Why Companies Crushing Cash Flow Today Could Suddenly Crash Tomorrow – The 10-Year Profit Trap You Can’t Afford to Ignore!

This price-to-cash flow stuff might have interest him enough to do some work haha!

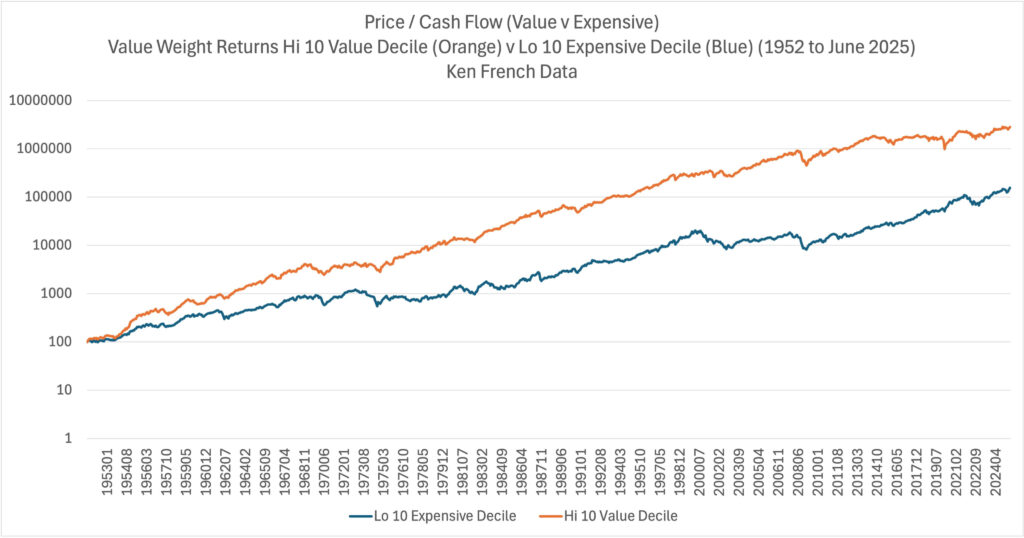

Professor Kenneth French (one half of the Nobel winning Fama-French) graciously provided everyone with data on his Dartmouth page.

We have data about cash flows dating back to 1952 which is about 73 years. If we compare a value-weighted portfolio of those with the lowest price to cash flow (blue) against those with the highest price to cash flow (orange), you can see a distinct gap in performance. If there is anytime the low price to cash flow made a comeback, the lines will narrow.

Post Comment