week’s speculation:

- Chancellor refuses to rule out manifesto-breaking tax hikes – Sky

- NIESR: hike income tax by 2-10p in the pound – This Is Money

- How much would a 2p income tax rise cost you? – Which

- Reeves also reportedly considering a 20% exit tax on UK leavers – Guardian

- Stand down! Reeves said to cool on big cash ISA reforms – City AM

- A 5% VAT cut on electricity bills in Budget will backfire, experts say – Guardian

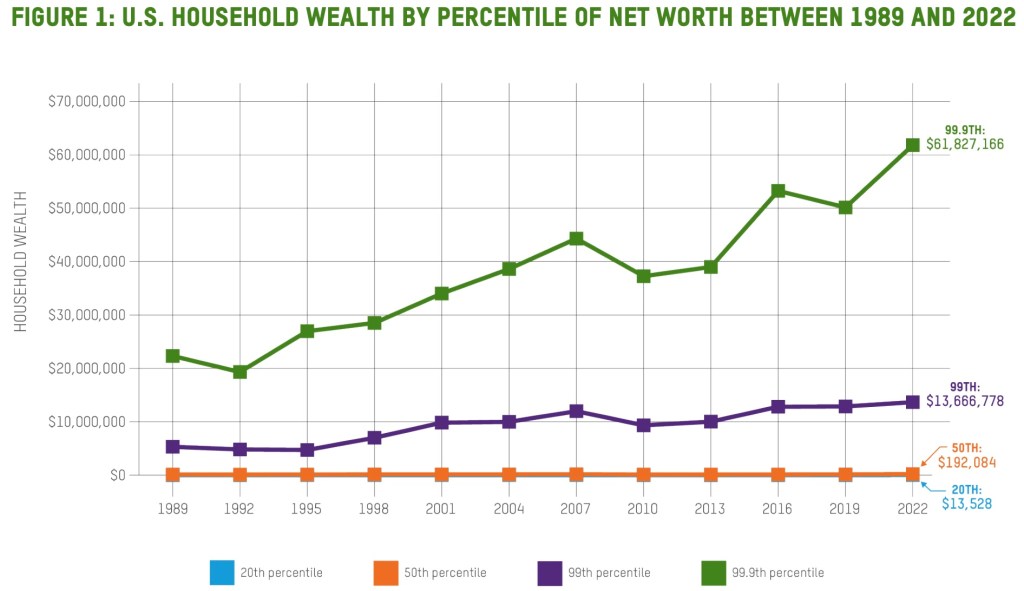

- How wealthy is ‘wealthy’, exactly? [Paywall] – FT

But that’s just a taste. I’ve run batches of budget speculation in these links for weeks, so thick and fast and indiscriminate have they come.

Of course what’s notably missing from most of the rumour-mongering is anything about spending cuts. I’ve probably read more about the two-child benefit cap being lifted – which will obviously cost yet more money – than on any mooted plans to curb spending.

It’s true the last round of so-called austerity under George Osborne didn’t do much for the UK. And perhaps it’s senseless to look to downsize government – or at least to stop it growing further – while the economy is only limping along.

But is this a different era? Rates are taking their time to fall, and we’ve borrowed much more money. There’s a growing feeling that we’re sleepwalking into a self-fulfilling prophecy.

I used to look forward to budgets. But I honestly just want this one to be over.

Have a great weekend!

From Monevator

Defensive asset allocation beyond the 60/40 portfolio – Monevator

Yes, you can eat risk-adjusted returns – Monevator [Mogul members]

From the archive-ator: How to choose a bond fund – Monevator

News

Bank of England holds its key rate at 4% – BBC

UK economic growth forecast downgraded for 2025 – Yahoo Finance

Construction sector suffers worst downturn since 2020 – This Is Money

Fixing Britain’s ‘worklessness’ crisis would cost business £6bn a year – Guardian

Motor finance backlash mounts, with calls to pull £4bn from lenders – City AM

UK children to get mortgage and budgeting lessons in school – This Is Money

Savills’ five-year forecast for house prices – This Is Money

AI-washing and the massive job cuts hitting the US economy – CNBC

Firm founded by winner of The Apprentice Harpreet Kaur collapses – City AM

The rise of a new American oligarchy – Oxfam

Products and services

Disclosure: Links to platforms may be affiliate links, where we may earn a commission. This article is not personal financial advice. When investing, your capital is at risk and you may get back less than invested. With commission-free brokers other fees may apply. See terms and fees. Past performance doesn’t guarantee future results.

Nationwide cuts mortgage rates to 3.64%, cheapest since 2022 – This Is Money

HSBC increase mortgage limit to 6.5x income for richest customers – This Is Money

A review of Chip’s £500,000 prize savings account – Be Clever With Your Cash

Get up to £1,500 cashback when you transfer your cash and/or investments to Charles Stanley Direct through this affiliate link. Terms apply – Charles Stanley

Nationwide offers interest-only mortgages to first-time buyers – What Mortgage

Why are workers abandoning their Nest pensions? – MoneyWeek

Where to price match when you purchase to save cash – Be Clever With Your Cash

Get up to £200 cashback when you open or switch to an Interactive Investor SIPP. Terms and fees apply, affiliate link. – Interactive Investor

How Experian has rejigged its credit scoring system – Which

Enjoy Apple CarPlay while you still can – The Atlantic

Homes for sale near a cycle route, in pictures – Guardian

Comment and opinion

A wistful farewell to Warren Buffett’s annual letters… – FA Mag

…and literacy as your investing edge – A Teachable Moment

How to fix wealth taxes [Podcast] – IFS

Should you buy at all-time highs? – Of Dollars and Data

A history of private equity [Podcast] – A Long Time In Finance via Spotify

Zen and the art of moat maintenance – 3652 Days

“Can I make more money working for myself?” [Paywall] – FT

The benefits of bubbles – Stratechery

Is now the time to go all-in on tech stocks? – A Wealth of Common Sense

Funds-of-funds really layer up those fees – Basis Pointing

Just buy stocks until you die? – Wall Street Journal [h/t Abnormal Returns]

Howard Mark’s famous memos anthologised [PDF] – Oaktree Capital

Deutsche Bank long-term asset study / data dump – DB Research

Naughty corner: Active antics

Cockroaches in the coal mine – Howard Marks

Cash hoarded by Buffett’s Berkshire Hathaway hits $381bn – CNBC

Growth stocks aren’t the only route to riches – Morningstar

Currency valuations – Verdad

Which Trump trades paid off? – Morningstar

Kindle book bargains

Poor Charlie’s Almanack by Charlie Munger – £0.99 on Kindle

The Man Who Solved the Market by Gregory Zuckerman – £0.99 on Kindle

Chip War by Chris Miller – £0.99 on Kindle

Meltdown: The Collapse of Credit Suisse by Duncan Mavin – £0.99 on Kindle

Or pick up one of the all-time great investing classics – Monevator shop

Environmental factors

Climate models show the 1.5°C goal is dead… [Paywall] – The Economist

…with three hottest years in a row putting the nail in the coffin – Guardian

Does installing a heat pump deliver savings after one year? – MoneyWeek

Climate action is the best way to ensure long-term growth – Observer

Government touts new forests from £1bn tree-planting programme – GOV.UK

How bird flu has decimated the elephant seal population – BBC

Pearls of the ocean that might return to British shores – Guardian

A pumping station and WW2 pillbox converted for bats – BBC

Robot overlord roundup

OpenAI’s planned $1 trillion infrastructure spend – Tom Tunguz

The double bind of the AI bubble means we’re screwed either way – Vanity Fair

Google plans to put data centres in space to meet AI demand – BBC

French philosopher Baudrillard predicted AI 30 years ago – The Conversation

AI’s exciting until companies want to use it: Rightmove edition [Paywall] – FT

Why do people love or hate AI? The answer is in our brains – The Conversation

Too much social media gives AI chatbots ‘brain rot’ [Research] – Nature

Not at the dinner table

Will Rachel Reeves repeat Denis Healey’s nightmare 1975 budget? – Sky

What a UK government led by Reform would really look like – BBC

Britain’s fiscal reality check – New Statesman

Stupidology – N+1

BBC has questions to answer over edited Trump speech, MPs say – BBC

Trump says he has “no idea” who he just pardoned – Citation Needed

Tensions rise in UK’s asylum and refuge hotspot – Guardian

Off our beat

Why is Argentina poor? – Uncharted Territories

The world’s most militarised economies by three metrics – Visual Capitalist

Everyone is a strategist. No one is a writer – Gen Zero

Scientists excited by gel to repair tooth enamel – BBC

Adaptability – We Are Gonna Get Those Bastards

This physicist says we don’t take Covid seriously enough – The Tyee

Celebrity chefs urge Britons to bang in some beans – Guardian

The lucrative economics of being an expert witness – The Hustle

Tails, things, and stuff – Permanent Equity

And finally…

“When you sell in desperation, you always sell cheap.”

– Peter Lynch, One Up On Wall Street

Like these links? Subscribe to get them every Saturday. Note this article includes affiliate links, such as from Amazon and Interactive Investor.

Post Comment