Why Companies Crushing Cash Flow Today Could Suddenly Crash Tomorrow – The 10-Year Profit Trap You Can’t Afford to Ignore!

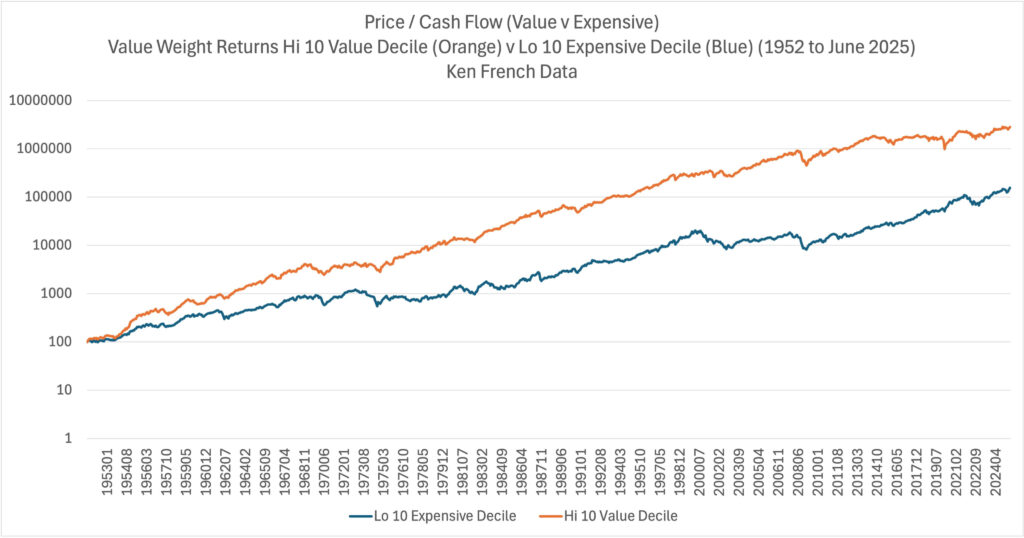

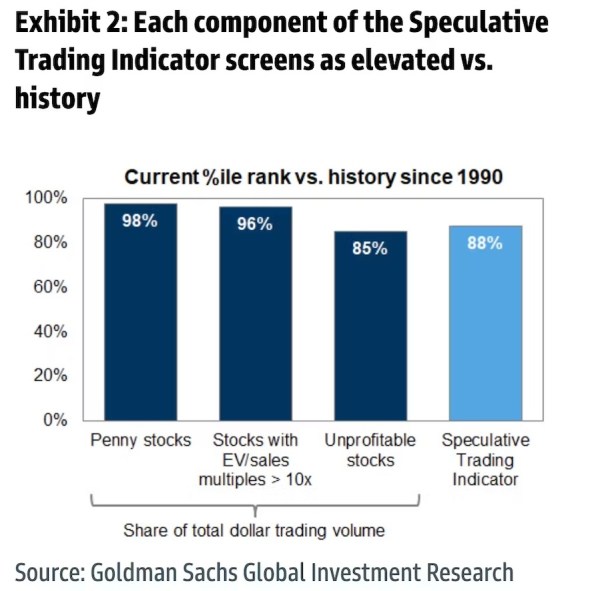

So what’s got everyone scratching their heads? Since 2014, those “cheap” value stocks that historically doubled as the tortoise in the race suddenly started struggling against the flashy rabbits with sky-high price-to-cash flow ratios. Has the game changed? Or are we just side-eyeing the next bubble? Could cash flow data be our financial crystal ball—or just another shiny metric to confuse us? We’ll chew over this, break down the numbers, debate the wisdom behind sticking to value investing’s old-school principles, and explore what it means to really know what you’re holding. Curious? You should be.

Post Comment