Why Arthur Hayes Thinks the Crypto Bull Run Could Catch Wall Street Off Guard Until 2026—Are You Ready to Ride the Wave?

Is the Bitcoin bull run really ready to clock out by Q4 2025, or is it about to surprise us all and keep charging well into 2026? Arthur Hayes, the ever-watchful founder of BitMEX, suggests we might still be in for a wild ride—thanks to some hefty macro catalysts brewing beneath the surface. It’s fascinating to look back and notice Bitcoin’s past halving cycles in 2017 and 2021 both peaked late in the year, setting a neat calendar rhythm most traders swear by. But here’s the head-scratcher: Hayes throws in a curveball, hinting that President Donald Trump’s political maneuvers might just fan the flames further, extending this rally into a fresh year. Now, before the bulls dart off, there’s a beast to tame—a $117K threshold that BTC must clear to truly signal the next leg upwards. Are we on the brink of a new Bitcoin record, or is this eye of the storm before a market pivot? Stick around as we unravel these possibilities and look beyond the charts and headlines for what’s really fueling this momentum. LEARN MORE

Key Takeaways

The bull run may extend beyond Q4 2025, into 2026, due to macro catalysts, according to Arthur Hayes. In the short term, though, BTC must clear $117K to advance.

The market may still have room for growth despite being in the late stage of the bull run, according to BitMEX Founder Arthur Hayes.

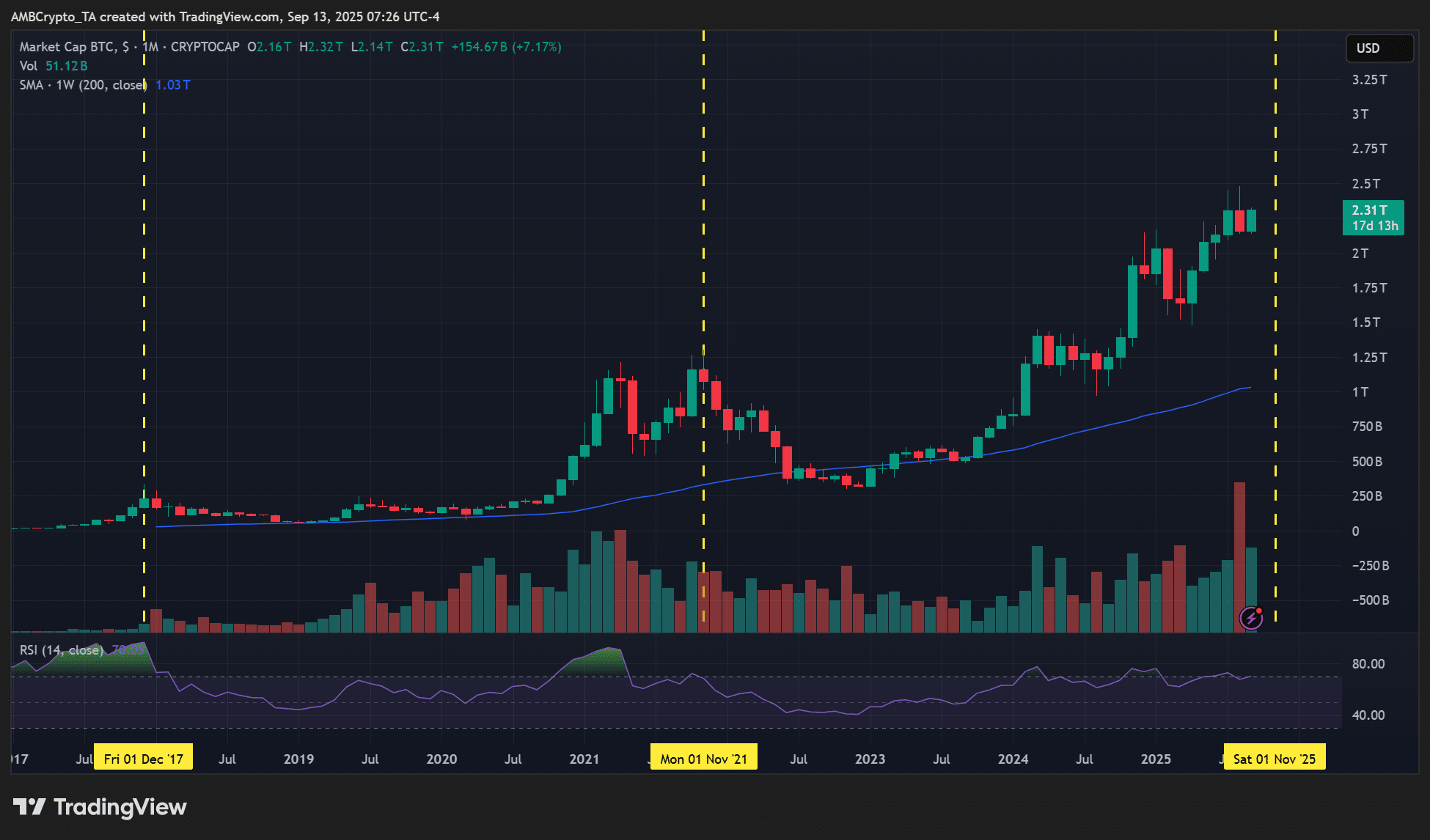

In the past two cycles (2017 and 2021), Bitcoin [BTC] peaked in Q4 of the year after the halving event.

If that pattern repeats, the timeline would be Q4, 2025. But Hayes believes President Donald Trump could extend the rally into 2026.

Trump effect

According to Hayes, Trump would like to print more money like Covid cheques to support programs that could give Republicans an easy win in the next midterm election in 2026.

He said that the current Fed chair, Jerome Powell, will be out of office, adding to ‘full steam’ and ‘middle of the cycle. He added,

“I think people are underpricing the upside in equities, crypto, and everything.”

In other words, it looks like the ‘Trump trade’ that lifted the market in late 2024 may come to play again in 2026, per Hayes.

However, Glassnode data showed that we’re already in euphoria, typically seen as BTC enters price discovery or a new record level.

Since the levels are associated with massive unrealized profit, the pressure to sell also increases. The end result is a marked cycle top if the sell-off escalates.

But the True MVRV, another market cycle top indicator, was far from flagging a ‘strong sell’ associated with past market peaks. Hence, there could be a little room for extra rally as Hayes projects.

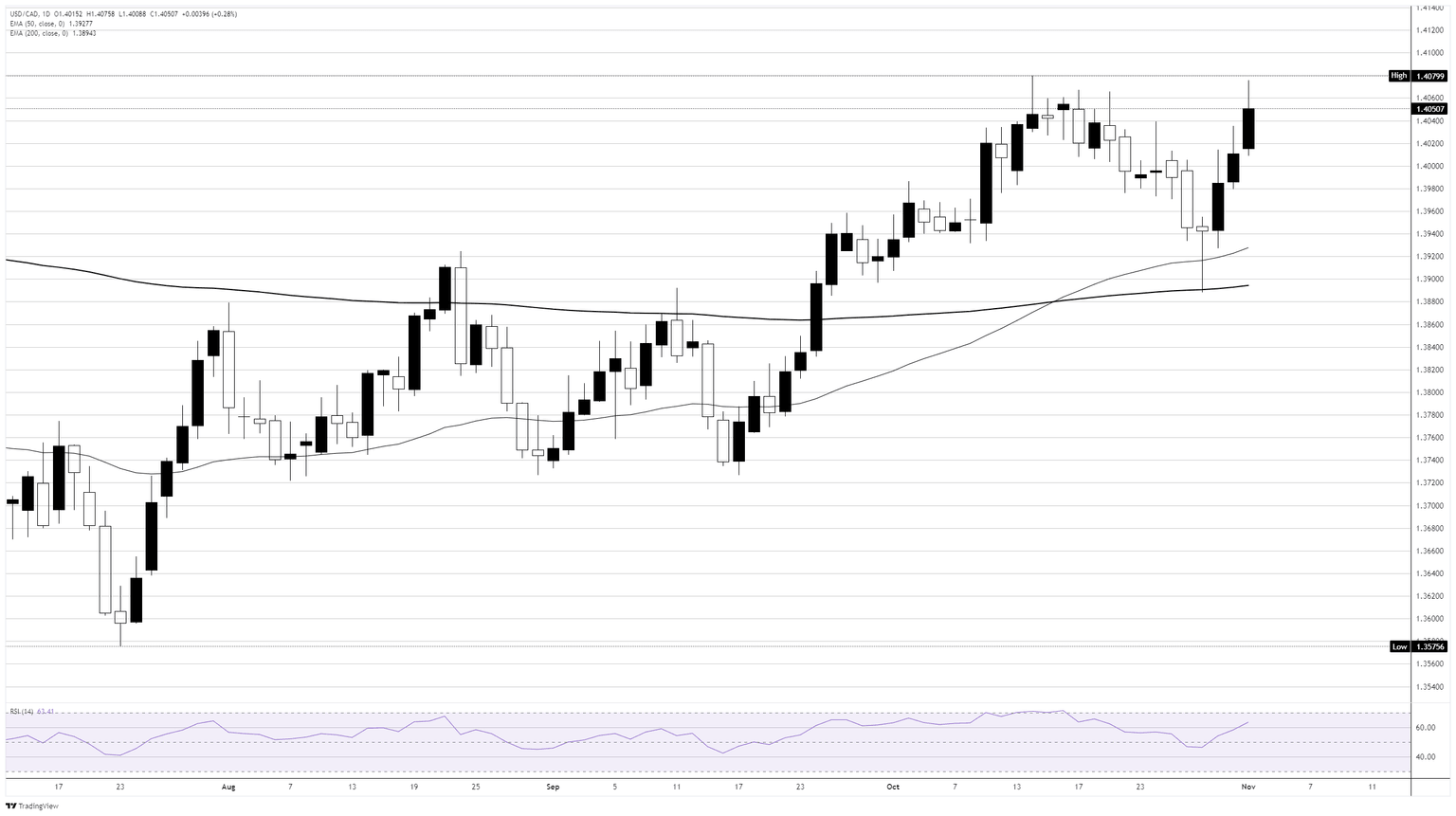

Meanwhile, in the short term, Glassnode noted that BTC must clear the $117K hurdle, as a huge supply was bought at the level and could attract sell-pressure.

Hence, ahead of the Fed rate decision, the level could be key to determining the bulls’ continued advance towards $120K

Post Comment