Why Bitcoin’s $90B Surge Could Just Be the Opening Act—Altcoins Poised to Steal the Q4 Spotlight!

Ever get that feeling the market is playing a subtle game of tug-of-war between Bitcoin and altcoins? Well, right now, Bitcoin’s flexing those muscles, leading the rebound with a hefty 56% slice of the $160 billion inflow pie. Yet, altcoins aren’t throwing in the towel—they’re lurking patiently, capped on leverage but poised to pounce if Bitcoin hits a wall. Here’s the twist: only about a quarter of Binance altcoins are strutting above their 200-day moving averages, whispering that most are still quietly snuggling in the accumulation phase. So, is it time to throw your hat in the altcoin ring, or stick with the Bitcoin heavyweight champion? As the market flips back to risk-on mode and traders crowd around BTC, the scene’s set for a potential capital rotation—maybe the calm before altcoins shine? Buckle up, because the next moves could redraw the crypto game board in ways even seasoned investors might not expect. LEARN MORE.

Key Takeaways

Is the market favoring Bitcoin or altcoins right now?

Bitcoin is leading the rebound. However, altcoin leverage is capped. If BTC hits resistance, alts could grab rotation capital.

Is this a good time to buy altcoins?

Only 24% of Binance altcoins are above their 200-day SMA, showing most alts are still in accumulation.

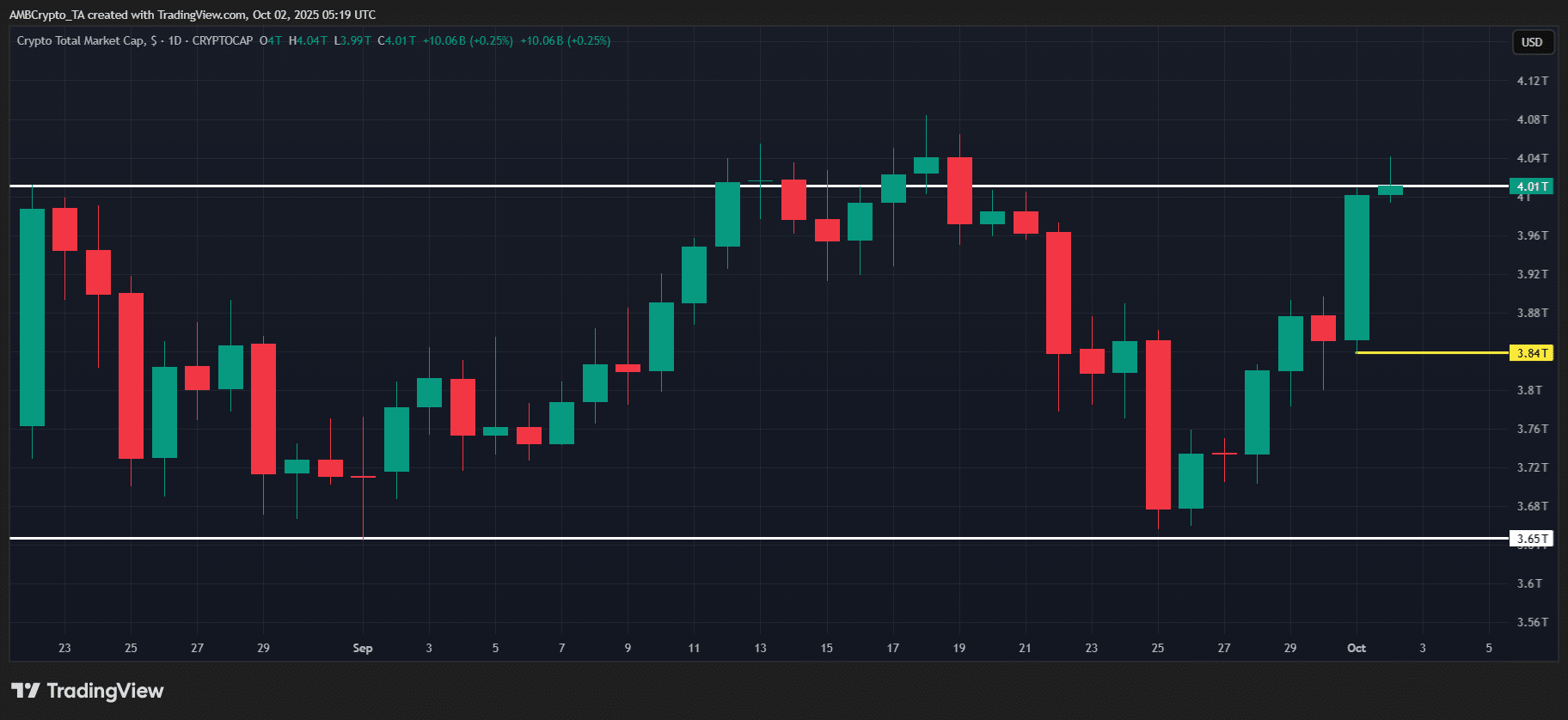

The market has flipped back to risk-on. Q4 kicked off with the TOTAL market cap bouncing 3.88% off the $3.85 trillion base, representing nearly $160 billion in inflows, and marking the longest green candle since August.

Bitcoin [BTC] also saw its market cap climb 3.92%, reaching $2.36 trillion. Technically, this highlights a notable trend: BTC’s $90 billion inflow accounted for 56% of the total crypto market cap inflow.

Simply put, more than half of the $160 billion rotated into BTC, showing that the rebound was BTC-led. By contrast, TOTAL2 (market cap ex-BTC) jumped 3.81%, highlighting typical rotational flows.

In short, traders are leaning into BTC, keeping altcoins on the back foot.

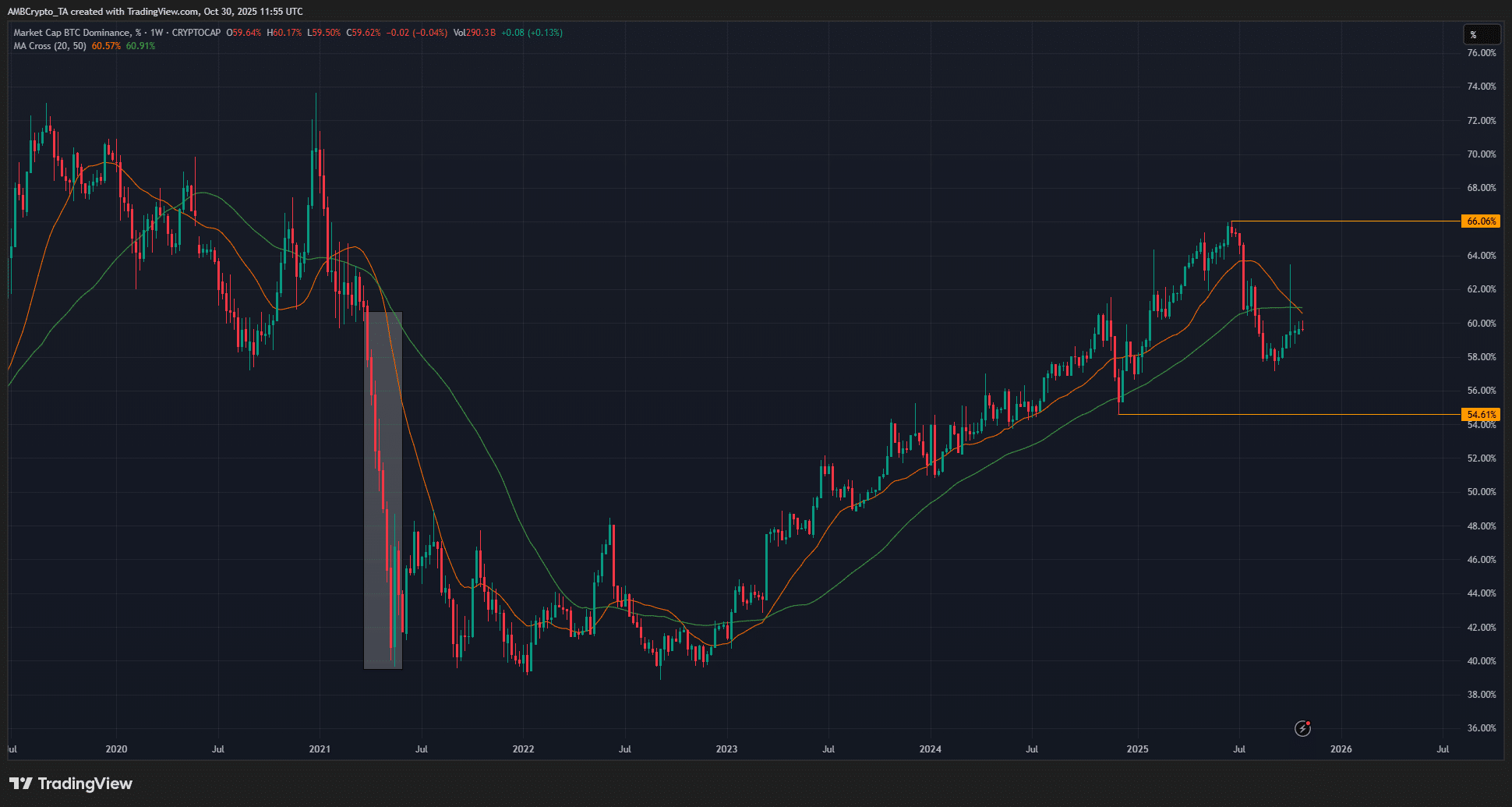

Supporting this, the Altcoin Season Index dipped 2 points to 65, at press time, signaling rotation away from alt-season. If this momentum holds, we could be heading into a Bitcoin-led phase, keeping altcoin market share capped.

However, what if BTC hits resistance? BTC.D was in the red, and BTC is down 0.16% intraday, hinting at weak follow-through. In that case, could the Altcoin Season Index rebound, sparking a rotation back into alts?

Bitcoin bloodbath sets stage for a strategic altcoin entry

The crypto market experienced a sharp sell-off over the past 24 hours, triggering widespread liquidations.

According to CoinGlass, 129,474 traders were liquidated, totaling $592.19 million—81% of which came from short positions. This means nearly $490 million was wiped out in short squeezes, fueling a rapid price surge.

Bitcoin bore the brunt, with $423 million in short liquidations, accounting for 81% of the total. Despite this, Bitcoin’s Open Interest (OI) remains near all-time highs, indicating that the derivatives market is still highly active and heavily leveraged.

Meanwhile, Ethereum [ETH] leverage sits about $10 billion shy of its ATH.

Why does this matter? With Bitcoin leading the rebound, traders are aggressively piling into BTC. This is keeping altcoin leverage capped and limiting excessive risk from spilling into the broader alt market.

In this context, if Bitcoin runs into resistance, alts could grab the spotlight, especially with the Altcoin Season Index sliding back toward the 60 support, setting up a potential rotation into altcoins.

Alts in accumulation zone – Buying opportunity ahead?

CryptoQuant points to a strong altcoin buying opportunity.

With positioning under control, euphoria cooling, and the Season Index holding key support, the setup screams “dip-buy,” especially with Bitcoin derivatives still overheated, capping long-term upside.

On-chain data backs this up. Only 24% of Binance altcoins are above their 200-day SMA. In other words, 76% of altcoins are still trading below their long-term trend, indicating a potential accumulation zone.

Historically, altcoin tops line up when 100% of alts are above their 200-day SMA, marked by the blue/purple long peaks. In short, the market is still far from altcoin euphoria, leaving plenty of room for accumulation.

In this context, the rotation thesis only gets stronger.

Even with BTC kicking off October with big inflows, a full-blown “Bitcoin Season” is still a stretch. That leaves altcoins in a prime spot to soak up capital, making this a clean dip-buy setup.

Post Comment