Why Avantis Global Small Cap Value ETF’s Insane 23% Cash Flow Yield Could Be the Hidden Goldmine Investors Are Missing Right Now

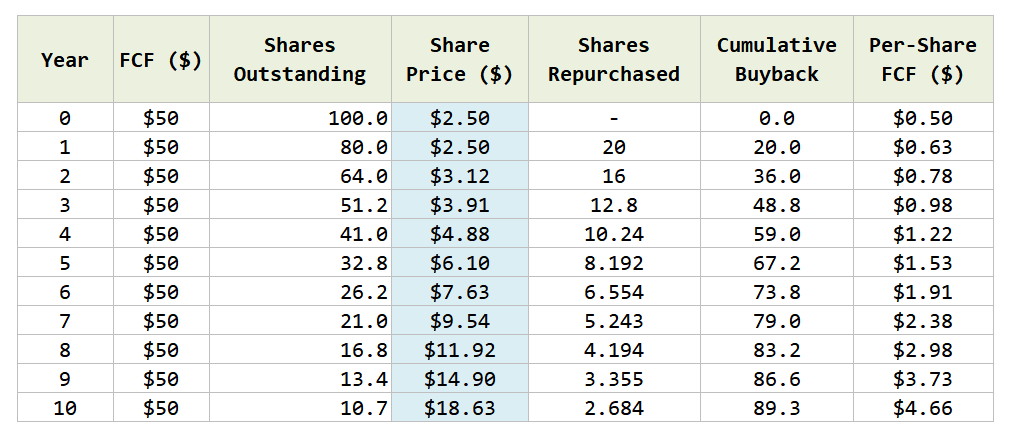

Morningstar gives us a snapshot of the aggregate valuation and growth metrics of the 1347 stocks that form the fund:

Category Average is Global Small/Mid Cap Equity and Index is the MSCI World Small Value NR USD.

The portfolio is cheaper by value, lower in price-to-book, price-to-sales, price-to-cash-flow and has higher earnings yield.

Particularly, the price/cash-flow is intriguing low at 4.3 times. This is the operating cash flow estimated of each stock, then aggregated together. This is not free cash flow, which is taking the net cash from operations deducting away the capital expenditure.

Post Comment