Why El Salvador’s Bold Bitcoin Bank Law Could Trigger a Global Financial Earthquake—Are You Ready to Cash In?

Ever wondered what it takes for a tiny Central American nation to climb the ranks and become a global crypto finance powerhouse? El Salvador is daring to rewrite the rules of traditional banking by letting regulated investment banks hold Bitcoin—and not just dabble, but fully embrace crypto services for accredited investors. Yes, you heard that right. This bold move isn’t just some flashy headline; it’s a calculated leap to lure in foreign capital and cement their position on the world stage as a rising crypto hub. But can this gamble pay off in a market buzzing with skepticism and volatility? The new Investment Banking Law sets the stage for a radical shift—sophisticated players with deep pockets and savvy experience will have unprecedented access to Bitcoin-driven banking, blurring lines between old finance and the future. It’s a fascinating playbook in motion, especially with El Salvador forging new international partnerships and dreaming up Bitcoin banks that could soon be more than just an idea. If you’re curious about how this tiny country might just shake up global markets and what it all means for investors everywhere, you’ve come to the right place. LEARN MORE

Key Takeaways

El Salvador’s new Investment Banking Law allows regulated banks to hold Bitcoin and offer crypto services to accredited investors. With growing global interest, the country is positioning itself as a rising crypto finance hub.

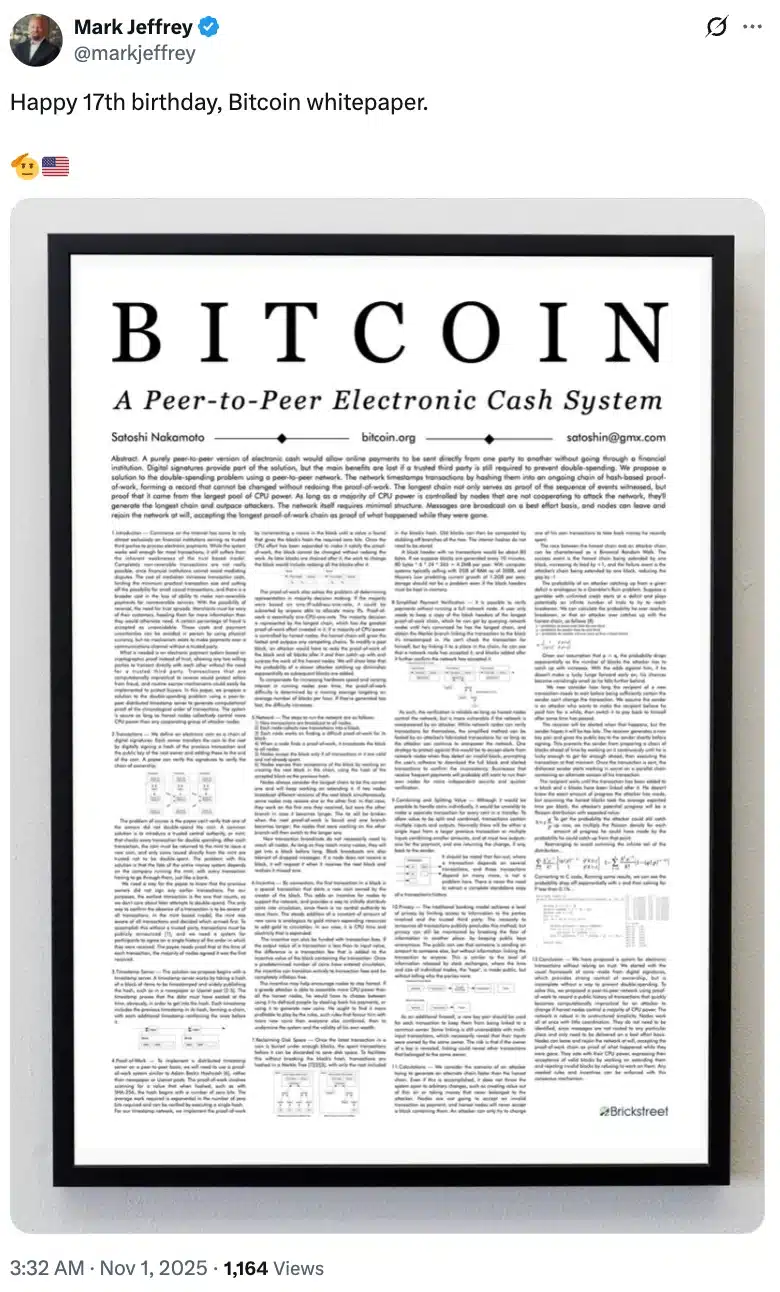

El Salvador’s Legislative Assembly is doubling down on its Bitcoin [BTC] bet.

A newly approved Investment Banking Law will let regulated investment banks hold Bitcoin and offer crypto services to accredited investors. This would be a big step forward to lure foreign capital and help further the country’s status as an emerging global crypto hub.

El Salvador’s big crypto move

The law applies to investment banking institutions. They will serve only “sophisticated investors”, defined as individuals or entities with at least $250,000 in liquid assets and extensive market experience.

Naturally, the framework sets investment banks apart from traditional commercial banks.

They can operate in both legal tender and foreign currencies, handle complex financing for sectors such as infrastructure, energy, and technology, and secure a Digital Asset Service Provider license to go fully Bitcoin-native.

Juan Carlos Reyes, President of El Salvador’s Commission of Digital Assets (CNAD), said,

“With a Digital Asset Service Provider (PSAD) license, a bank could choose to operate entirely as a Bitcoin bank.”

With fresh partnerships with nations like Pakistan and Bolivia, the country is moving forward to become a global crypto hub.

Bitcoin banks, closer to reality now

The new Investment Banking Law comes just days after the Salvadorian government revealed plans to establish Bitcoin banks.

The proposal, overseen by the National Bitcoin Office, allows private investment banks to operate in both Bitcoin and U.S. dollars. They’ll offer deposits, loans, and other financial services.

With a $50 million minimum capital requirement and allowance for foreign ownership, the hope is that the initiative will attract global investors and support El Salvador’s Bitcoin-focused economic policy.

Global capital is watching

El Salvador’s policy shift comes as institutional interest in Bitcoin accelerates abroad.

In fact, thirteen of the 25 largest U.S. banks – including JPMorgan, Citigroup, and Goldman Sachs – are now offering or exploring Bitcoin custody and trading.

At the same time, the world’s Top 100 public companies with Bitcoin treasuries collectively hold nearly one million BTC!

With this, El Salvador’s push to allow Bitcoin investment banks positions it to tap into growing institutional market liquidity.

Post Comment