Why Avantis Global Small Cap Value ETF’s Insane 23% Cash Flow Yield Could Be the Hidden Goldmine Investors Are Missing Right Now

But what if the premise is that the business has no growth?

That would be your fear. Why would you want a stock if it does not appreciate for the next 20 years?

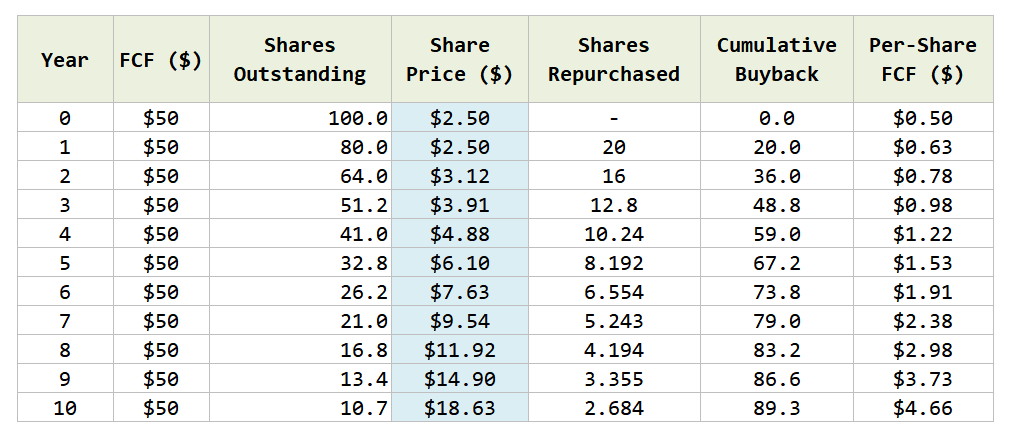

I asked ChatGPT to help me model what Mr Huber presented: If we have a business that trades at 5 times FCF today. Our assessment is that the business is stable to give the FCF yield but it will never grow (0% FCF growth forever). If the Price to FCF remains consistent and the business takes whatever they earn to buyback the shares, what will happen?

Post Comment