Why Avantis Global Small Cap Value ETF’s Insane 23% Cash Flow Yield Could Be the Hidden Goldmine Investors Are Missing Right Now

He shares about the companies… that does not really have growth, but trades at tremendously attractive valuation:

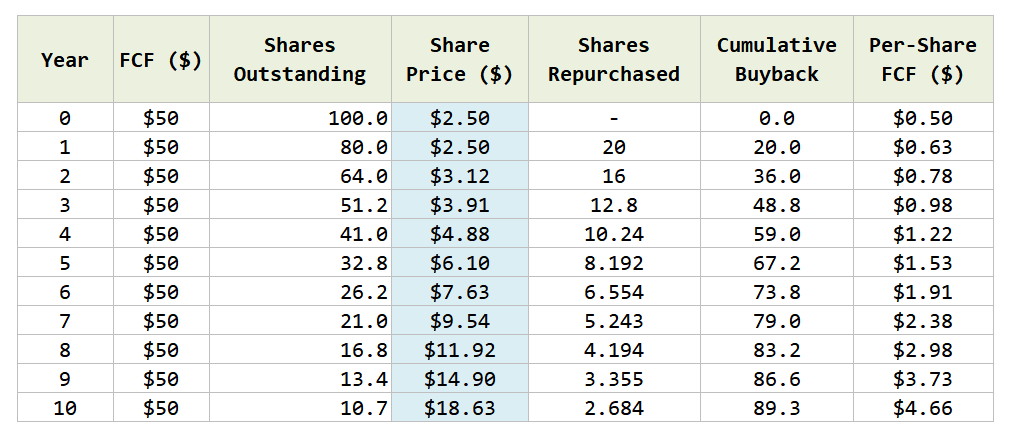

Consider the following:

- A durable, mature company that trades at 5x FCF

- The FCF is stable but will never grow (0% growth forever)

- The P/FCF never moves higher (it will always stay at 5x)

The result of this stock is it will return 20% annually forever.

But, the real beauty of this 20% FCF yield setup that I think is underappreciated by investors and management teams alike is this: you don’t need to care about what the market thinks about your stock. You control your destiny. The multiple doesn’t need to move higher if the stock is that cheap. The share price will rise at 20% per year if the valuation stays at 5x FCF, the FCF is stable, and the FCF is used to buy back shares.

Post Comment