Why Coinbase’s Stablecoin Bootstrap Fund Revival Could Rewrite Crypto’s Future—And What It Means for Investors Now

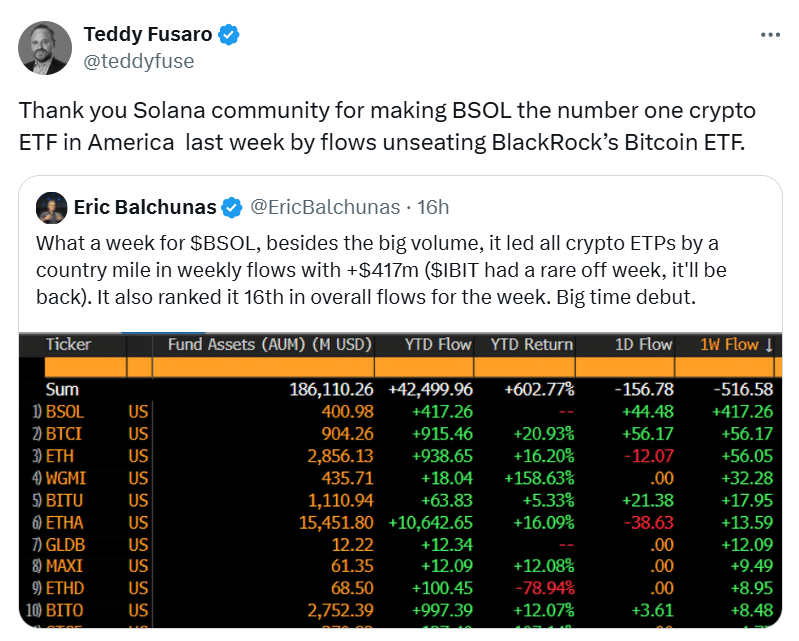

Stablecoins—they might sound as steady as a rock, but in the fast-evolving world of decentralized finance, they’re anything but boring. Now, Coinbase has thrown its hat back into the ring with the relaunch of its Stablecoin Bootstrap Fund, aiming to flood some serious USDC and EURC liquidity into key DeFi platforms on Ethereum and Solana. Sounds straightforward? Well, not quite. This move isn’t just about tossing coins around—it’s a strategic play to tighten market efficiency, lower borrowing costs, and slash trading slippage, setting the stage for both seasoned protocols and fresh newcomers to thrive. After all, why settle for a one-trick pony when you can back multiple networks and fuel the next wave of decentralized innovation? Curious how this could recalibrate the stablecoin landscape and what it spells for the future of DeFi? Let’s dive in. LEARN MORE

Key Takeaways

Coinbase has relaunched its Stablecoin Bootstrap Fund to inject USDC and EURC liquidity into major DeFi protocols on Ethereum and Solana.

The buzz around stablecoins is heating up, with Coinbase grabbing headlines as it relaunches its Stablecoin Bootstrap Fund.

The initiative aims to boost USDC liquidity across both established and emerging decentralized finance (DeFi) platforms.

Coinbase relaunches its Stablecoin Bootstrap Fund

According to the company, the first deployments will channel USDC into Ethereum [ETH]-based lenders Aave [AAVE] and Morpho, as well as Solana [SOL]-based trading platforms Kamino and Jupiter.

The company further quipped,

“We’re particularly eager to collaborate with pre-launch teams or those seeking to drive stablecoin growth from day one.”

More than just USDC

Coinbase has not disclosed the exact size of its relaunched Stablecoin Bootstrap Fund.

However, it has confirmed that the fund will provide liquidity in both Circle’s USDC and its EURC stablecoin. There is also potential for the fund to expand to include other stablecoins in the future.

Coinbase emphasized that the move aligns with its long-term plan to maintain steady USDC liquidity across both mature and up-and-coming networks.

They noted that the goal is to lower borrowing costs, reduce trading slippage, and foster growth for participating protocols.

The journey continues after 6 years

The revival comes six years after the original fund, which deployed $1 million each to Compound and dYdX, helping establish USDC as a leading DeFi stablecoin.

USDC holds a $65.6 billion market cap, second only to USDT’s $164.6 billion, according to CoinGecko.

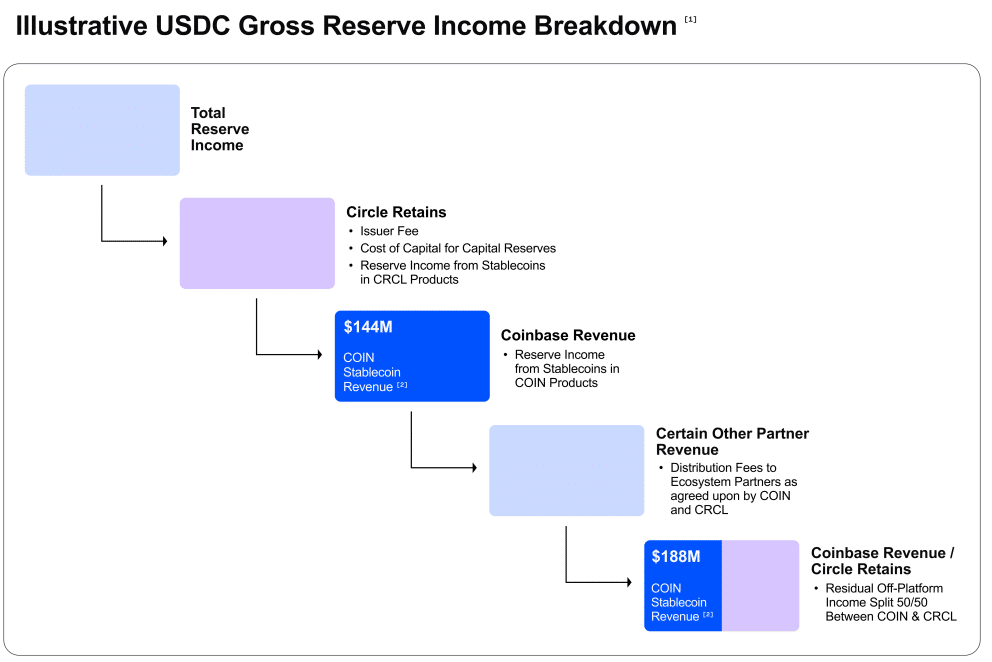

Coinbase’s Q2 2025 results showed $332 million in stablecoin revenue, with average USDC balances in Coinbase products rising 13% quarter-over-quarter to $13.8 billion.

A revenue tailwind despite softer earnings

In fact, despite reporting $1.5 billion in Q2 revenue, slightly below expectations, Coinbase saw a 12% increase in stablecoin-related earnings, driven largely by USDC activity.

Notably, CEO Brian Armstrong downplayed concerns about Charles Schwab’s planned entry into crypto, reaffirming Coinbase’s market leadership and comparing the platform to the “Amazon of crypto.”

Post Comment