Why Avantis Global Small Cap Value ETF’s Insane 23% Cash Flow Yield Could Be the Hidden Goldmine Investors Are Missing Right Now

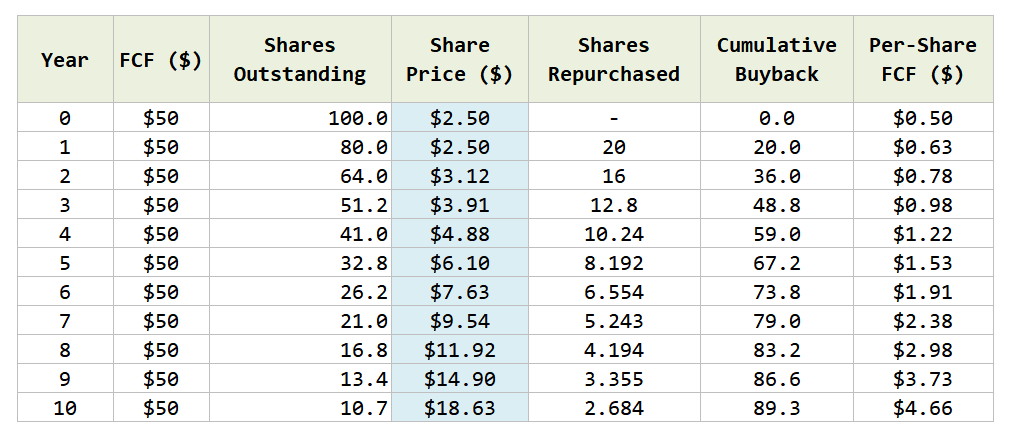

Then what happens to the 23% yielding cash flow?

Okay, even if that is too crazy, remember that the aggregate earnings yield is almost 9.3%.

As an aggregate, these business are not your asset attractively cheap no earnings/cash flow business but with cash flow.

Would the cash flow just disappear? Has to go somewhere right?

If you speak to my friend Ser Jing, he as his eye less on the stock price of this holdings but how much gross profits all the stocks in his Compounder fund generates.

And this is where you ask yourself if you own 10 stocks, and their aggregate earnings yield is 9.3% or aggregated cash flow yield is somewhat close to that, diversified across not just one industry, a few regions, how worried should you be if the prices languish for a couple of years?

Post Comment