Why Ethereum Could Be the Ultimate Macro Bet You’re Missing—3 Insider Reasons That’ll Change Your Portfolio Forever

Ever wonder what could propel Ethereum beyond the rollercoaster dips we’ve been seeing? Despite a recent 12% stumble, savvy traders are placing their bets on a rebound fueled by not just one—but three powerhouse catalysts: stablecoins, Wall Street’s ambitious Project Crypto, and the game-changing force of AI. It’s like watching the future of finance and technology unfold right before our eyes, with Ethereum positioned as the bedrock of this new digital era. Tom Lee, a Wall Street heavyweight, didn’t just whisper predictions—he shouted them, envisioning ETH hitting $5.5K soon and a jaw-dropping $12K by year’s end. And get this, he believes the bull market might just keep roaring until 2035! If you ask me, this isn’t mere speculation—it’s a strategic insight into where the global economy is headed, with Ethereum at the nerve center of finance and artificial intelligence. How’s that for a bold long-term play? Dive deeper into this fascinating trajectory and why now might be the moment to pay attention. LEARN MORE

Key Takeaways

Ethereum could benefit from three catalysts: stablecoins, Project Crypto, and AI. Despite a 12% correction, some ETH traders were betting on a potential recovery.

Wall Street strategist and Fundstrat Chief Investment Officer Tom Lee recently made a bold prediction that Ethereum [ETH] could tag $5.5K in the near term and eye $12K by the end of the year.

In a recent interview with Mario Nawfal on X (formerly Twitter), Lee added that the current bull market could extend to 2035.

He doubled down on Ethereum as the ‘biggest macro trade’ of the decade, citing stablecoins, Project Crypto (Wall Street building on blockchain) and AI as top three catalysts.

“All these should benefit the most reliable smart contract platform, which is Ethereum”

Lee highlighted that agentic AI and robots will generate a lot of data that will need to be verified through zero-knowledge proofs via blockchain.

Simply put, Ethereum will be the foundation layer of global finance and AI.

ETH slips 12%

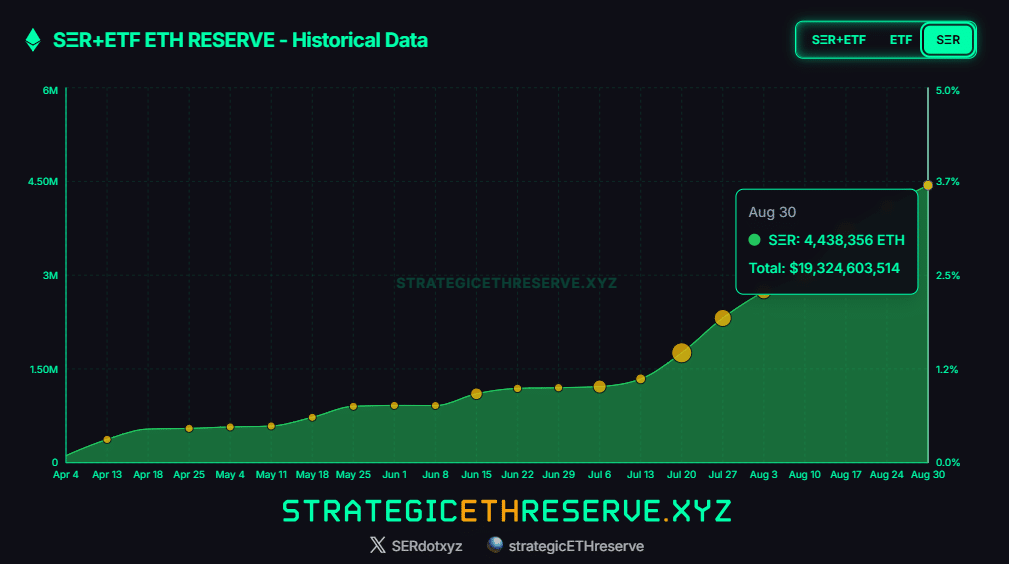

In fact, the above outlook has sparked a frenzy in crypto treasuries and ETF clients seeking exposure in ETH to capture this expected growth.

The U.S. Spot ETF has attracted nearly $10B in inflows in the past two months.

Similarly, corporate treasuries have accumulated about 3.7% of the ETH supply, worth about $19B at press time value.

However, the broader market sell-off at the end of August has tipped the altcoin to erase some of its recent gains on the price chart.

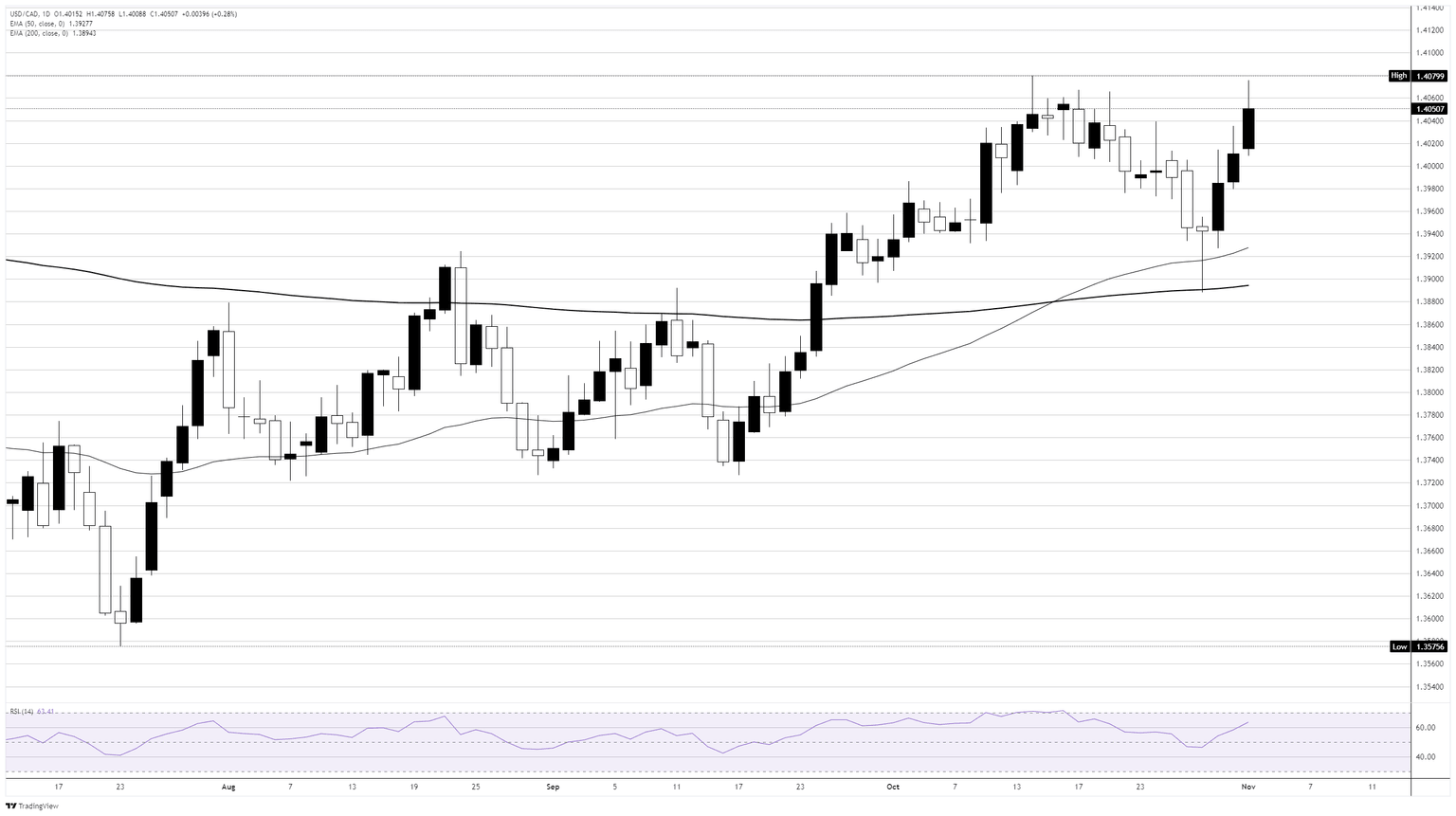

At the time of writing, ETH was down 12% from its record high of $4.95K and cracked the $4.5K level.

If the correction persists, ETH could tag $4K, which doubled as the lower range of the Bollinger Band on the daily chart.

Additionally, the daily RSI has stayed above the mid-range since July, hence defending it could reinforce bullish bias.

On the other hand, slipping below the mid-range RSI level could suggest further drawdown below $4K.

But despite the short-term weakness, the 25-Delta Skew, which tracks sentiment, spiked higher about 1%-4% for short-dated tenors (1-week, 1-month).

Simply put, traders were buying short-dated calls (bullish bets) more than puts (bearish bets). This suggested that some players expected a potential price recovery in the next few days.

Post Comment