Why Avantis Global Small Cap Value ETF’s Insane 23% Cash Flow Yield Could Be the Hidden Goldmine Investors Are Missing Right Now

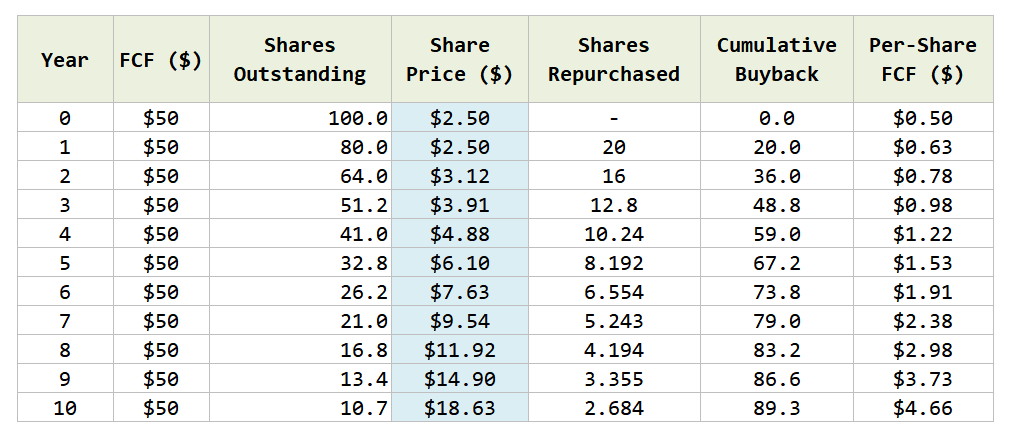

What John Huber, Tobias Carlisle would like to tell us is that value can don’t work for the next 10 years, but that is not the only return we get, and the more concrete return is the aggregate cash flow we earn by waiting in the fund.

They should pile up.

If you are a dividend investor who has received 8 years worth of 5% dividends, you should kind of get it. You should also kind of get that markets are fairly efficient that the market will eventually realize it.

The more cash accumulated the bigger the value gap and the more absurd it gets.

Post Comment