Why Avantis Global Small Cap Value ETF’s Insane 23% Cash Flow Yield Could Be the Hidden Goldmine Investors Are Missing Right Now

Uncertainty will make us wonder if a business can have stable FCF for 10 years but if our assessment gives us quiet confidence that it can, then what happens if the stock yield so much and is so neglected?

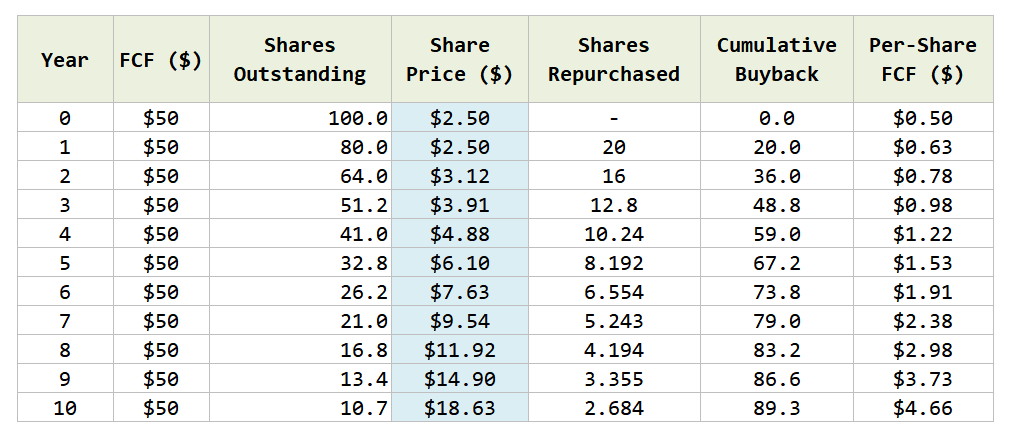

If the company consistently takes its 20% FCF yield and buyback its own shares, the Free Cash Flow (FCF) per share grow from $0.50 to $4.66 or 9 times in the 10 years.

Now in what fxxk would would people in the public markets not notice that?

Mr Huber may have a few points:

- The key difference compare to asset-based business is that the value company is profitable.

- Even without growth, value is value.

- But only if the business show some sort of intrinsic value that outweighs the price. The most difficult judge is not the stuff you can value today (e.g. properties relative to the price they traded at), but what people find it hard to judge over time.

- The price can don’t move, but if you keep churning out cash flow after cash flow, and you don’t make stupid decisions over its allocation, sooner or later some fxxker is going to notice.

Why not pay out the 20% yield as dividend?

Post Comment