Why Avarga Ltd’s 43% Dividend Payout Might Be the Boldest Opportunity You’re Overlooking Right Now

Ever stumbled upon a company and thought, “Is this a hidden gem… or just a shiny rock?” That’s exactly the crossroads I found myself at with Avarga Ltd (Ticker: X5N). Listed in Singapore and formerly known as UPP, Avarga’s transformation journey is anything but ordinary—from industrial-grade paper mills and power plants to holding a controlling stake in a Canadian building products distributor. But here’s the kicker: despite all these shifts, the market seems to be pricing Avarga somewhere between “pretty fair” and “just mediocre.” Now, doesn’t that spark a curious itch in you? Especially when they just announced a jaw-dropping dividend yield of 43% after a 10-to-1 reverse split in 2025—a move backed by significant cash flow coming from Taiga Building Products, their Canadian prize. So, is buying Avarga like snagging a bargain on a solid asset trading at a discount, or are we just clutching at straws? I’m diving deep, crunching numbers, and peeling back layers to figure out whether this under-the-radar player might quietly double your money over the next decade—or if it’s better left alone. Ready to explore the details with me? LEARN MORE

img#mv-trellis-img-1::before{padding-top:15.4296875%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:52.24609375%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:41.30859375%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:24.0234375%; }img#mv-trellis-img-4{display:block;}img#mv-trellis-img-5::before{padding-top:29.4921875%; }img#mv-trellis-img-5{display:block;}img#mv-trellis-img-6::before{padding-top:41.30859375%; }img#mv-trellis-img-6{display:block;}img#mv-trellis-img-7::before{padding-top:40.8203125%; }img#mv-trellis-img-7{display:block;}

I wanted to leave some short notes on Avarga Ltd(Ticker: X5N) in the public just in case I need to search for it.

I don’t think this is a particularly undervalued company to the point that many are interested in. I am still feeling through a couple of aspects and there is a possibility Avarga actually looked better after reflection. Or it will just be mediocre (that price is currently fair).

Avarga is listed in Singapore and some older investors will remember it as UPP. Avarga is interesting indirectly that its current CEO is Ian Tong, who is also the director in The Edge Magazine. Many readers of the Edge will remember Ian’s fundamental portfolio commentary. This is why reading Avarga’s annual report feels a little different from other annual report commentaries.

Avarga used to have core segments in Paper Mill and Power Plan. The company was known as UPP before the name change and started off manufacturing industrial-grade paper products. They also have a power utility operation generating electricity in Myanmar.

They have sold UPP Greentech and UPP Power limited in 2024. Since Dec 2024, they also shut down the paper mill business due to persistent profitability issues. Conditions have been very challenging.

So what is left on Avarga is a 74% controlling stake in Taiga Building Products, which is listed in Canada (Ticker: TBL). Since they own more than 51%, Taiga’s assets and income is consolidated in Avarga’s financial statements. Being the only operating segment makes things easier but that really does not help us to see what Taiga Building owns and how much Taiga is worth, relative to where Avarga is trading at.

On May 2025, Avarga did a 10 to 1 reverse split, which means currently there are 90 million shares outstanding. Avarga recently announced a very big dividend of $1.20 when the share was trading at $2.75.

This means the dividend yield was 43%!

The cash flow for this massive dividend comes from a big dividend distribution at their 75% own Taiga. Taiga decide to distribute a large chunk of the cash on their balance sheet.

Taiga has grown since its founding in 1973 into one of the largest independent wholesale distributors of building supplies in Canada. It serves both residential and commercial construction markets with a wide product lineup—flooring, siding, lumber, engineered wood, insulation, and more—and emphasizes innovation, logistics, and customer service. They have 15 distribution centers around Canada.

After Avarga went ex-dividend, the share price dropped to $2.20, lower than where Avarga trades at before the dividend announcement. This means the market capitalization of Avarga is currently S$198 million.

Taiga currently trades at CAD 3.35 per share. The number of shares outstanding is 108 million shares. Taiga currently trades at a market capitalization of CAD 361 million or S$333 million. If Avarga owns 74% of Taiga (80 million shares), it means their Taiga value is S$246 million.

Since Taiga’s balance sheet shows up in Avarga, it is challenging to make sense of what is whose. I reckon almost everything on Avarga’s balance sheet currently is Taiga’s balance sheet.

If I buy Avarga today at a share price of S$2.16, it is as if I buy Taiga at a 27% discount relative to where Taiga is trading at currently.

But if Taiga is crap, I basically bought something that is not worth anything but if there is something special about Taiga, then its worth considering.

I need to consider what I am buying indirectly. Am I buying something whose asset on balance sheet is clearly worth much more than where it is trading at currently but then Avarga has not too much control nor incentive to liquidate it. Or is Taiga something that will give a good shareholder return (in appreciation or payout) if Avarga held on over time?

I cannot find decent financial information of Taiga Building on their webpage despite being a listed entity but I can find Taiga’s financial information under SGX’s corporate announcement.

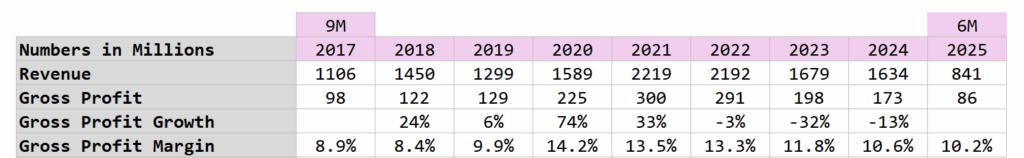

Avarga acquired their first stake in early 2017, and this is the earliest we can find Taiga’s financial on their website. Here is how their revenue and gross profit look like:

Taiga supplies lumber, panels, mouldings, flooring products, interior building materials to the US and Canadian builders through their distribution centers. 85% of their revenue in 2018 derives from Canada with the rest from United States.

On first glance, I thought that a supplier of wood products to the homebuilding industry will benefit from the lack of supply of homes in 2020 and 2021. In Avarga’s 2019 annual report, Tong explain that a marginal rise and fall in the housing market does not in itself impact Taiga’s sales and profitability. This is because of the counter-cyclical nature of new homes built and the renovation market. Taiga also have a diverse set of products to partly mitigate this.

Here is the Canadian housing starts from 2014 till 2024:

We can see that housing starts picked up in 2021 but tapered off in the last two years. Despite this, the housing starts is still more than slightly pre-covid. This may explain why the gross profit is still better than pre-covid.

Tong explain that what has more effect on revenue and profits are the prices of lumber. When lumber prices fell sharply and quickly, a wholesale distributor like Taiga which carries inventories, will suffer inventory losses. Revenue of their products will fall per unit and this will compress their gross margin due to the inventory losses.

Here is the lumber prices from 2014 till today (source of data):

Tong is right. If you track the difference in lumber prices between years, it explains how well Taiga did for the year. 2020 was so good because of a 3 standard deviation price rise.

While less obvious from the chart, the current lumber prices is still slightly higher than the period of 2014 to 2020.

Housing starts and lumber prices would probably give us a good prediction of how well Taiga will do.

For 2025:

- Housing starts is much more than the last two years.

- Lumber prices relatively flat. (Lumber prices actually plunged recently and there are quant analyst who use lumber as a barometer of the equity markets calling that this might be a precursor to a bear market. But from my year-to-date lens, the prices remain fairly flat).

We should expect similar results to last year.

At first glance this is not what will make me interested in anyway.

I would usually tally some of these financials by hand in the past. I know we have financial data sources that I shouldn’t have to do this. I felt that I won’t have a real feel of the data. I would also not know if the data from the data provider is exactly accurate. In fact, after doing this, I realize TradingView have Taiga’s financial data going back to 2005.

Here is Taiga’s LT debt, cash and equity over time:

The equity through the period that Avarga first acquired the stake just went up over time. Then I realize that they been paying down their long term debt by $12 million every year, then once that is done, its like they are adding $30 million in cash every year.

That is like adding 8.3% of cash per year relative to where Taiga is currently trading at. I don’t really understand the business but if the business allows you to pay off debt then accumulate cash over eight years, there might be something to it.

The six month 2025 cash is low at 35 million because they paid out 180 million in dividends (which is the S$1.20 div Avarga is seeing). If not, they would have added like $20 million in cash in the first half alone despite the property scene clearly slowing down.

Net profit benefited from the property boom but have came back down but at current market cap, Taiga is still on track to be a 12.5% earnings yield company. Taiga’s business does not have big capital expenditure investment, and we can see a consistent $4 million capex recently.

This means a lot of the cash flow goes into the company and we can see them first making share repurchases, debt payment, then build up cash and then paying out dividends once in a while. Shareholder return in the table above is the sum of dividend paid out, share repurchase and debt repayment. If management does a combination of those things over time, they put the company in a better shape or reward the shareholder.

Taiga trades at est. CAD 170 million in Sep 2017 after Avarga first acquired it and the firm has paid out CAD 235 million in dividends, and today share price is 111% higher still.

This has not been a bad ride but not ground breaking.

Since we have more data on TradingView, I can see how the gross profit have been in the past.

There wasn’t much growth, but clearly after Taiga acquired in 2017, gross profit became remarkably better. I am not sure how much they improve operationally or whether it is due to Covid luck but we do see some improvements. For some reason, there are no data in 2016.

They even did decently well after the housing boom in the early 2000 and the bust after.

The operating profit is probably closest to reviewing the operations, without considering the interest expenses and taxes. If we consider the difference in debt structure, it make sense to appreciate the nature of the business without consider that. It feels like an annuity stream despite what happen to the building market. Taiga trades around CAD 0.90 for a long stretch from 2010 to 2017, so that may be around CAD 111 in market cap. That is like a 30-40% yearly operating earnings yield before considering taxes and interest payments. That has come down to about 20% with Taiga’s share price appreciation but also relatively slower trend growth.

I would summarize Taiga in the following way at this point:

- Avarga who used to be in paper mills, probably knows the nature of business to a certain extent before they acquired it.

- Part of the Canadian and America homebuilding business. That is not going away anytime soon.

- No debt business

- Always operating profitable business for 20 years.

- There is evidence of product use of cash flow in buying back shares early, paying down debt and paying one-off dividends.

- The cash flow yield available for allocation comes up to be between 8-11% p.a. with respect to the current market cap of Taiga.

- But how well is the cash flow depends very much on Lumber prices to a certain extent. Currently it is not high but higher than what it used to be in the early 2000s.

I like to think the supply chain issues causes a rare lumber price spike, and together with increase homebuilding demand provided a tailwind for Taiga to earn good cash flow. We should be considering the cash flow situation without such uncommon catalyst and the evidence seem to show pretty good cash flow generation (as evidence by the buybacks, debt paydown, one time dividend).

There are just matured business like this that doesn’t interest much people because it doesn’t have exceptionally high growth rates and probably so far that we cannot be on the boots to take a look.

Lumber prices currently are not exceptionally high and buying in this environment is good. Given their past track record of shareholder return, I think I can see a picture for this to double in 8-12 years based on the cash flow. Just that your returns is going to be lumpy.

And the returns is likely from dividends. Actually, I wouldn’t be surprise if Tong changes the dividend policy.

I think potentially there are catalysts here:

- If we assume that commodity prices is going to trend higher.

- They can still bolt on similar business and gain efficiencies.

Owning it indirectly through Avarga, which currently trades at 27% discount to what Taiga is worth publicly is a decent deal. We know Taiga’s share price is volatile as an individual stock but if the shareholder yield (cash flow for dividend, buyback and debt pay down) can amount to 8-11%, I think Taiga’s personal valuation is not too expensive.

If I understand the business better, I might not like this profile as much or that I would plonk in even more money.

Disclosure: Currently owns a tiny stake of Avarga Ltd in Crystalys.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment