Why Companies Crushing Cash Flow Today Could Suddenly Crash Tomorrow – The 10-Year Profit Trap You Can’t Afford to Ignore!

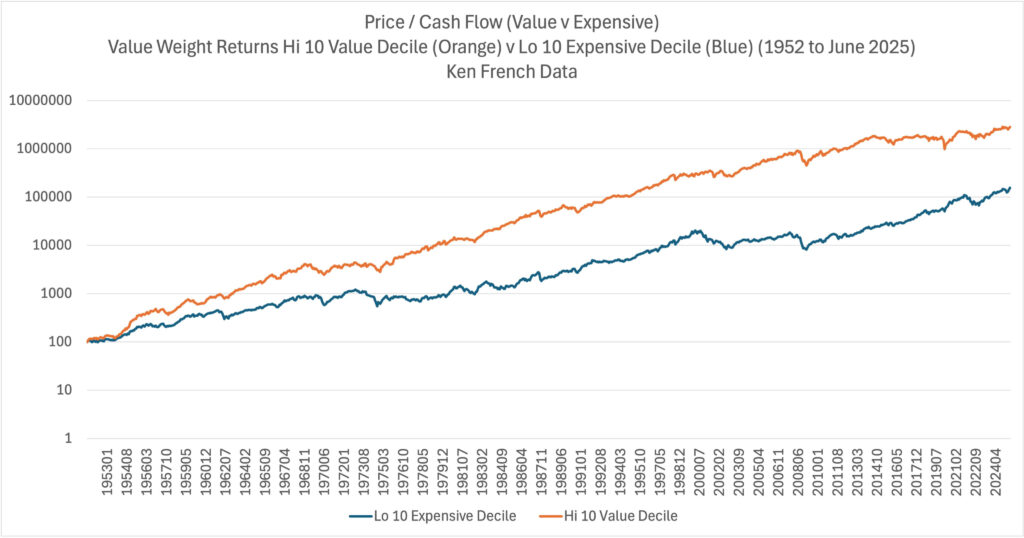

The traditional value investing way is to place more emphasis on the cash flow today.

The growth is just the icing on the cake. If it happens then its good.

But you want to make sure that you don’t overpay for the cash flow today. You want to make sure that even if the growth doesn’t happen, the cash flow is so ridiculous that the market will realize its value.

For those that understood these fundamentals, reflecting upon this with some of their systematic-active strategies would allow them to build the conviction to hold on even if it is not working (I am saying that this applies in general, not just value related strategies)

Post Comment