Why Avantis Global Small Cap Value ETF’s Insane 23% Cash Flow Yield Could Be the Hidden Goldmine Investors Are Missing Right Now

But I feel it is good enough.

In their assessment of profitability, Avantis uses operating profit less off the interest expense, divide by book value.

To let you size up this 4.3 times, the IWDA (MSCI World) has a price to cash flow of 13 times.

4.3 times translates to a cash flow yield of 23%. Now i am sure that FCF yield is much lower.

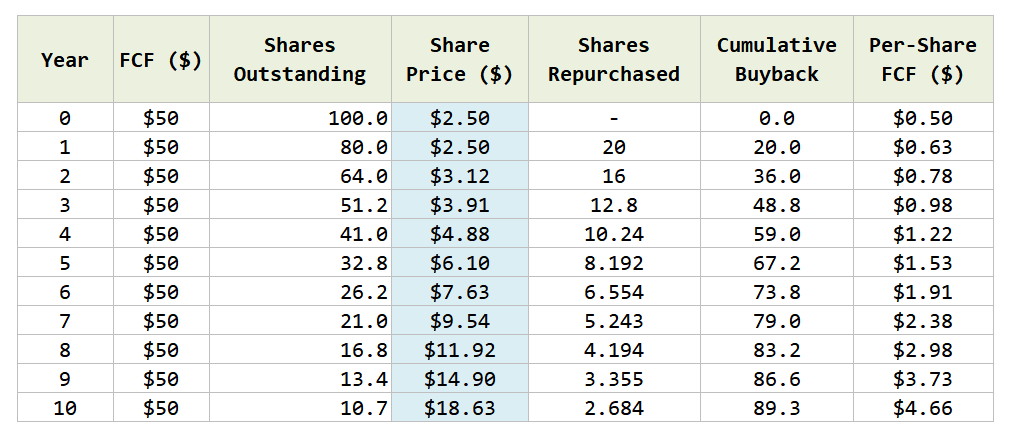

I get the argument that the growth rate of this 1347 stocks is less than the others.

But what if we invert and assume that we buy these 1347 stocks and they don’t go up in price as a collective.

Post Comment